Readers this year responded to Mick Mulvaney's leadership at the Consumer Financial Protection Bureau, the banking industry's role in the national gun debate, Rep. Maxine Waters' upcoming leadership of the Financial Services Committee, the influence of tech companies like Facebook and Amazon on financial services and much more.

“Mulvaney is ABSOLUTELY CORRECT in his assessment and criticism of the crusaders from the prior administration. His insightful assertions of the flaws and abuse of power resident in the Warren/Cordray era offers hope that a more measured and objective approach is in our immediate future. Good news for the health of the financial services industry and the economy as a whole.”

Related:

“Digital will not differentiate. Practically all banks, CU's, etc. will have very good digital platforms. Pricing is a similarly hard way to differentiate. Competitors can match. Physical presence in markets still matters to customers, and especially small businesses. Don't bet against JPM Chase here.”

Related:

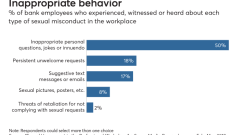

“Anyone that believes harassment is inevitable has no place in management. Not just in banking - anywhere.”

Related:

“While it is refreshing to see that bank CEOs show a fairly globalist socially liberal point of view, it's not hard to conceive of a scenario that goes too far (and/or in the other direction), particularly on constraining legal purchasing and financing. Most Planned Parenthood locations accept major payment card brands. Bankers as the moral compass of society just doesn't sit well with me. Bank risk managers as the implementers of policy - even less so.”

Related:

"At a time when political discourse has given way to polemics and histrionics, Waters would lead us like lemmings over the edge to lunacy. We need to return to reasoned debate based on shared values and mutual respect. If we are becoming an ungovernable society, it is the likes of Ms. Waters and her kindred spirits from both political poles that are taking us there. Get a grip, folks."

Related:

"I think the technical term for this is 'bad idea.'"

Related:

"Part of the problem with your entire argument is that you give the public the impression that credit unions don't make money (non-profit). That's simply an industry tag-line. Facts are facts. If you look at N.I.M. comparisons, credit unions have very similar N.I.M.'s. The field of membership is the biggest sham and the NCUA's lack of enforcement and oversight has made them the laughing stock of the industry. Act like a bank, get taxed and regulated like one."

Related:

"I've been doing CRA for 30 years and we should welcome the opportunity to refine the CRA evaluation process. It's too subjective as one examiner may consider a CRA investment innovative while another examiner considers it uneventful. The law isn't the problem; it's the paperwork burden and subjectivity in the exam process that's created the problem we're dealing with today."

Related:

"Banks controlled by politicians. What could go wrong?"

Related:

"Why are we fixated on making the branch more appealing? It's reminiscent of Blockbuster investing in remodeling and adding products to its video rental stores, when consumers were flocking to streaming services. Digital self-service in branches is a technology fail; consumers don't need or want to come to our location and use our devices to conduct digital transactions when they can do them on their devices from anywhere, at anytime."

Related:

"Another 'creative' way for Wall Street to create a series of dominos that can tumble and take a disproportionate portion of the economy along - lots of potential for collateral damage as the effects of a downturn are magnified by the leverage and second and third level businesses (the ones that bank on 'Main Street') are impacted by the breakdown of upstream businesses."

Related:

"Common sense, that rarest of commodities in Washington, puts in an appearance here. Pick the battles that are worth fighting. Bravo."

Related:

"Without question the President poses a systemic threat to the financial system as his economic policies (tariffs, huge budget deficits, partial government shutdown, endless bashing of Jay Powell, etc.) threaten the continuation of an already very long economic expansion. The Treasury Secretary’s news release last night, reporting on his calls to large-bank CEOs has further rattled the financial markets by stupidly raising the specter of a financial crisis. What will the next idiocy be?"

Related:

"I get all of Trump's warts, but what people forget with all the bashing is, what was the alternative to Trump in the 2016 election? It certainly wasn't any better and we would be going down a very different road by now, probably not to the satisfaction of any readers here."

Related: