-

In his confirmation hearing, Treasury Secretary-designate Steven Mnuchin said he wanted to work with both parties to find a “bipartisan fix” for the housing finance system.

January 19 -

Treasury Secretary-designate Steven Mnuchin will divest himself of his investments and interests in a number of companies and funds once confirmed, including a fund that has bet on Fannie Mae and Freddie Mac being recapitalized and released from government control.

January 11 -

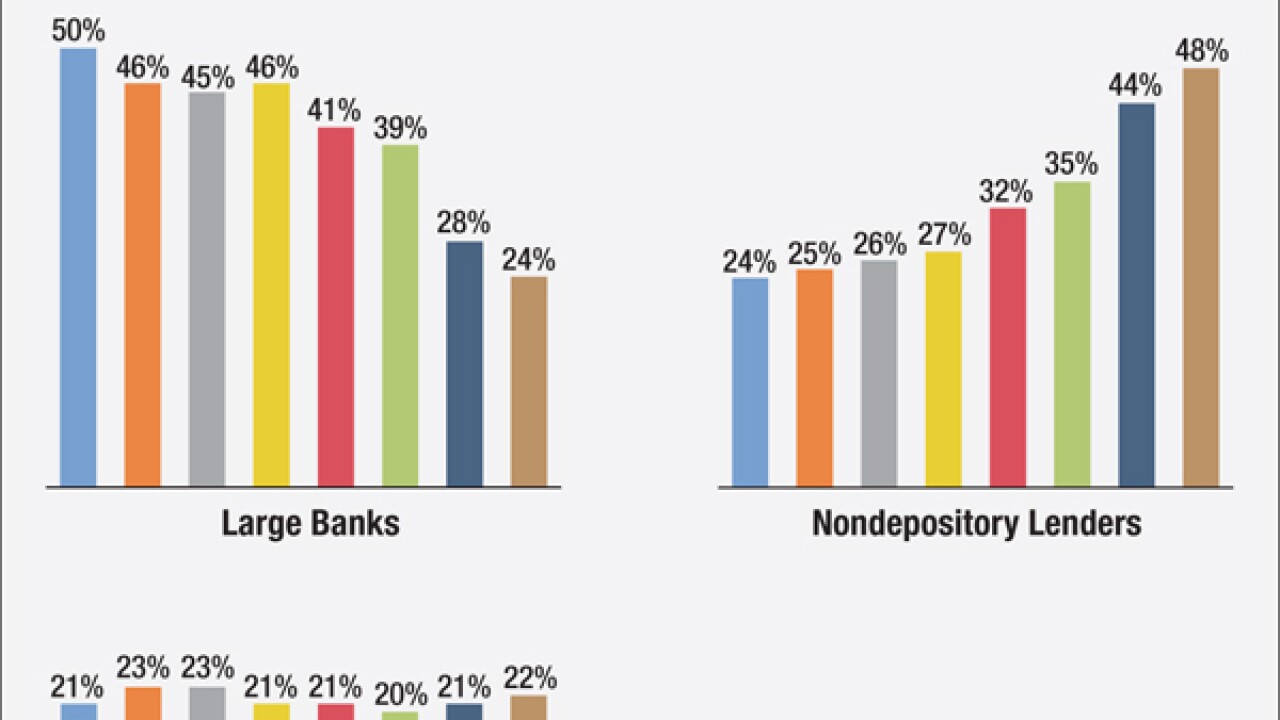

Nondepository lenders are beating their bank competitors when it comes to both digital innovation and market share in the mortgage industry. As interest rates rise, banks will need to move toward electronic closings and adopt other innovations if they want to stay competitive.

January 10

-

WASHINGTON The Senate Banking Committee is scheduled to hold a hearing Jan. 12 on the nomination of Dr. Ben Carson as secretary of the Department of Housing and Urban Development.

January 5 -

Proponents of "recap and release" misread the political risks and the depth of interest that key lawmakers have in determining the long-term future of Fannie Mae and Freddie Mac.

January 3 Mountain Lake Consulting

Mountain Lake Consulting -

WASHINGTON The Federal Housing Finance Agency is making it easier for Federal Home Loan banks to expand the kinds of collateral they can accept for advances.

December 29 -

Congress wants to put federal flood program on sounder financial footing, encourage the development of private flood insurance market and stop the insanity of rebuilding properties subject to repetitive flooding.

December 23 -

The case against Fannie Mae and Freddie Mac is stronger than the argument for their survival.

December 23 Mitsubishi UFJ Securities International

Mitsubishi UFJ Securities International -

Treasury sweep agreement set to deplete Fannie and Freddie's capital reserves by the end of 2017.

December 23 -

Ginnie Mae has revised the wording of the acknowledgment agreements necessary to finance mortgage servicing rights. It sought to resolve a concern warehouse lenders had in the event issuers become troubled.

December 21