-

Readers this year responded to Mick Mulvaney's leadership at the Consumer Financial Protection Bureau, the banking industry's role in the national gun debate, Rep. Maxine Waters' upcoming leadership of the Financial Services Committee, the influence of tech companies like Facebook and Amazon on financial services and much more.

December 27 -

Despite some growing support for central banks issuing digital currencies, the practice raises important privacy concerns and questions about the structure of the banking system.

December 27 Cato Institute

Cato Institute -

Jonathan Gould, the committee's chief counsel, has been hired by the Office of the Comptroller of the Currency as senior deputy comptroller and chief counsel.

December 26 -

Two groups are asking the agency to restrict collectors to "one live conversation per week" with a borrower and up to three phone attempts per week.

December 20 -

The SEC is already ramping up action in the cryptocurrency space, with stronger moves in the year ahead, and market participants should be preparing to respond, according to Aaron Kaplan, a securities lawyer and founder at Prometheum.

December 20 Prometheum

Prometheum -

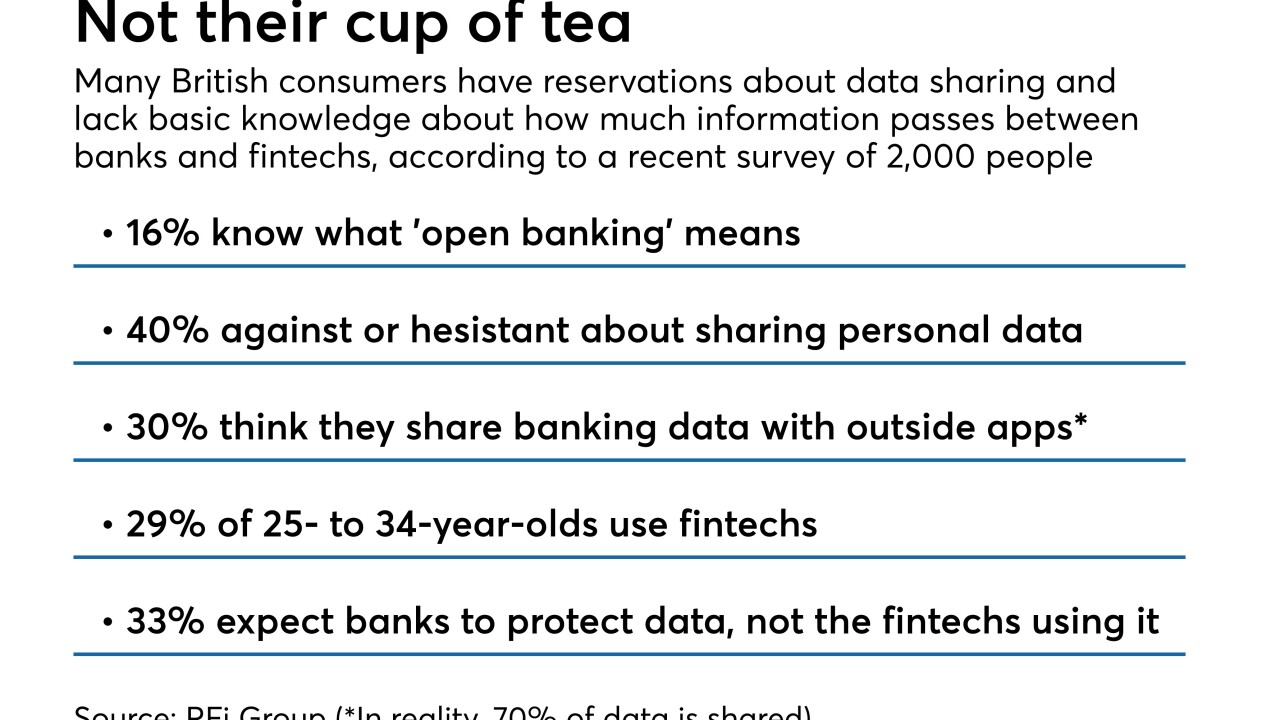

Though it became official in January in the U.K., most people there don't know what it is, according to a new survey that offers many insights for U.S. banks.

December 19 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

In a rare move, Maryland Financial is voluntarily liquidating after its customer base shrank and efforts to sell itself failed.

December 17 -

The fintech's new products may violate several banking and securities regulations and could mislead the public about the differences between coverage on banking and investment accounts, industry officials say.

December 14 -

The fintech Robinhood did not contact the Securities Investor Protection Corp. to discuss protection for deposits, according to SIPC CEO Stephen Harbeck.

December 14 -

The Fed wants more information on Treasury and mortgage-backed securities; will overlook compliance failures resulting from pilot programs.

December 4 -

To convince skeptical bankers about the benefits of distributed ledger technology, some suggest it needs to be separated from the volatile digital currency it underlies.

November 30 -

The initiative would allow financial firms to test new — and potentially less transparent — disclosure forms on customers.

November 29 Americans for Financial Reform

Americans for Financial Reform -

Atlanta Fed chief says consumers don't know the risks of using nonbank payments providers, like Apple Pay; equity derivatives desks will reap rewards of volatility.

November 28 -

A 10-year exemption for banks offering estimated fees and exchange rates under the rule, instead of exact amounts, is set to expire in 2020. Lawmakers should consider a temporary extension.

November 27 Akerman LLP

Akerman LLP -

Lawmakers this week are expected to consider Kathy Kraninger's nomination to the CFPB along with reauthorization of the National Flood Insurance Program.

November 26 -

Cash-outs accounted for 80% of mortgage refinances in the third quarter; state will accept bitcoin for business tax payments.

November 26 -

Readers react to trends in public banking, weigh potential changes for brokered deposits, consider oversight of foreign banks and more.

November 21 -

Decades-old measures designed to rein in risky lenders are now preventing healthy banks from tapping crucial sources of funds.

November 21 American Bankers Association

American Bankers Association -

The initiative would allow financial firms to test new — and potentially less transparent — disclosure forms on customers.

November 19 Americans for Financial Reform

Americans for Financial Reform