Rock Bottom

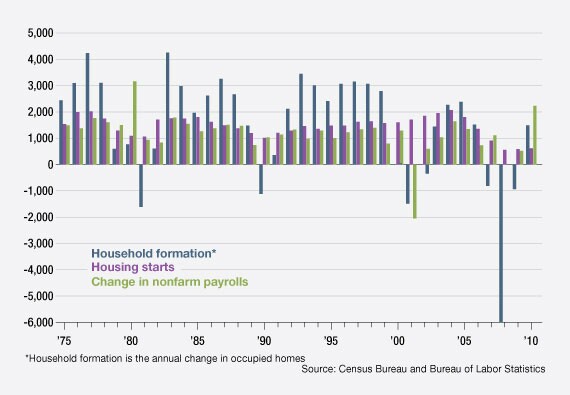

Housing Drag

Starts Up

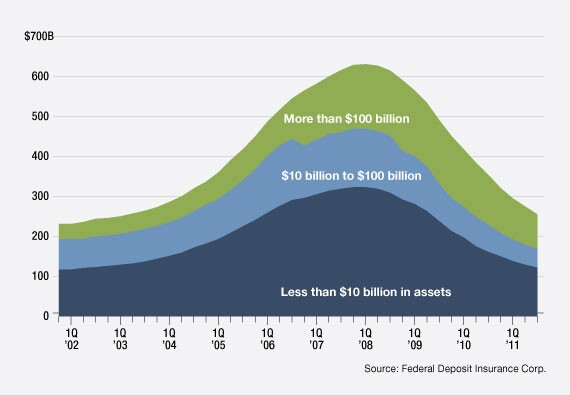

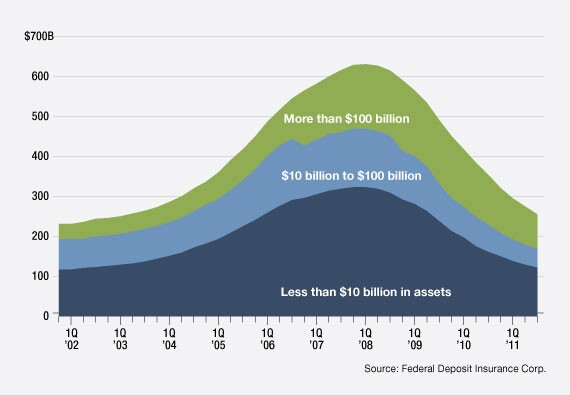

Big Role on Small Balance Sheets

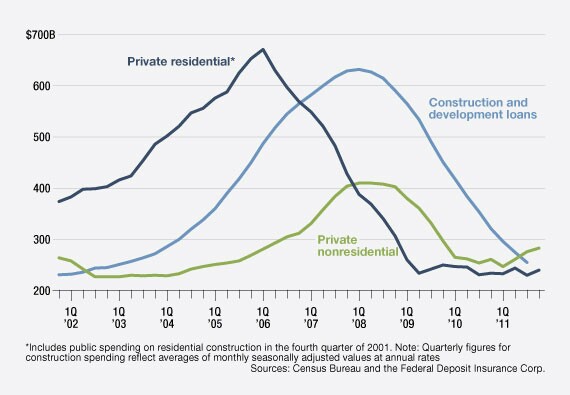

Looser Credit, Stronger Demand

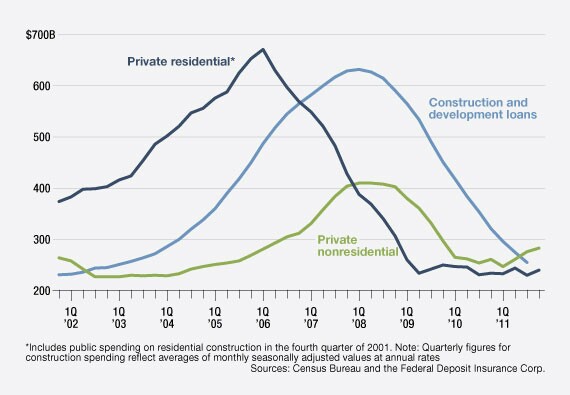

Bad Hangover

Real Estate Owned

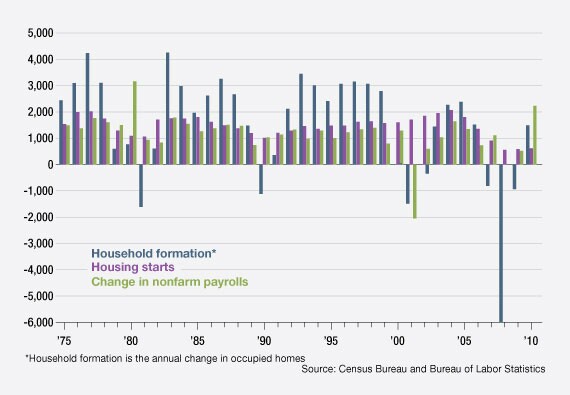

Household Disintegration

The two BNPL giants' pay-over-time loans will now be available for in-store purchases on Apple Pay in a move to capture more sales at brick and mortar stores.

State regulator says blockchain tools are key to detecting money laundering and sanctions violations.

The Bank of England may cap ownership, drawing ire from crypto groups that claim that will hinder innovation.

Visa is introducing a premium service to the Middle East, and Lloyds Banking says its cash protection product is showing results. Plus, Brex teams up with Doordash and more in the American Banker global payments and fintech roundup.

A report from Democratic staff on the Senate Permanent Subcommittee on Investigations said accounting firm KPMG gave Silicon Valley Bank, Signature Bank and First Republic clean audits despite internal warnings, fraud allegations and apparent risks of failure.

Each year, American Banker chooses five teams that embody the spirit of collaboration and illustrate how teamwork can have a substantial impact on a bank's top and bottom lines.