-

The decline in foreclosures and short sales is contributing to the dearth of housing inventory, complicating the prospects for home buyers feeling the pinch of tight credit and lenders that need purchase mortgages to supplant refinancing once interest rates rise.

June 15 -

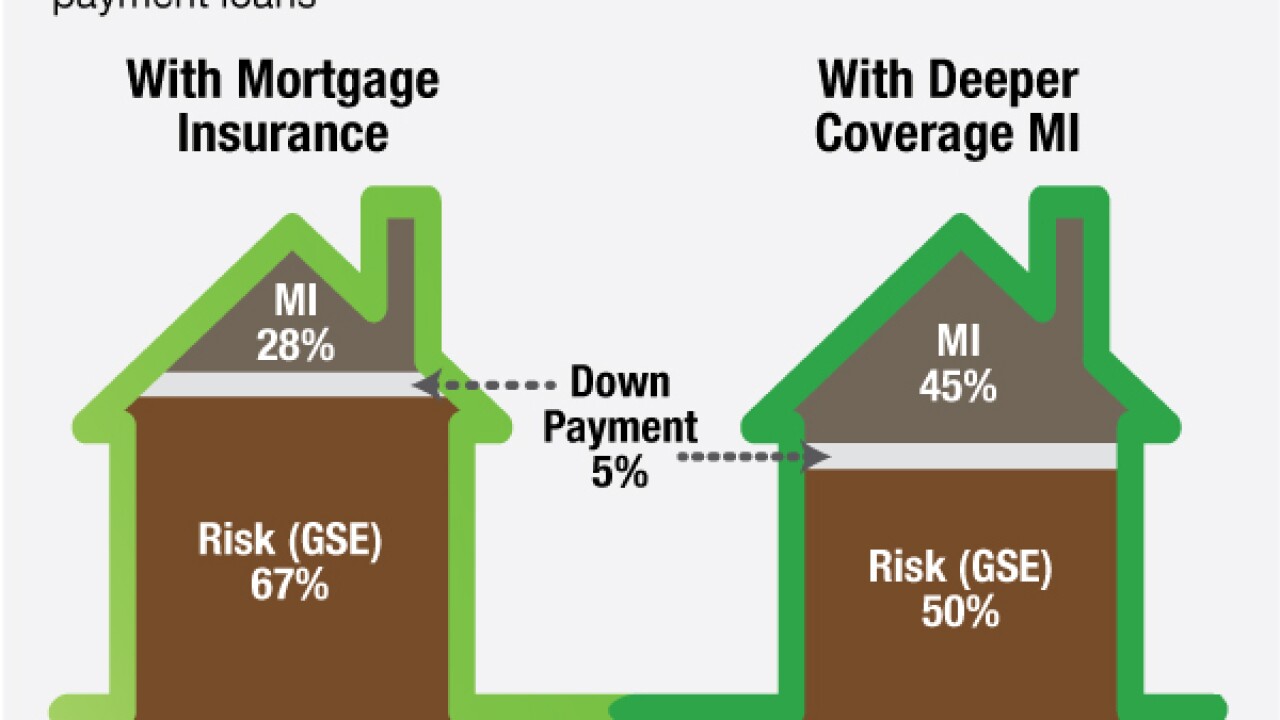

Private mortgage insurers see deeper coverage of GSE loans as a way to expand business, while lenders hope it could lead to a reduction to guarantee fees.

June 12 -

A bipartisan group of Senate Banking Committee members is urging the Federal Housing Finance Agency to make risk-sharing a higher priority for Fannie Mae and Freddie Mac.

June 10 -

Fannie and Freddie should offer upfront risk-sharing options in order to give lenders an opportunity to lower their guarantee fees while encouraging more private capital and competition to flow into the secondary mortgage market.

June 10

-

The details of the final Des-Moines-Seattle Home Loan Bank deal made it clear why this merger worked when past attempts had not and gave clues as to whether other institutions could one day follow suit. Following are three items that jumped out.

June 9 -

Rep. Edward Royce, R-Calif., urged fellow House members Wednesday to support a Senate proposal that would make significant reforms to Fannie Mae and Freddie Mac.

June 3 -

The merger of the Federal Home Loan Banks in Des Moines and Seattle became official on Monday, shrinking the overall number of banks in the system to 11.

June 1 -

New servicing standards issued by the government-sponsored enterprises are unlikely to pose a hurdle for the biggest nonbank players in the market, but small servicers could find it more challenging.

May 28 -

In a sign that the GSEs may once again be trying to compete with each other, Freddie Mac will no longer charge lenders to use its Loan Prospector automated underwriting system.

May 27 -

Fannie and Freddie's profits depend on having their obligations backed by the U.S. Treasury. Therefore they should have to pay a sensible price for this backstop just like big banks.

May 22

-

Nonbank servicers selling and buying Fannie and Freddie MSRs must meet new capital and liquidity requirement to transfer servicing.

May 20 -

WASHINGTON The Financial Stability Oversight Council is encouraging mortgage agencies to continue clarifying when lenders must repurchase defective loans.

May 20 -

Lost in the debate so far over Shelby's regulatory relief bill are the significant changes it makes to the housing finance system. It essentially takes consensus elements from multiple past stabs at reform, leaving out the most controversial parts and making future reform far easier.

May 19 -

It's a good idea to raise the asset threshold at which financial institutions are automatically designated as systemically important financial institutions. But Sen. Richard Shelby's proposed legislation for regulatory relief does require one crucial change.

May 19

-

The regulatory relief package coming before the Senate Banking Committee Thursday would force the Federal Housing Finance Agency to withdraw the contentious proposal within 30 days.

May 18 -

As major banks have pulled back from originating Federal Housing Administration single-family loans, nonbank mortgage lenders have become bigger players in the Ginnie Mae program.

May 18 -

The Federal Housing Finance Agency provided more details Friday about key features for the new single security that will be issued by Fannie Mae and Freddie Mac.

May 15 -

JPMorgan Chase has purchased $45 billion in servicing rights from embattled mortgage firm Ocwen Financial.

May 14 -

Other regional Federal Home Loan Banks are lining up so their members can securitize FHA and VA loans through Chicago FHLB conduit.

May 14 -

The administration's signature loan modification and refinancing programs will be extended for one year to help borrowers "who continue to face challenges," the director of the Federal Housing Finance Agency said.

May 8