Mulvaney’s first days at CFPB: Payday, personnel and a prank

(Full story

Mulvaney's plan to embed political staffers in CFPB sparks backlash

(Full story

GAO effectively scraps CFPB auto lending guidance

(Full story

Tax cuts, hacking and fintech partnerships: A bank CEO's take

(Full story

Big banks hope early bet on Alexa will pay off

(Full story

Fifth Third's McWilliams tapped as next FDIC chair

(Full story

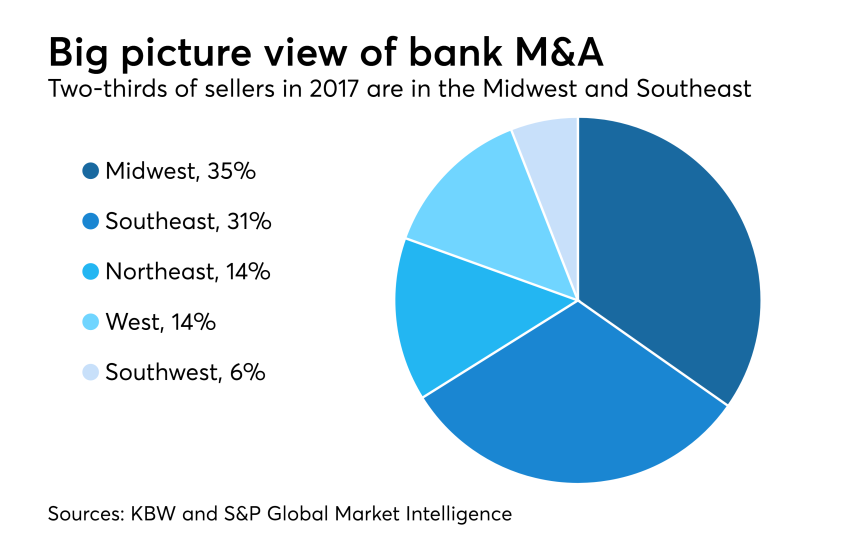

M&T finally seems ready for another bank acquisition

(Full story

When technology becomes a bank merger's albatross

(Full story

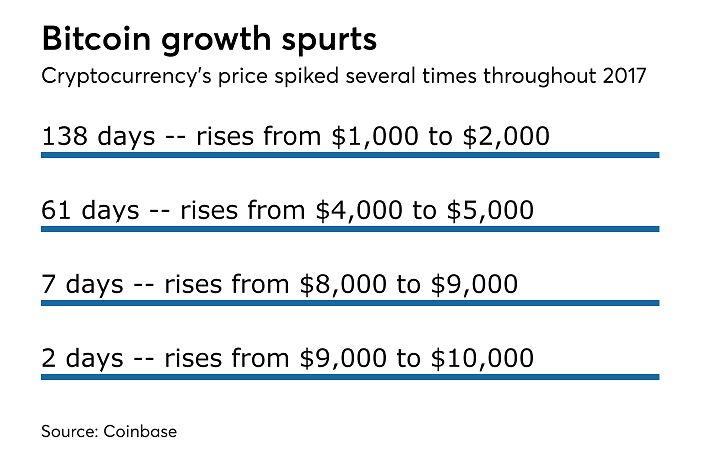

Is it time for bankers to rethink bitcoin?

(Full story

Breaking down Hensarling's GSE reform overture

(Full story