-

Consumer prices rose 0.4% in August, up from 0.2% in July, as weak job growth and lingering tariff uncertainty reinforce expectations for a September Fed rate cut.

September 11 -

A headline-grabbing 2022 lawsuit alleging racial bias by home appraisers has been quietly dismissed for lack of evidence. At the same time, the Trump administration is rolling back many of the policy changes involving home appraisals that the Biden administration put in place.

August 12 -

President Trump and his administration have begun to scrap new mortgage lending guidelines that made it easier for home buyers and sellers to dispute property appraisals, finding that homes owned by racial minorities are routinely valued lower than comparable homes with white owners. But despite the promised regulatory relief, many mortgage lenders say the regulatory changes will not impact their lending practices.

August 4 -

-

The 30-year average for both conforming and jumbo loans jumped more than 20 basis points, according to the Mortgage Bankers Association.

May 31 -

Home loan applications dropped for the second time in three weeks, with the 30-year conforming interest rate ticking up 13 basis points, according to data from the Mortgage Bankers Association.

April 19 -

During a hearing on racial bias in home valuation, the head of the Consumer Financial Protection Bureau questions the Appraisal Foundation's "weird" regulatory structure.

January 24 -

The increased limit on the size of the mortgages the government-sponsored enterprises will be able to buy reflects the year-over-year change in home prices.

November 29 -

Even with another annual surge of over 20%, the pace of home-price growth eased in May and experts anticipate even further moderation over the next year.

July 5 -

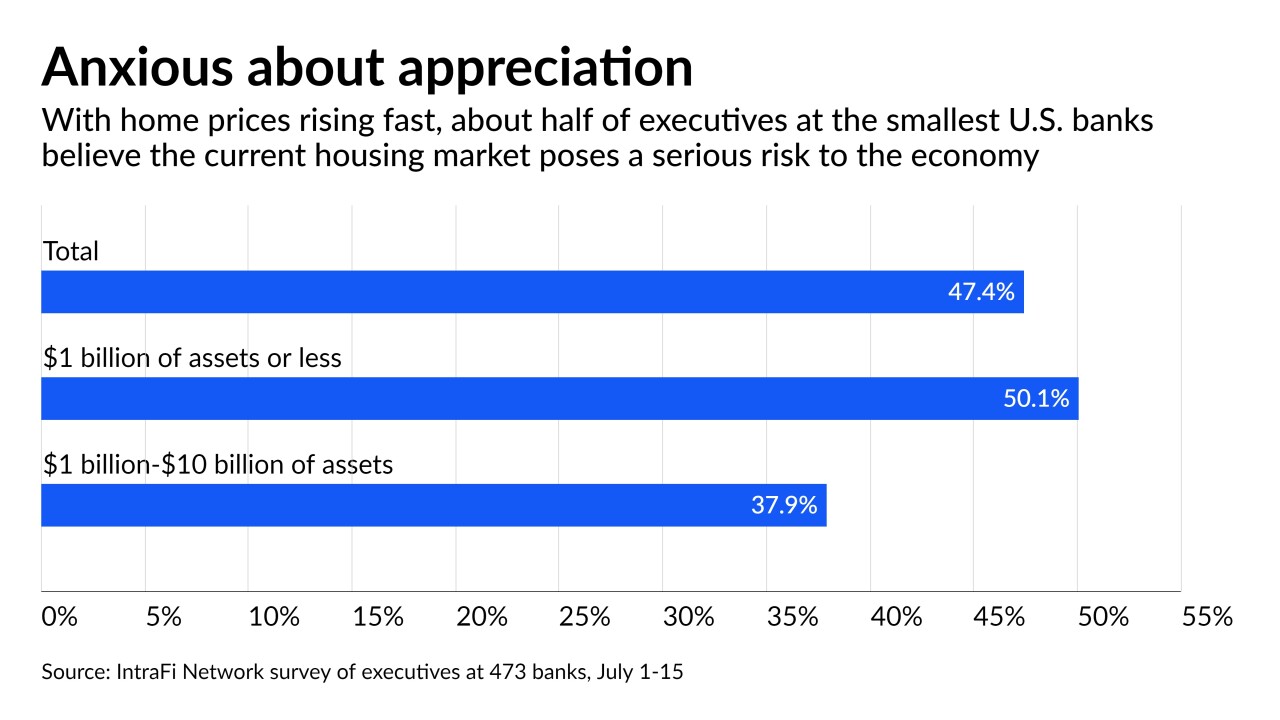

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

April 28 -

The reduction currently under consideration by the Biden Administration would lead to even faster home price appreciation, especially in areas with moderate FHA presence, says Tobias Peter, the American Enterprise Institute’s director of housing research.

February 12 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

November 13 -

JPMorgan Chase is going on the “offensive” in mortgages as home prices rise across the country, said Marianne Lake, the bank’s chief executive for consumer lending.

November 9 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

HELOCs and second mortgages at credit unions are on the decline amid increasing refis and shifts in consumer sentiment about borrowing against their home’s value.

December 20 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

The housing market has changed dramatically since 2002 but the current appraisal limit has not. It's time for NCUA to catch up.

November 25

-

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 2