-

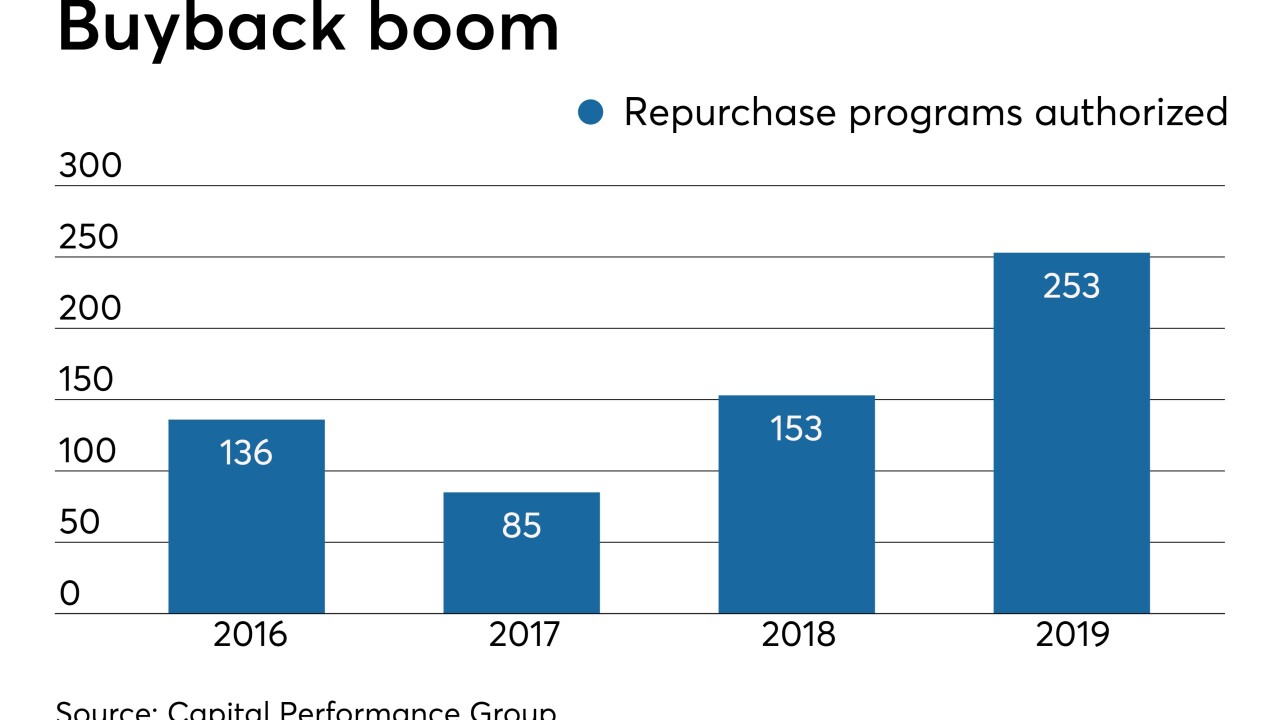

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

MyCUID, an identity-verification tool launched in early 2018, has a new identity of its own.

February 5 -

Popular’s branch in a Brooklyn neighborhood faced an uncertain future until it was designated as a bank development district. Now it’s eligible to receive millions of dollars in municipal deposits.

February 5 -

Inertia or resistance to change have kept small businesses from making the move to more modern systems, says Clover's Mark Schulze.

February 5 Clover

Clover -

Investors think the billions being shelled out to keep up with the likes of Amazon might be better spent elsewhere.

February 5 Oliver Wyman

Oliver Wyman -

The Maine-based credit union also grew membership last year to the point where it now serves nearly 40,000 consumers.

February 5 -

After the State of the Union speech Tuesday, Republican lawmakers hailed the president's economic record while Democrats continued criticism of an administration plan to reform the Community Reinvestment Act.

February 5 -

Instead of a live caller engaging in social engineering with a single prospective target, automatic dialers call thousands of people, instructing them to call bogus telephone numbers purported to belong to the IRS, Social Security Administration, or their bank, says The Santa Fe Group's Bob Jones

February 5 The Santa Fe Group

The Santa Fe Group -

The 49 companies that made our third annual list of Best Fintechs to Work For (a ranking compiled by our parent company, Arizent) include a wide variety of employers, such as small-business lenders, wealth management software developers, direct mortgage lenders, digital banks and payments platforms.

February 4 -

The credit union service organization Member Driven Technologies has a laid-back work environment but works hard to translate its internal culture to employees who may be located hundreds of miles from headquarters.

February 4