-

Businesses affected by the pandemic are accepting online and touchless in-person payments from consumers with the help of technologies developed originally for B2B invoicing and payments.

July 15 -

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

July 15 Financial Services Forum

Financial Services Forum -

A top Federal Reserve official is issuing a warning about fast-growing and largely unregulated shadow lenders: They were a big factor in why central banks had to save markets earlier this year, and much more needs to be done to assess the risks posed by the sector.

July 15 -

Video banking can be safe and effective but members and staff need to be reminded of common-sense precautions to guard against cybercriminals.

July 15 University Credit Union

University Credit Union -

Goldman Sachs Group made the most of a historic market rebound in the second quarter as the Federal Reserve’s stimulus efforts handed a bonanza to Wall Street trading desks.

July 15 -

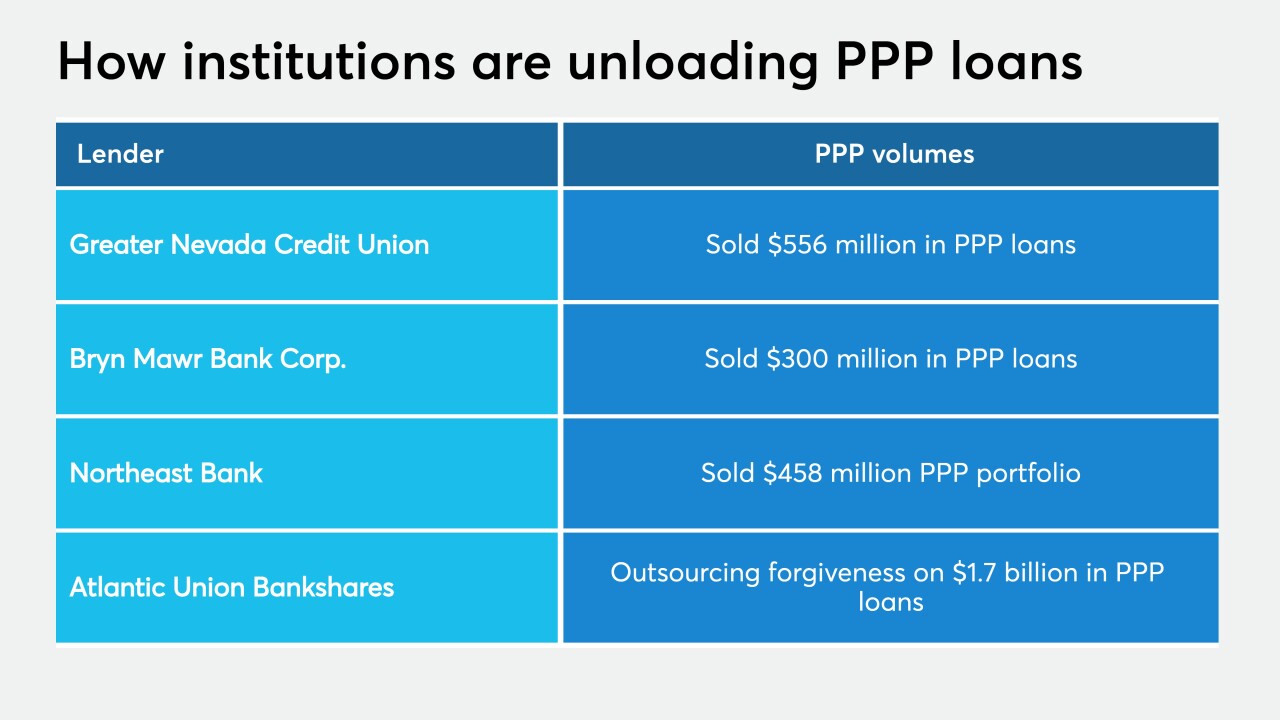

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

July 15 -

JPM Chase, Citi and Wells put aside an additional $28 billion in Q2 for future loan losses; Fed governor Brainard warns of future risks, but St. Louis Fed chief says the worst may be over.

July 15 -

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

The coronavirus pandemic has generated more interest in pay-at-the-pump apps, a growing segment of the payments industry that may not have grown fast enough to be ready for the sudden surge of interest in contactless payments.

July 15 -

A staged implementation rolling up national systems offers EPI its best prospects. Still, it’s a long shot, says Intrepid Ventures’ Eric Grover.

July 15