-

The announcement Thursday that Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mel Watt agreed to let Fannie Mae and Freddie Mac each build a $3 billion capital buffer avoided a potential crisis.

December 21 -

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

For the second week in a row, the CFPB's leadership shakeout dominated readers' attention, while a regional banker discussed efforts to fight hacking and the impact of the tax cuts, and bitcoin's price soared.

December 8 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

Farmer Mac has terminated President and CEO Timothy Buzby for violating company policies not related to its financial and business performance.

December 7 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

Cutting payments helps stave off default, but principal reduction on underwater loans and lower consumer debt levels are less effective, according to JPMorgan Chase Institute's new study of post-crisis modifications.

December 5 -

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

The White House and congressional GOP leaders are eyeing a tight window between tax reform passage and the 2018 midterms to pass housing finance reform. And with key policymakers readying their exit, the effort could be the most concerted push yet.

November 17 -

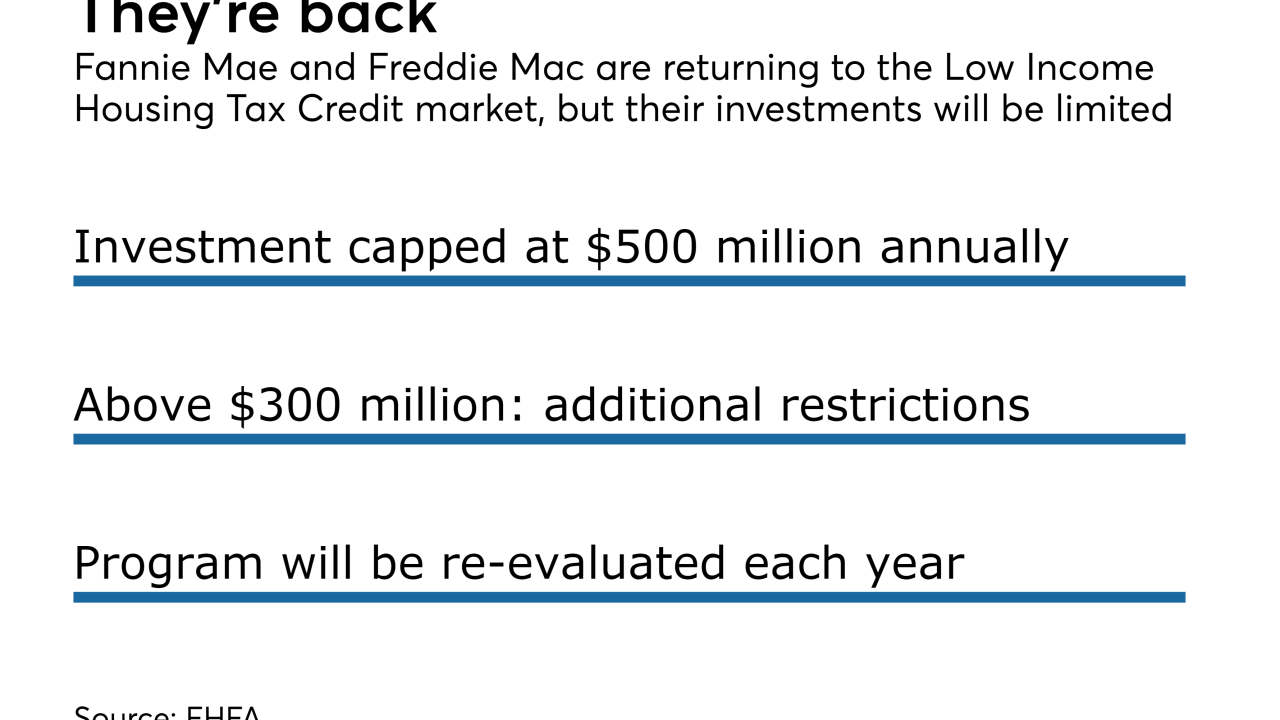

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

The battle lines are drawn between those seeking to protect the mortgage interest deduction and a legislative effort to greatly reduce its use. Hopefully, this is a battle that taxpayers will win.

November 10 American Enterprise Institute

American Enterprise Institute -

More FHA homeowners than expected are refinancing out of the program and into conventional mortgages, despite an increase in mortgage rates over the past year.

November 7 -

Growth in loans with higher debt-to-income ratios is reviving focus on a regulatory exemption for Fannie Mae, Freddie Mac and other federal agencies that back mortgages.

November 3 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

Mark Calabria, the chief economic adviser to Vice President Mike Pence, said the administration is focused for now on more pressing issues than GSE reform, including addressing housing damage from recent hurricanes.

November 1