-

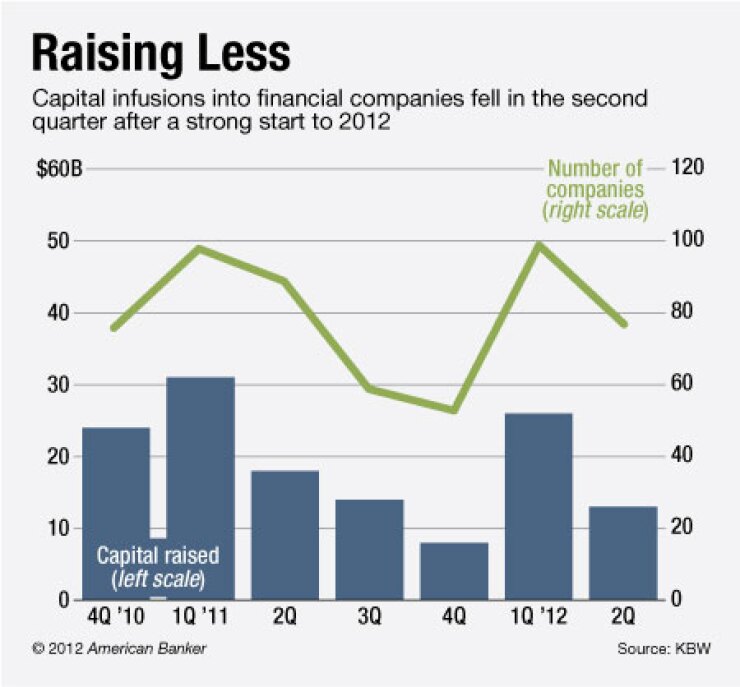

Financial firms are raising less capital as domestic and international concerns abound.

July 12 -

Three years after a group of private equity firms bought BankUnited out of receivership, industry observers wonder if the deal really paved the way for other firms interested in consolidating banks.

May 30 -

A small Florida bank whose shares are so thinly traded that they are in danger of being delisted is suddenly one of the hottest stocks on the Nasdaq — and its president has no idea why.

March 29

ProFinancial Holdings may be the parent of a small bank in Florida, but it has distinguished itself after successfully completing a recapitalization in the state.

The company's ProBank, a five-year-old bank with $75 million in assets, raised enough capital from existing shareholders this month to emerge from a lengthy malaise largely triggered by bad loans. Regulators hit the bank with a consent order last July.

ProFinancial's executives believe the $5 million they raised should be enough to address the capital concerns raised in the regulatory order. And they raised the money at a time when fresh capital is hard to come by for banks of all sizes, especially in Florida.

"We think it's a modern miracle," says Corey Coughlin, ProFinancial's president and chief executive. "We were in the survival business and now we're back in the banking business."

Capital markets

That is what makes ProFinancial's accomplishment noteworthy, industry observers say.

"I just cannot think of another successful [private] stock offer by any bank under any kind of order in the last year," say Ben Bishop, the chairman of Allen C. Ewing & Co. in Jacksonville, Fla.

Still, Bishop is concerned that ProFinancial's success could be an anomaly or, as Coughlin put it, a miracle. "It's too small and every deal is different," he says. "I wouldn't want to say this represents a turning point."

Just four other Florida banks have raised capital this year, compared to seven at mid-2011, according to Bishop's firm. Of the banks raising money this year, only OptimumBank Holdings (OPHC) in Fort Lauderdale

Coughlin says ProFinancial's success may have been tied to its de novo status and its need for a relatively small amount of capital. The company raised about $13 million to launch in late 2007. Less than four years later, the bank fell under a consent order tied to deteriorating credit quality and capital.

"The first thing [shareholders] wanted to know was what the heck happened," Coughlin says. Management met with existing shareholders over an eight-month capital-raising process. The company has less than 300 investors, who are mostly local.

Investors "were understanding of what happened …in light of the fact that we're not the only bank suffering," Coughlin says. "There may be some truth to the fact that everyone suffers equally."

ProBank's total risk-based capital ratio stood at 11.3% on March 31, meeting official regulatory requirements. But the consent order required a ratio of at least 12%. The capital raise lifted the ratio above 14%.

Coughlin joined ProFinancial in August, bringing in a chief financial officer and chief credit officer to start weeding through every loan and to create a risk management platform. They sold foreclosed real estate loans and sliced deposit rates to reduce funding costs.

Coughlin says the bank can start adding earning assets that are guaranteed and sellable, so it won't balloon the balance sheet. The bank reduced its assets by 23% over the 12 months that ended March 31, to $74.8 million.

"That capital will remain fragile until we get the earnings piece fixed," Coughlin says. Creating a platform for U.S. Small Business Administration loans will help ProBank "concentrate on growing revenue as opposed to growing assets."

Coughlin says he expects the bank's first SBA loans to close this month. He describes demand as "moderate" though he vows to take a measured approach by adding loans in "small bites."

"We have to be disciplined in our lending and disciplined in overall accounting for our business," Coughlin says. "We do have to find a way to do it and we will."