Updated every Wednesday evening, circa 11 p.m. ET. Links may require registration/subscription.

Filing to Keep Home

Much has been written since the crisis began about "walkaways" or

But Consumer Credit Counseling Service of Greater Atlanta Inc., which advises debtors around the country, has begun tracking what could be described as the opposite behavior: people filing for bankruptcy protection so they can keep their homes.

Chapter 13 of the U.S. Bankruptcy Code offers powerful protection against foreclosures: filers get automatic stay on the proceedings. They can keep their homes provided they resume making payments on the mortgage (and eventually repay past-due amounts) while their other debts are restructured.

Of the 50,385 people to whom the Atlanta nonprofit provided pre-filing counseling during the second quarter,

Consumer Credit Counseling began keeping this data in March, so there is no comparable figure from prior periods. But Doug Erickson, a vice president at the agency, said that historically, 25% to 30% of the people who filed for Chapter 13 did so to protect assets of some kind, and that most of the time that asset was probably the home.

Erickson said he was surprised that the home-saver share of filers was not higher during the period his agency began measuring it.

"We're going to watch that percentage carefully," he said. "It will be interesting if it starts to climb."

The most common condition that forced homeowners to turn to bankruptcy to keep their homes, Erickson said, was that they were "overobligated: they owed too much money" to various creditors. The second most common reason was that their income had been reduced; the third, unemployment.

Taxing Times

The National Tax Lien Association in Pensacola, Fla., estimates that 28 states will auction off more than $20 billion of unpaid property tax bills this year to raise cash — which would be a fourfold increase since 2004.

For the first time ever, mortgage servicers and lenders are falling behind in

"There were so many mortgage failures and there's so much chaos, that some tax liens are falling through the cracks," he said. "There's still another massive round of foreclosures coming, and anytime you see foreclosures, you see more tax liens as well."

If the taxes on a property are not paid, the lender can lose the property to a tax bill, though it does not happen very often, he said.

Investors have been eagerly snapping up tax liens because interest charged can range from 12% to 18%, he said.

In Florida alone, the number of delinquent tax certificates offered for purchase by third-party investors spiked 30% last year and is expected to jump 20% this year, Liggett said.

There also is a huge demand from states to collect every dollar from delinquent property taxes.

"States are starved for cash, the cutbacks have been Draconian and the reliance on local property taxes hasn't subsided," Liggett said.

Eye on Refis

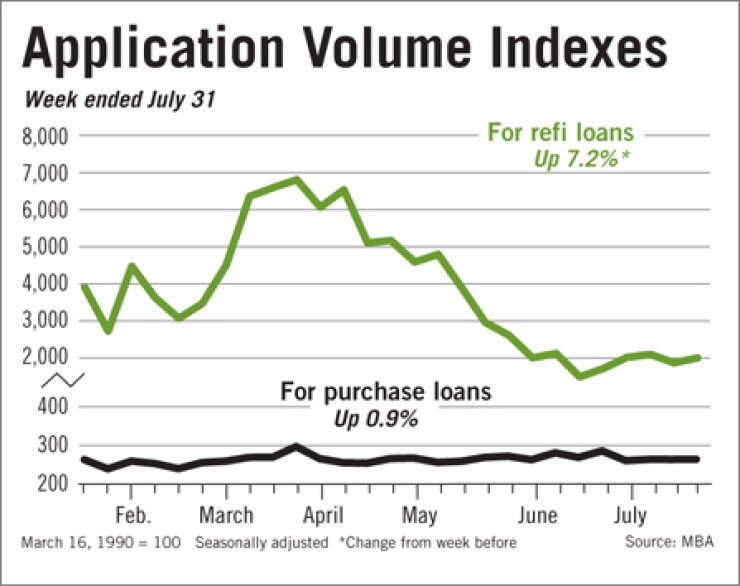

The Mortgage Bankers Association's index of refinance applications

The climb during the week lifted the refinance index to about 35% over a recent low at the end of June.

The trade group said Wednesday that its index of purchase applications, which has not moved much for three weeks, also increased, by 0.9%.

The MBA's overall index increased 4.4% and was 18% higher than a year earlier. The share of the total made up of refinance applications increased 16 basis points from the week before, to 54.2%.

Meanwhile, an index of applications in key markets maintained by Mortgage Maxx LLC fell 8.5% in the week that ended last Friday.

The company said Monday that homeowners are "still playing defense" in part because of stiff underwriting terms and predicted a further decrease in the index of more than 10% by Labor Day, reflecting "just how poorly government intervention has assisted to date."

Quotable …

Many mortgage fraudsters have been "just dormant as securitization dried up, as underwriting standards tightened. There are sophisticated mortgage fraud cells out there who … [have] just been waiting. We're already seeing, like rats to

— Neil Barofsky, the special inspector general for the Treasury Department's Troubled Asset Relief Program, at a seminar in New York last month. (On Monday, his office and the Federal Bureau of Investigation