The seemingly

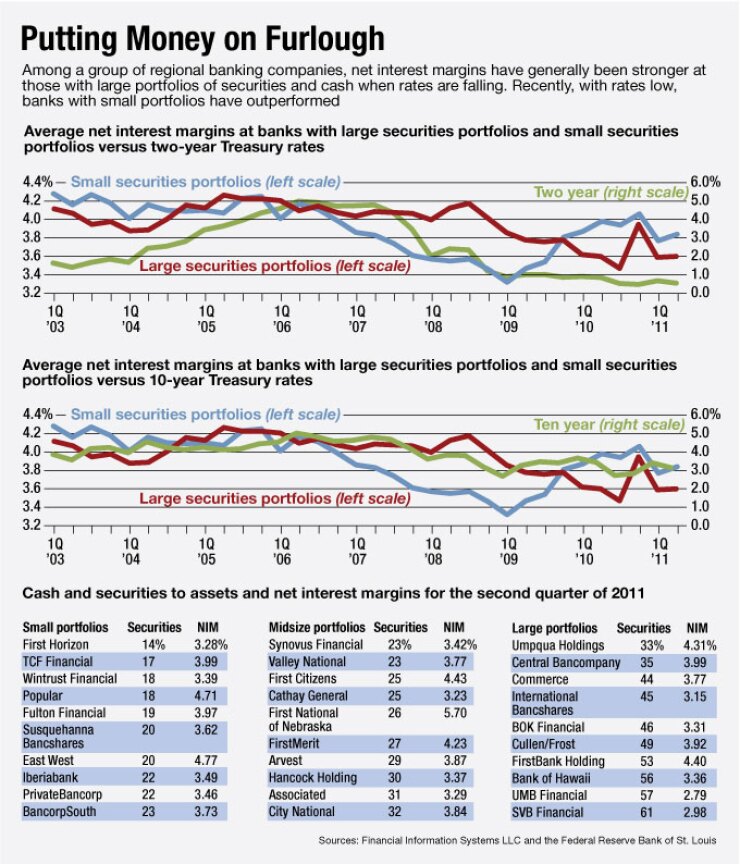

Among a group of regional banking companies, net interest margins at such institutions held up when rates were falling in late 2007 and 2008. Now, with rates at historically low levels, margins at institutions with small portfolios of securities and cash have outperformed (see charts).

The pattern makes sense: bond values increase when rates drop, while institutions with the competitive wherewithal and strategic orientation to sustain loan portfolios with relatively healthy spreads are better positioned for a shallow yield curve.

The data here categorizes a group of 30 bank holding companies with assets of between $10 billion and $40 billion at June 30 by securities and cash as a percentage of assets for each quarter since the beginning of 2003.

Average net interest margins are shown for the 10 institutions with the highest percentages and the 10 institutions with the lowest percentages during each period.

(The same company that was categorized among the 10 with the highest percentages of cash and securities in one period could be categorized among the 10 with the lowest percentages in a different period, though such migrations between the top tier and the bottom tier were rare during the time frame considered.)

While entities with small securities allocations have posted higher net interest margins in recent periods, it is of course impossible to draw a straight line from bond holdings to profitability. Raw numbers on amounts of securities say nothing about their maturities, and thus how quickly investments would be rolled over at market rates — hedging strategies, or the shape of funding profiles, for example.

One notably idiosyncratic case is SVB Financial Group, which specializes in providing capital and other services to technology companies and the venture capital industry. It had the highest percentage of cash and securities to assets in the second quarter, 61%, and among the lowest net interest margins at 2.98%.

But loan growth has been brisk at SVB: about 35% from the year prior, to $5.9 billion at June 30. And, says Julianna Balicka at Keefe, Bruyette & Woods, the securities buildup is simply the flip side of a flood of deposits from the company's cash-rich clients.

Normally, SVB would channel a larger portion of such flows into money market funds and other investment vehicles it manages, but it has struggled to do so because the yields it can offer are so low. In a note in August, Balicka jacked up her earnings estimates for SVB because of its ballooning balance sheet, but slashed her price target for the company's shares after assigning a mortgage real estate investment trust-like multiple to much of the enterprise.