Toronto-Dominion Bank's $3.8 billion deal for 51% of Banknorth Group Inc. is a bet that both companies will be more effective acquirers in the United States together than either could be on its own.

The widely expected deal, announced Thursday, is not TD's first attempt to expand into retail banking in this country. By keeping the purchase to a partial stake, it would leave itself enough capital to do more deals down the road. W. Edmund Clark, the president and chief executive of the $312 billion-asset company, is aiming to put it in the top-20 ranks in U.S. banking.

"We believe there are ongoing opportunities for deals in the U.S., and Banknorth can continue to do deals with our help," Mr. Clark told investors on a joint conference call Thursday morning.

For the $29.3 billion-asset Bank- north, which has also been acquisitive, the deal means deeper pockets with which to pursue targets in New England and into the metro New York area.

"It was important for me to find a partner to get to the size I want," said William J. Ryan, Banknorth's chief executive.

The Portland, Maine, company has acquired 10 banks in Massachusetts and Connecticut since 2000 but wants to do more deals, keeping up its pace of two to three a year, Mr. Ryan said.

Analyst Mark Fitzgibbon of Sandler O'Neill & Partners LP in New York said Thursday's announcement would provide Banknorth with a competitive advantage when bidding on future acquisitions.

In an interview on Thursday afternoon, Mr. Ryan said that his company, to be renamed TD Banknorth, could eventually reach $70 billion of assets. It has 389 branches and 548 automated teller machines in five New England states and upstate New York and ranks among the 35 largest U.S. banking companies.

But Mr. Ryan, who is also Banknorth's president, vowed to maintain its community-bank feel. "There will be no customer disruptions, which is important given what's going on in New England right now," he said - a dig at Bank of America Corp.'s April 1 purchase of FleetBoston Financial Corp.

Toronto-Dominion would pay cash and stock for its initial 51% stake and would have the option of buying 15.67% more on the open market when the deal closed. However, Mr. Ryan said Thursday morning, "it's fair to say TD will have the opportunity to buy the rest of our company."

Mr. Ryan, 60, would remain its CEO after the deal closed, which is expected to happen in early 2005. He said on the conference call that he plans to retire at age 65.

Under Thursday's deal, Toronto-Dominion could bid for the remaining shares, with certain restrictions, two years after the deal closed.

Toronto-Dominion, Canada's third biggest banking company, already has a presence in this country through TD Waterhouse Group, its New York-based discount brokerage house. But the company has been itching to expand further.

Royal Bank of Canada and Bank of Montreal have already completed a laundry list of U.S. acquisitions.

Toronto-Dominion has stumbled in expansion efforts here. Talks earlier this year with E-Trade Financial Corp., another New York discount broker, were stymied by corporate governance issues, said Daniel Marinangeli, the Canadian company's chief financial officer, in a telephone interview Thursday.

Before those talks, Toronto-Dominion had a deal to offer retail banking in many as 100 Wal-Mart stores. It pulled back in April 2003 after failing to overcome regulatory hurdles.

Mr. Marinangeli said the company now has more clout to do deals, having spent the last couple of years managing its risk profile and increasing capital.

Two years ago it was tripped up by souring credits to the telecom and energy sector, which he said had made it the least capitalized among Canada's six biggest banking companies.

Since then the company has reduced its lending exposure, and its Tier-1 capital levels have increased 4.6% in two years. to $9.4 billion on July 31, or 12.3%, he said. That makes Toronto-Dominion the second-best-capitalized Canadian bank, after Bank of Nova Scotia, Mr. Marinangeli said.

Reducing its risk exposure has allowed Toronto-Dominion to increase its earnings, he added. On Thursday the company reported earnings of $432.9 million for its fiscal third quarter, which ended July 31, 17.7% more than a year earlier. (See "

"Banknorth is our vehicle for expanding in the retail banking space," Mr. Marinangeli said. He added, though, that the economic advantages of a merger in discount brokerage are "overwhelming."

Toronto-Dominion would probably not bid for the troubled Charles Schwab Corp., were it for sale, he said. "We never say never, but I wouldn't say the probability is high."

Schwab is "in state of flux right now," Mr. Marinangeli said. "They need to focus their strategy."

Toronto-Dominion executives reiterated there interest in pursuing a bank merger in Canada if the government loosens restrictions. A proposal that it combine with Canadian Imperial Bank was one of two big deals famously blocked by the government in 1998, over concerns about competition. But Finance Minister Ralph Goodale is expected to meet with bankers soon.

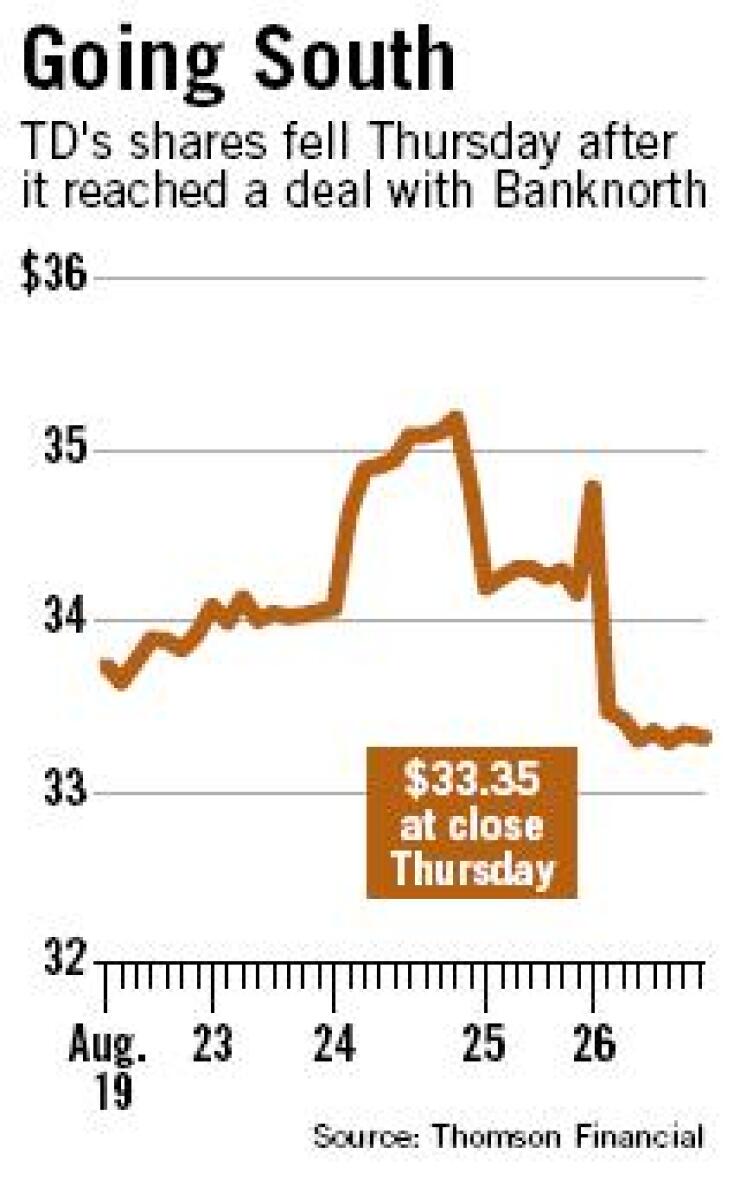

Banknorth investors, apparently worried about the complexity of the deal, sent its shares down 2.8% on Thursday.

John Reosti contributed to this story.