-

A bipartisan group of Senate Banking Committee members is urging the Federal Housing Finance Agency to make risk-sharing a higher priority for Fannie Mae and Freddie Mac.

June 10 -

Fannie Mae executives are confident they can responsibly administer a new 3% down payment program to ensure it's an effective tool for increasing access to credit.

November 10

Private mortgage insurers' interest in providing deeper coverage of government-sponsored enterprise loans is growing following the release of new private mortgage insurance eligibility requirements if they can overcome other hurdles standing in the way of this emerging growth opportunity.

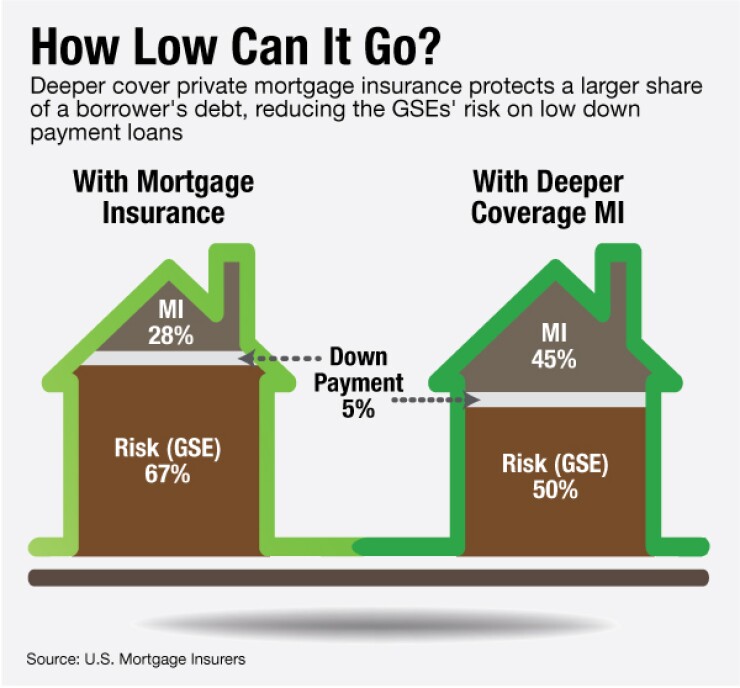

Deep coverage MI differs from traditional private mortgage insurance in that it protects investors against a larger share of losses in the case of a mortgage default. It's not a new concept, but has gained renewed interest as the GSEs work to simultaneously reduce their overall risk exposure and increase consumer access to mortgage credit with low down payment loan products.

"I think conditions are right to try to get involved in some kind of deeper MI coverage," Brad Shuster, CEO of NMI Holdings, a relative newcomer to the PMI industry, said in an interview. "You have very strong capital standards for the industry. You also have the master policy alignment project, which is complete."

Patrick Sinks, CEO of MGIC Investment Corp., was equally optimistic about deep coverage PMI during the recent Keefe, Bruyette & Woods Mortgage Finance Conference in New York.

"It's important to know we have the ability to disperse that risk. We have reinsurance relationships we can find ways to layoff that risk before the loans get to Fannie and Freddie," Sinks said. "But there's a lot more discussion to take place."

Rohit Gupta, president and CEO of Genworth Financial's U.S. mortgage insurance unit, also suggested at the conference that PMI firms could take some additional risk away from the GSEs by offering coverage on mortgages with 75%-80% loan-to-value ratios.

It's too early to tell if such ideas will gain traction, but KBW analyst Bose George said in an interview he expects to see the issue explored further.

"What we've seen in the risk-sharing across the board it takes some time for these programs to get going," he said. "Hopefully we will get a pilot at some point this year and that can move it in the right direction."

The proposed

But any other sort of risk-sharing is unlikely to happen unless the GSEs and their regulator first sign off.

Naa Awaa Tagoe, a senior associate director at the Federal Housing Finance Agency, spoke during a session closed to media during the KBW conference, and a source in attendance said she commented on deeper coverage but didn't commit to it.

"FHFA remains open to considering additional ways that Fannie Mae and Freddie Mac can share credit risk with the private sector," FHFA spokesperson Peter Garuccio said in an email.

"The final PMIERs that were announced in April, and take effect on Dec. 31, will reduce risk exposure for Fannie Mae and Freddie Mac," Garuccio wrote. "It is important to evaluate the impact of the implemented PMIERs as we consider additional risk sharing."

A typical PMI policy covers risk equal to 28% of the property value when a borrower provides only a 5% down payment, until the consumer has made timely payments equal to a 20% equity stake. But insurers could theoretically provide deeper

Lenders hope this type of arrangement could lead to a reduction in the GSEs' guarantee fees.

"If, as a result of risk-sharing structures, the impact results in overall reduced G-fees, that will benefit us," said Kevin Hughes, chief operating officer at Commerce Home Mortgage.

But whether deep coverage PMI would offer savings for lenders would depend on private insurers' rates, as well as the GSEs'.

"You'd have to weigh the additional cost of the deeper MI against the break you're going to get on the G-fee," said Chuck Rumfola, senior vice president of strategic initiatives at Veros Real Estate Solutions, an industry vendor that works with the GSEs and private MI firms.

During MGIC Investment Corp.'s session at the KBW conference, Sinks said that while the private MIs would charge a higher premium for covering a higher percentage of the loan, the G-fee cut would most likely be larger.

And with the final rule for the new PMIERs now in place, it's more likely that the GSEs would be willing to hand off more risk to the private MIs, said Michael Fratantoni, the Mortgage Bankers Association's chief economist.

"Having the PMIERs in place, along with the new master policies, provides confidence to the market and to policymakers that approved MIs can take on a larger role," he said in an email. "However, some aspects of the PMIERs unnecessarily put hurdles in front of this effort."

One hurdle, Fratantoni said, is the limits of the loan-to-value grid that helps determine PMI firms' capital reserves.

"To fully realize the benefits of this approach, the grids would need to be expanded to recognize the lower levels of default incidence and loss severity at lower LTVs," he said.

PMIERs also makes how much new insurance private MIs can write dependent on how much capital they have, Radian Group CEO S.A. Ibrahim noted at the KBW conference.

"You need capital to accommodate new business you are writing," he said.