Finding the bottom line has become a little trickier with banking companies that received government infusions.

Many first-quarter reports contained two different numbers for "net income" — one that subtracted dividends paid on preferred shares issued to the Treasury Department under the Troubled Asset Relief Program, and one that did not.

Companies presented these figures in a variety of ways. Some listed both measures prominently in their press releases; others highlighted just one type of net income at the top and made the distinction only lower down, in the income statement.

Investors and the general public have been demanding increased transparency from financial institutions. Analysts said net income available to common shareholders (the figure that takes the Tarp dividend into account) is the more meaningful one, since the payouts to the government are a cost — and a significant one, at that.

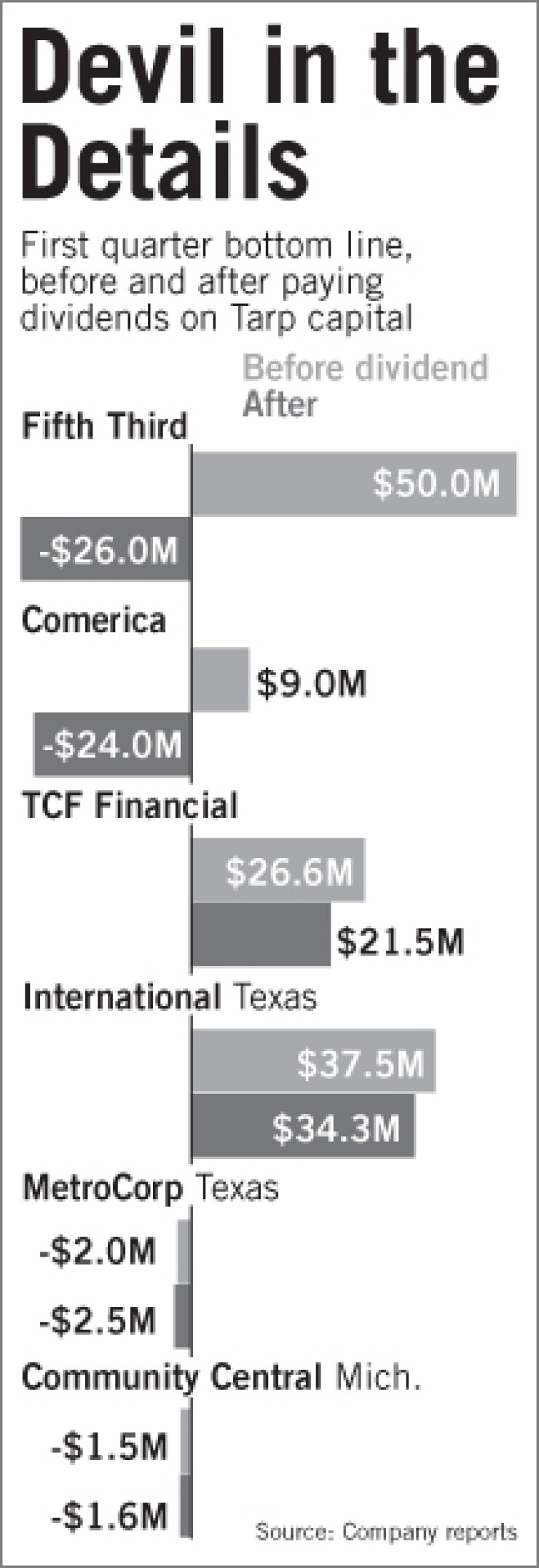

For several companies, the preferred dividends made the difference between reporting a profit and a net loss for the first quarter.

Some bankers, however, argue that net income excluding Tarp dividend payments is an important measure of a company's ability to generate profits from operations, regardless of which equity holders benefit from those profits.

And most of the financial institutions that have received infusions since the Treasury program was created in the fall had no preferred shareholders to pay before the first quarter, so how to present them was a novel question.

"This is new," said Jonathan Nixon, the general counsel for the $12.1 billion-asset International Bancshares Corp. in Laredo, Texas. "A lot of banks don't have preferred, so everybody is scrambling on what to do. Everybody will read each other's and start to get in lock step."

Some observers called it misleading to emphasize the pre-Tarp dividend calculation.

"It's the same sort of 'creativity' that got us into this mess in the first place," said Jerome Patterson, the chief marketing officer of the Houston consulting firm Acorn Systems Inc. "Some seem to want to be as transparent as they can be, and others, it is interesting to see that any numbers that are favorable, they report those in the lead paragraph, and the less favorable numbers, they shove them way down to the bottom."

Accountants following the banking industry said that under generally accepted accounting principles, both net income and net income available to common shareholders are acceptable pieces of information to present without further discussion. And how those numbers are presented in the discussion section of a quarterly report is largely left up to a company's management team.

"It's their prerogative," said Scott Siefers, a managing director in the equity research department of Sandler O'Neill & Partners LP. "They are the ones writing the release. Like with anything, there is an incentive to put the best foot forward."

Bryce Rowe, an equity analyst with Robert E. Baird & Co., said he is more interested in the amount a company netted after the dividend is paid.

"That bottom-line number is more important," Rowe said. "That preferred dividend is a cost right now. … To me, 'net income' would be the bottom-line net income." Profits excluding preferred dividends "should be noted as 'net income before preferred dividends were paid.' "

Fifth Third Bancorp in Cincinnati posted a $50 million profit. However, after paying dividends on preferred shares, the company swung to a loss of $26 million. And Comerica Inc. in Dallas reported net income of $9 million — before dividend payments that pushed the company to a $24 million loss. Both companies included net income (the positive figure) and net income to common shareholders (negative) in the first paragraphs of their press releases.

Still, Fifth Third's inclusion of two separate numbers led to contradictory headlines in the mass news media: "Fifth Third Bancorp reports 1Q loss," in the Associated Press; "Fifth Third posts small 1Q profit," in Business First of Louisville.

A spokeswoman from Fifth Third said it reports its results according to regulations and guidelines and put both numbers up high in bullet points or the discussion portion, because it is more transparent for interested parties in this format.

Fifth Third, which had preferred shareholders before it received Tarp funds, has used different approaches in recent periods.

In its third- and first-quarter reports, the company broke out net income and net income after dividend payments in its opening narrative. In its fourth-quarter report, it listed net income before dividends only in the "earnings highlights" at the top.

Other companies chose bullet points only to show the two different net income numbers for the first quarter, but they left the dividend payments out of the discussion section at the top of their press releases.

Wells Fargo & Co. bulleted net income and income available to common shareholders, but it did not mention the net income to common shareholders in the opening passage.

Before it received a capital injection through Tarp, Wells did not have preferred stock dividends to pay. But Wachovia Corp., which Wells acquired last year, did.

A Wells spokeswoman said the San Francisco company had no comment.

MetroCorp Bancshares Inc. in Houston put both the net income before preferred dividends and the earnings per share after the dividend payments in the headline of its first-quarter release: "MetroCorp Bancshares, Inc. Announces First Quarter Earnings With Net Loss of ($2.0 Million), or ($0.23) Per Diluted Common Share as a Result of Increase in Provision for Loan Losses and Loan Charge-Offs."

The company did not return calls for comment.

It is not just industry watchers who are getting confused.

Mid Penn Bancorp in Millersburg, Pa., corrected its first-quarter results last week after the $560 million-asset company discovered it had forgotten to calculate the dividend it paid the government when it reported earnings April 24.

The revision reduced its earnings from 6 cents to 2 cents a share for the quarter.

Mid Penn did not return calls seeking comment.

Nixon said International Bancshares included both numbers in the first paragraph of its press release, because the company felt it was the most transparent way of communicating.

"It was definitely conscious," he said.

Nixon also said he felt it would have been a poor move to include only one of the numbers, because the income before paying the dividends shows the company's earning power, and the number after paying the dividends is the one that would be meaningful to investors.