-

Faced with an influx of money that could stream out as suddenly as it arrived, banks are being forced to maintain big pools of liquid assets, and potentially earn negative returns on deposits.

August 5 -

Foreign entities could account for roughly half of reserves booked at the Fed, but, recently, wavering confidence in European banks appears to have channeled some reserves to domestic banks.

July 27

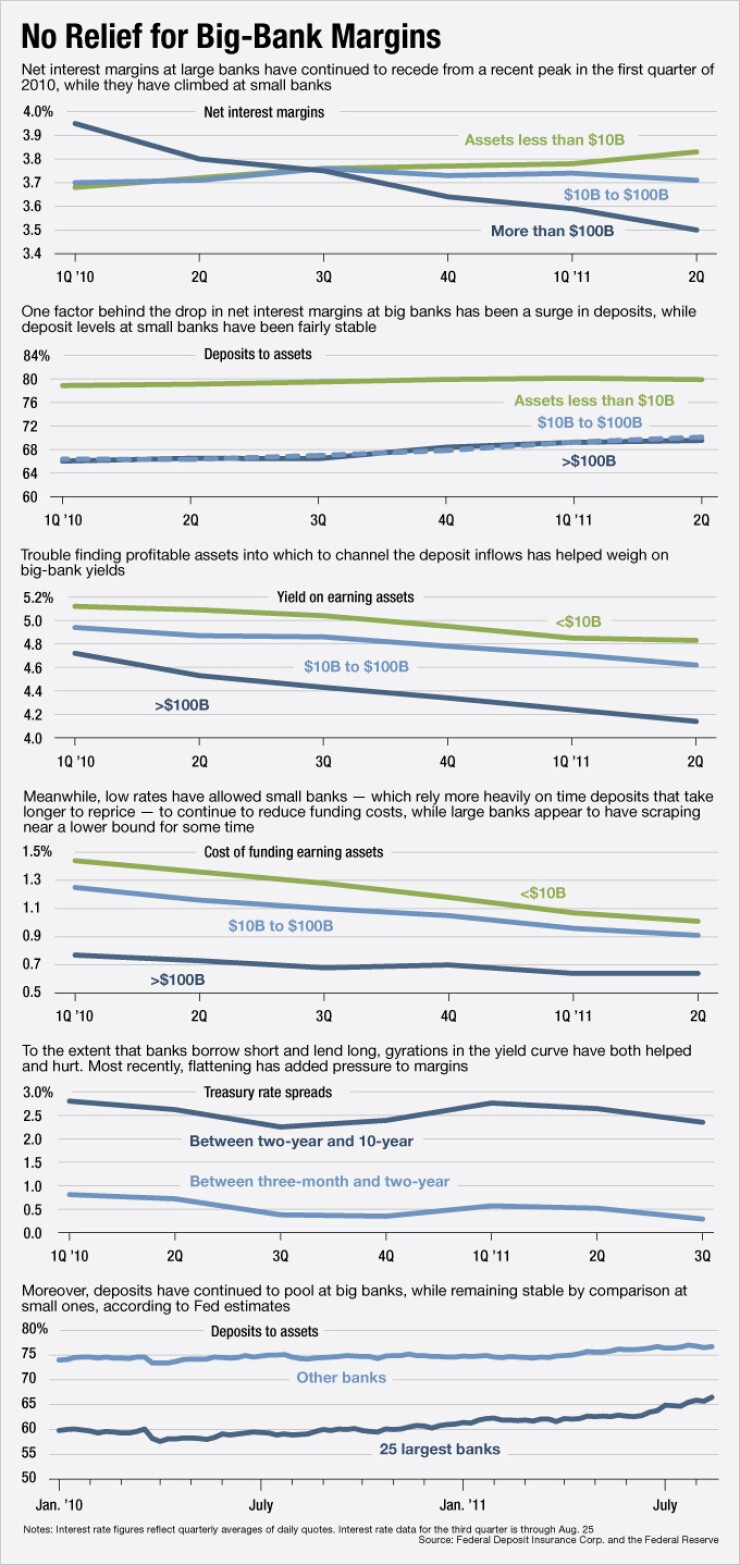

Net interest margins continued to contract at big banks during the second quarter, and the outlook has now deteriorated further.

A flight to cash, which has flooded banks with deposits that they

Margins at banks with more than $100 billion of assets fell 45 basis points from a recent peak in the first quarter of 2010 to 3.5% during the second quarter, according to data published by the Federal Deposit Insurance Corp. in August (see charts).

They have held steady at banks with assets of $10 billion to $100 billion, and they increased 15 basis points at banks with less than $10 billion of assets, to 3.83%, during the same time.

Large and midsize banks are positioned to

Pressure from such buildups of liquidity in an environment of soft loan demand appears to have helped push down yields on earning assets at large banks by about 58 basis points, to 4.14%. Yields also fell at small banks, but only by 29 basis points, to 4.83%.

The boost to margins at small banks has come from reductions in funding costs, which dropped 43 basis points, to 1.01%.

Time deposits account for larger proportions of small banks' portfolios, making them relatively slow to adjust to market rates. Large banks benefited from a fall in funding costs before small banks, and for the last five quarters rates paid by large banks appear to have been scraping near a bottom of around 0.7%.

Risk appetites and expectations for growth have both collapsed, leading to a fall in yields generally. Since short-term yields are already near zero, however, long-term rates have more room to fall.

The gap between rates on 10-year and two-year Treasuries averaged 2.35% during roughly the first two months of the third quarter, close to a recent low of 2.25% in the third quarter of 2010.

To be sure, the decline in margins at big banks has been exaggerated by the onboarding of about $300 billion of high-yielding, securitized credit card loans in the first quarter of 2010 under new accounting rules. That consolidation caused an artificial spike in big banks' yields and set them up for a slide as the card portfolios shriveled.

Moreover, despite the recent decline and ongoing pressure, net interest margins remain relatively healthy by historical standards, holding above levels that prevailed during the middle of the last decade.