WASHINGTON — On its face, the Federal Deposit Insurance Corp.'s report on bank earnings in the first quarter was nearly all good news: net income at precrisis levels combined with higher capital and fewer troubled loans.

But there was a darker side to the Quarterly Banking Profile that signaled bank profits may not be sustainable.

While the industry earned $29 billion during the first quarter, that was primarily due to a significant drop in loan loss reserves, which fell 60% from a year earlier to $20.7 billion, its lowest level in nearly four years.

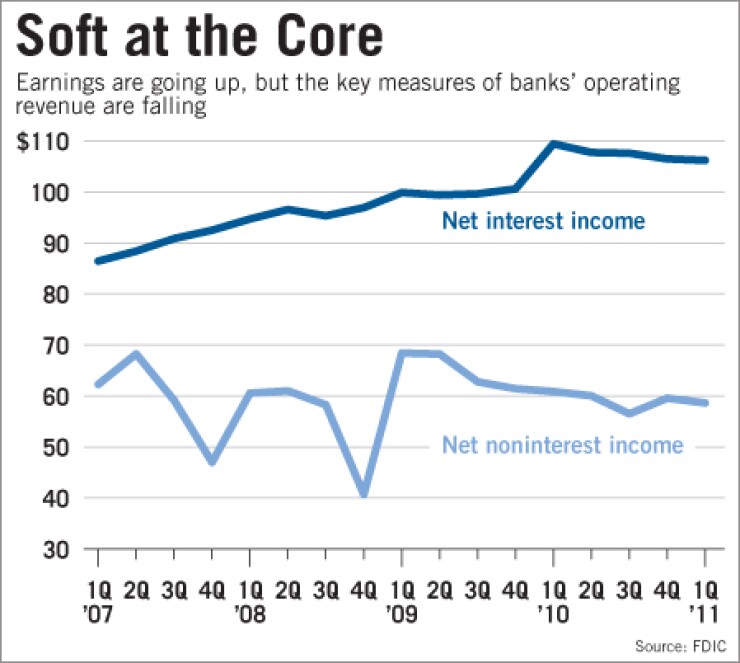

Of more concern was falling operating revenue and a continued drop in lending. Revenue, sluggish in recent quarters, actually declined by 3.2% to $165 billion from the first quarter of last year — only the second such drop in the 27 years that data has been kept. Loans, meanwhile, fell 1.7%, the fifth steepest decline on record.

"There is a limit to how far reductions in loan-loss provisions can boost industry earnings," FDIC Chairman Sheila Bair said in a press conference. "At some point, if banks are to continue to increase their profitability, they will have to grow their revenues."

In many ways the report crystallized what banks have been reporting individually. But the FDIC said the largest banks have been particularly hard hit by revenue declines. Of the 10 biggest institutions, which hold over half of all assets, six had lower revenue compared with the first quarter of 2010, six reported lower noninterest income and eight reported lower net interest income.

Overall, net interest income declined from a year earlier — by 3% to $106 billion — for the first time since 1989, while noninterest income fell 3.7% to $58.6 billion. Interest income suffered in part from tighter margins. (The average net interest margin of 3.66% was 18 basis points smaller than a year earlier.)

"This matters to banks of all sizes, because net interest income accounts for almost two-thirds of industry revenues," Bair said. "But it is especially important for community banks, which rely on net interest income for more than three-fourths of their revenues."

Meanwhile, even though assets grew by 0.7% in the quarter — helped by increases in Federal Reserve bank balances and bigger shares of mortgage-backed securities — loans fell for the 10th time in the past 11 quarters. (Loans and leases totaled about $7.2 trillion.)

Bair said as the liquidity continues to flood the system, "banks have ended up using much of that funding to accumulate excess reserves or invest in low-risk, low-yielding assets instead of making loans."

"Given current asset quality trends, we may see further reductions in loss provisions in the coming quarters that would provide an additional boost to bank earnings," Bair said. "But most of the gains that can be realized from lower provisions have already occurred.

"Banks need growth in higher-yielding assets, particularly loans. That requires increased credit demand from qualified borrowers and a willingness on the part of lenders to extend credit."

Still, the steadily falling loan losses are reason to be optimistic. It was the seventh straight quarter of year-over-year earnings improvement, and 56% of institutions reported higher profit while only 15% suffered a net loss.

Net charge-offs — down 37% from a year earlier to $33 billion — were also down in all major loan categories. The biggest drop was a $7 billion decline — or 39% — in charge-offs for credit card accounts. Noncurrent loans fell 4.7% from the end of 2010 to $341.7 billion. Meanwhile, capital improvements at the largest institutions led to all-time highs in average capital ratios.

"Though insured banks still face many challenges, most are stronger today than they were five years ago," said Bair, who is leaving after joining the agency in 2006. "They are better capitalized and better managed. They have a stable funding that proved itself during the crisis. And they are well-positioned for future growth opportunities so long as we have long term fiscal and economic policies that will give businesses the confidence to grow."

But with banks now competing for a limited loan pool, she warned against relaxing credit standards as banks did before the crisis.

"It is important that banks strike a proper balance," Bair said. "We're approaching a critical point in the credit cycle, where banks are starting to compete more aggressively for quality loan customers. So we may face the risk of the pendulum swinging too far back in the other direction, with banks having incentives to substantially relax lending standards in the pursuit of scarce loans."

Bair used her remarks not only to provide an update on the industry's health but also to reflect on her term.

"It's been a good run," she said.

She discussed the stark differences in the industry between when she arrived and now, as well as her hope for the future of securitization. She also prodded the White House and lawmakers to work more efficiently in filling positions atop the agencies, including hers.

"I wish the administration would put a higher priority on getting names up there, and I hope desperately that the Senate can work with the administration in a bipartisan way to move qualified nominees through the process," she said.

She also noted the different situation from when she arrived in 2006, when banks were earning record profits, no institutions were failing, and only 50 banks were on the agency's "Problem List." At the end of the first quarter, there were 888 banks on the list (an increase of four from yearend), while assets on the list totaled $397 billion. The Deposit Insurance Fund moved ever so close to being in the black, as the ratio of FDIC reserves to insured deposits rose by 10 basis points to negative-0.02%.

"With the benefit of hindsight, we now know that a substantial part of those record profits were illusory" and "reflected an overheated housing market fueled by lax lending and excess leverage throughout the system," Bair said.

Responding to questions, Bair said if the securitization market returns, she hopes the safeguards regulators have put in place will prevent a repeat of the crisis.

"I don't want the party to start up again," she said.