-

Washington Trust warned that it could lose $3 million in annual revenue after two top advisers left to join a brokerage firm. Other banks are facing similar hits.

November 7 -

Readers react to Sen. Warren's call for banks to fund her Medicare plan, a proposal requiring big-bank CEOs to testify before Congress, federal regulators lacking Trump appointees on their board and more.

November 7 -

If the no-premium agreement announced by First Horizon and Iberiabank this week is a sign that sellers’ asking prices will come down, then Regions might reconsider its anti-M&A stance, a company executive said.

November 7 -

The Honolulu-based credit union saw a nearly 7% increase in new members, thanks in part to an expanded branch presence in West Oahu.

November 7 -

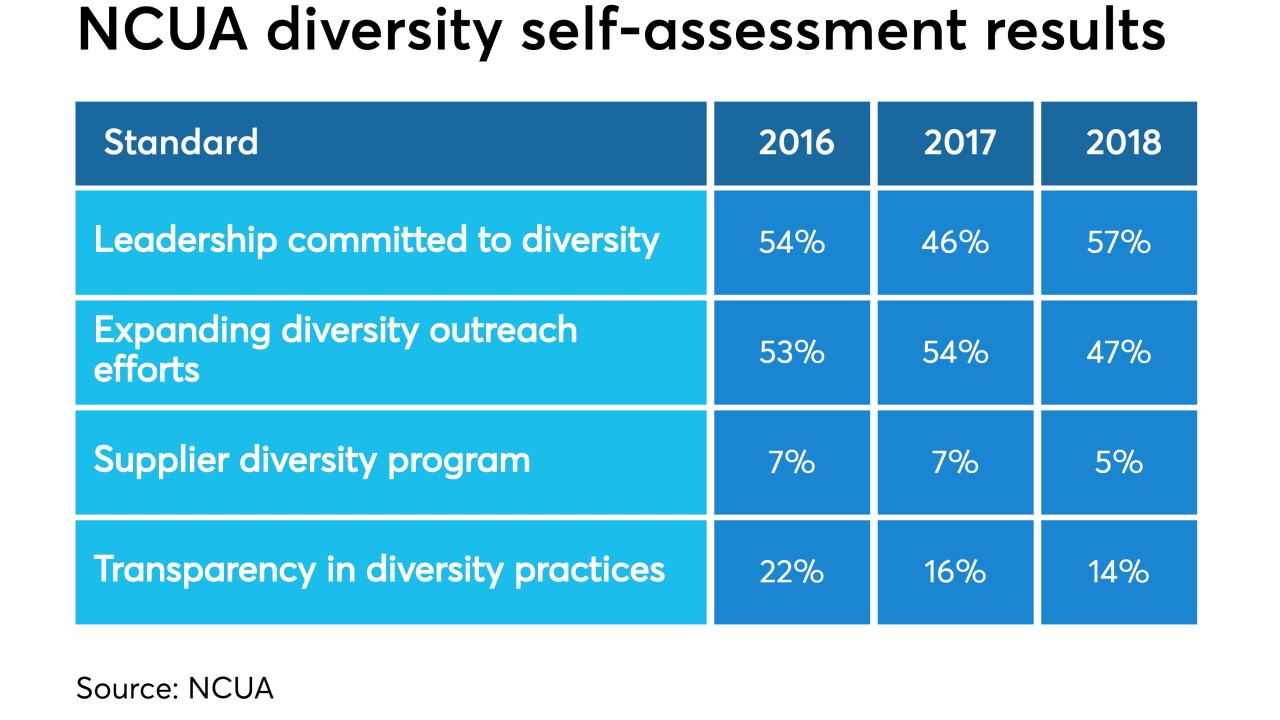

The regulator’s inaugural event on equity and inclusion highlighted the personal and professional but also veered into addressing hurdles credit unions face regarding this issue.

November 7 -

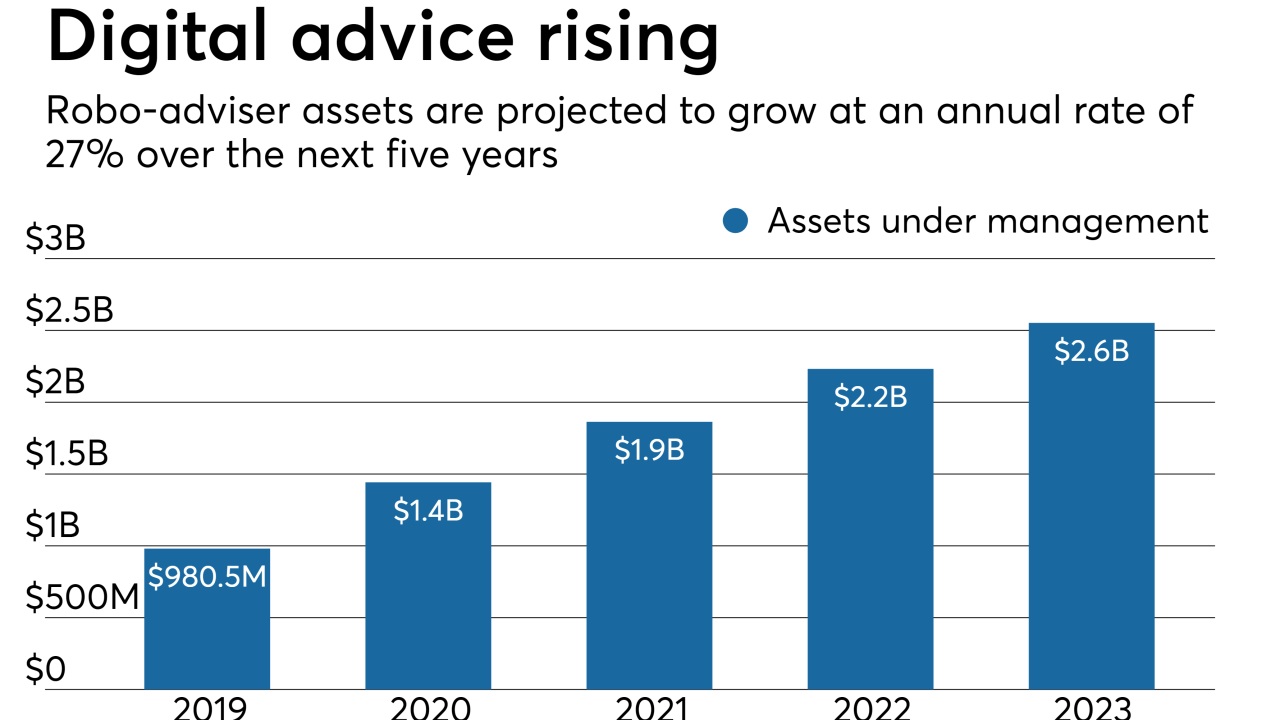

A new partnership will let some community banks and credit unions roll out robo-advice platforms without a significant investment of their own.

November 7 -

A proposal to revise how the agency calculates the restrictions for less than well-capitalized banks relies on faulty methodology and ignores competition from fintechs and credit unions, according to the industry.

November 7 -

Mastercard has formed a strategic partnership with Tappy Technologies, a Hong Kong-based internet of things firm, to develop designer branded contactless payments-enabled wearables, starting with Timex.

November 7 -

Square Cash generates a lot of revenue – and the road to Square’s success is the Cash P2P app, along with Seller tools, as its two curated ecosystems that are cross-selling their way to profitability.

November 7 -

Consumer identities are becoming increasingly digital and more prone to privacy risks. Lawmakers cannot sit idle.

November 7 Orrick

Orrick