-

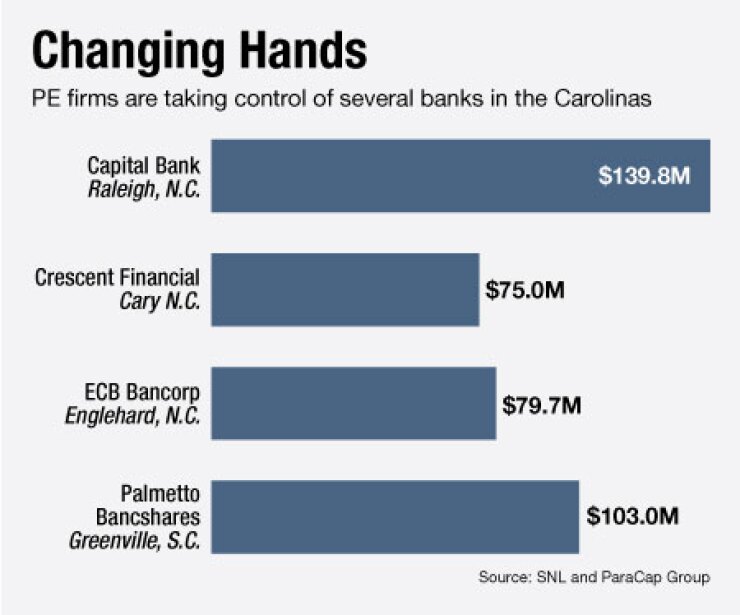

In what would be its first deal since creating a fund to invest in undervalued banks last year, bond giant Pacific Investment Management Co. is seeking regulatory approval to buy a roughly 20% stake in ECB Bancorp Inc. in Englehard, N.C.

September 22 -

ECB Bancorp in Englehard, N.C., announced after the market closed Thursday that it is buying seven branches and $195 million of deposits in North Carolina from Hampton Roads Bancshares Inc. of Norfolk, Va.

July 14 -

ECB Bancorp Inc. in Englehard, N.C., is planning to raise $75 million in a private stock offering and intends to use a portion of the funds to exit the Treasury Department's Troubled Asset Relief Program.

July 1

For the past year bankers at healthy institutions have been scratching their heads over how to deploy capital. The folks at ECB Bancorp Inc., by contrast, are brimming with ideas.

The Englehard, N.C., company said earlier this month that its $75 million private placement from three private-equity firms and a trio of other investors would swell to $80 million. ECB expects to complete the placement by mid-November.

ECB has a three-pronged strategy: organic growth, de novo branching and acquisitions. Company executives said the first two prongs will take time, but the $942 million-asset ECB is getting a head start on the buying front as it aims to grow to $3 billion to $5 billion in assets over the next three to five years.

"We're already building a pipeline of targets," said A. Dwight Utz, ECB's president and chief executive. "All things being equal to today's environment, I would expect that there would at least be an announcement of understanding for an acquisition in the late second quarter or early third quarter of 2012, if not sooner."

ECB has struck one deal since June, when it unveiled its $75 million capital raise. In July, ECB said it would buy about $200 million in deposits and a handful of branches in Raleigh, N.C., from Hampton Roads Bancshares Inc. of Norfolk, Va.

Utz said ECB is looking at similar acquisitions as well as whole-bank deals. It wants banks with strong deposit franchises, but that might be struggling with credit quality. "We want banks that have a strong right side of their balance sheet and are in good growth markets," he says.

Utz said ECB is not looking at transformational deals. Instead, it wants smaller banks of around $400 million in assets that could allow it to expand into new markets. The coastal company wants a way inland, too, said James Burson, ECB's chief revenue officer.

"We want to diversify off the coast. The majority of our business is east of [Interstate 95]. Our Hamptons Road deal gives us a toehold into the Raleigh market, and we are looking for the same kind of opportunities in western North Carolina, Virginia and South Carolina," Burson said. "That geographic diversity could diversify our portfolio off of tourism and agriculture."

Alongside likely acquisitions, ECB said it would focus on de novo expansion. That could take place in areas like Raleigh, where ECB owns four parcels of land or in areas like the North Carolina military towns of Fayetteville and Jacksonville, Burson said.

Organic growth lies in the hands of ECB's new commercial lending division. Earlier this year, it took nine of its best lenders and relieved them of smaller accounts so they could more aggressively pursue commercial and industrial loans. Burson said the goal is to expand the group to at least 18 in the next year and a half.

Over the last few years, the North Carolina market has been heated up by former executives of some of the country's largest banks joining with private equity. Those groups include North American Financial Holdings Inc., which is led by R. Eugene Taylor, a former vice chairman of Bank of America Corp.

"Banking is in their blood," said Christopher Marinac, a managing principal and director at FIG Partners LLC. "The state was built on banking, so it makes sense that we are seeing so many groups pop up there."

Utz is undaunted by the competition. In fact, he sees ECB as being uniquely positioned in contrast to those groups. "The national bankers are trying to go in and talk to the community bankers who have been community bankers all their lives," he said. "I don't think those guys have a clue what a community banking environment should be and I think that's what gets us in the door."

Marinac said that in striking deals, ultimately sellers will be motivated by price. Still, he said Utz and the team he has assembled since arriving in 2009 are strong. Before joining ECB, Utz was the chief retail officer at MidSouth Bancorp in Lafayette, La.

"I think they have a winning management team," Marinac said. "MidSouth went through a good growth spurt while he was there. [MidSouth CEO] Rusty [Cloutier] was largely responsible for that growth, but Dwight was a very important part of that team."

While ECB seems to have a plan, it also has critics. In July, Brady Gailey, an analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc., downgraded the stock to "perform" from "outperform." He wrote in a note to clients that he believes ECB will have a hard time with organic growth and finding properly priced acquisitions.

Utz and Bursen said they understood such reticence given the current market conditions, though they look forward to executing on their strategy.

Management's vision helped land a private equity investment at $16 a share, a 44% premium to ECB's stock price at the time. Several investment bankers called it one of the richest raises they've seen in recent years.

The private-equity partners include Pacific Investment Management Co., in its first deal since forming a fund to invest in undervalued banks last year; Patriot Financial Partners LP; and Endicott Management Co. Pimco did not return a call for comment, and Endicott declined to comment.

W. Kirk Wycoff, a managing partner at Patriot, said in a voicemail message that the company looks for "excellent management teams in markets we think that are poised to grow."