The outlook for the many-headed Capitol Bancorp Ltd. has gone from dreary to grim.

The Federal Deposit Insurance Corp. said last week it had issued prompt corrective action orders to four of Capitol's 24 banks, including its three largest, in February. The directive to each was clear: Sell stock to raise capital to adequate levels, or find a buyer.

Industry observers view such orders as the last public "or else" notice before seizure. If that happens, Capitol's other banks may also be shut down since they are liable for each other under federal law. The potential collapse of the $3.5 billion-asset company's largest banks, with about 68% of its assets, would pose a serious challenge for the FDIC.

"It would be an ungainly package that would likely prove difficult to market and would end up being a pretty expensive disposition," said Chip MacDonald, a partner at Jones Day in Atlanta.

Multibank holding companies are difficult to unwind if one bank fails. Capitol is a bit of an extreme example since it is perhaps the largest and most far-flung of such entities. There are still some banks that Capitol only partially owns, only compounding the problems.

"Capitol has an odd structure, and its condition shows one of the dangers of partial ownership and dramatic geographic expansion," MacDonald said.

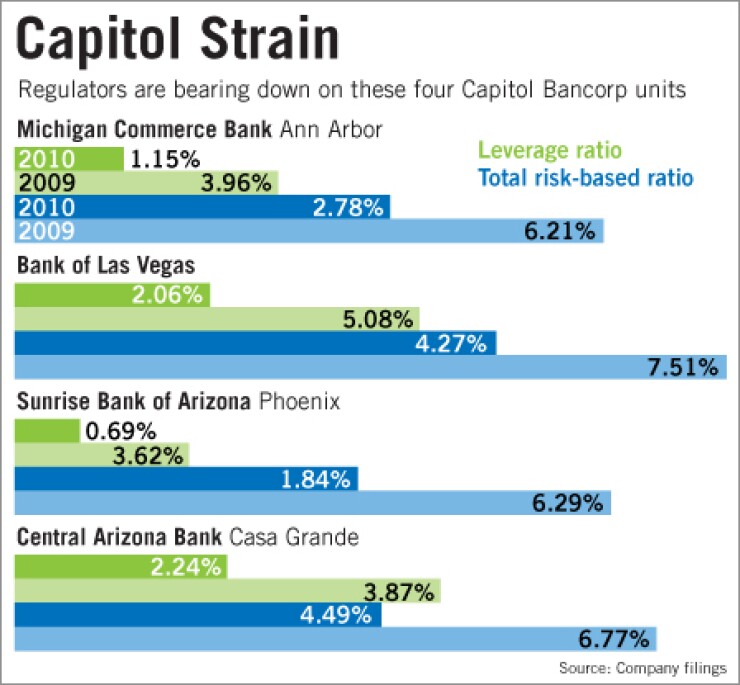

The four banks are the flagship bank, Michigan Commerce Bank in Ann Arbor; Sunrise Bank of Arizona in Phoenix; Central Arizona Bank in Casa Grande; and Bank of Las Vegas in Nevada. The company has dual headquarters in Lansing, Mich., and Phoenix.

The problem for Capitol's other banks is that they may be unable to absorb the loss of the company's biggest banks through cross-guaranty liability, industry observers said. The FDIC could determine that the least costly resolution would consist of bundling all the banks in a single sale.

Lawyers said regulators are keen to a potential tangle and that the recent directives show a desire to be limber. Most prompt corrective action orders banks 30 days to become adequately capitalized. Those issued to Capitol's banks give no time frame. "They may have done that to preserve their flexibility," MacDonald said. "It is a knotty problem."

Frank Bonaventure, a partner at Ober, Kaler, Grimes & Shiver and a former senior counsel with the Office of the Comptroller of the Currency, said the lack of a published deadline is not exactly good news. "Without a time frame, the regulator is reserving all of its options," he said.

The FDIC does not comment on individual banks, but a spokesman said in an email the most likely reason a prompt corrective action order would not include a date is that the institution may already be under an enforcement action that requires it to raise capital.

The banks have been under consent orders since early 2010 and none has been able to boost capital to the ratios outlined in those orders. All four were undercapitalized at the end of 2009 and remained so at the end of 2010.

Capitol has not been idling. In 2009 it hired KBW Inc. to help find capital. It immediately turned its attention to its 53 banks, many of which were partnerships with local management where Capitol held a 51% stake. Capitol has since sold many banks and consolidated others. At Dec. 31, it had 24 banks. The selling spree continues; earlier this month Capitol said it would sell its 51% stake in the Bank of Las Colinas in Irving, Texas.

Capitol has also tried to restructure its capital base by offering common stock to holders of its trust-preferred securities. Had all participated, it could have boosted common equity by $170.8 million. Participation was tepid, boosting capital by about only $20 million.

Eliot Stark, the managing director of the financial institutions group at Headwaters MB, a Denver investment bank, said Capitol has been tireless in pursuing options. "They are well advised with KBW," he said.

"They've talked to every institutional investor, wealthy individual, foreign bank, strategic or financial buyer, and anyone else who might have an interest," Stark added.

The capital that has been brought in with bank sales has been insufficient. At Dec. 31, nonperforming assets totaled $425 million. Capitol lost $225 million last year, compared to a $195 million loss in 2009. Total equity to total assets was a negative 1.09%, making it technically insolvent.

A call to Joseph Reid, Capitol's chairman and CEO, was not returned. Michael Moran, Capitol's chief of capital markets and its one-time spokesman, deferred calls to Reid's office, but said in a voice mail that Capitol is "trying to stay focused on the challenges that we have" and that the prompt corrective actions reinforce existing agreements the with regulators.

Banks with dual ownership have been motivated to sever ties to Capitol, after the 2009 failure of Commerce Bank of Southwest Florida. Though that bank was not owned by Capitol, regulators have asserted that there were ties between the two. Starting last year, the FDIC began granting cross-guaranty waivers to local owners if they were able to buy out Capitol.

The cross-guaranty liability was created with the Financial Institutions Reform, Recovery and Enforcement Act of 1989. It lets the FDIC assess any loss on any surviving siblings. The FDIC has two years to assess the liability. In the current cycle, the FDIC used its powers of the cross-guaranty with the failure of the nine banks of FBOP Corp. in October 2009.

In January 2010, Mitchell Glassman, the FDIC's director of resolutions and receiverships, told the House financial institutions subcommittee that the FDIC used the liability to close all nine banks at once rather than leaving two open, because it was the least costly resolution.

"As demonstrated by the bids, if the FDIC did not apply cross-guaranty to Park National Bank and Citizens National Bank — and those banks would have closed separately in the foreseeable future — the total cost to the FDIC would be $2.91 billion," he said. "Application of the cross-guaranty allowed for the resolution of the entire group for $2.54 billion."