-

It has been seven years, and its going to take about $16.1 million, but First Reliance Bancshares in Florence, S.C., says it is about to close a key chapter in its post-crisis recovery and is ready to ramp up growth.

June 6 -

The Federal Reserve has made clear that higher rates are more a question of when, not if, but banks should let go of rate hikes being anything like they were under Alan Greenspan.

June 6 Milepost Capital Management

Milepost Capital Management -

To account for the heightened questioning and investigations around the Panama Papers hack, people need to legal-up and issuers, financial institutions and processors need to gear-up for expected spikes in work related to due diligence, more precise monitoring of transactions, payments and sanctions filtering, possible ad-hoc examination and possible fines.

June 6 GFT

GFT -

In a pair of proposals approved by the Federal Reserve Board Friday afternoon, the Federal Reserve signaled to the insurance industry that it knows the difference between them and banks. But the devil may still be lurking in the details.

June 3 -

New York's financial regulator has ordered 28 online lenders to disclose whether they offer loans to state residents and to describe the types of financing they provide.

June 3 -

In an initial regulatory move released by the Federal Reserve Friday, the central bank was emphatic about distinguishing between the capital and liquidity risks posed by insurance activities versus the riskier ones that firms may be engaged in.

June 3 -

Comments by JPMorgan Chase's Jamie Dimon have added fuel to the long-discussed idea of a national database that would make it easier for banks to vet customers for anti-money-laundering and other risks.

June 3 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

June 3 -

The Consumer Financial Protection Bureau's complex payday lending proposal is sparking concerns that state legislatures will try to repeal existing usury laws and allow a parade of pro-payday-lending bills to move forward.

June 2 -

A lack of liquidity wasn't what caused most of the largest U.S. banks to fail their living wills test, a Federal Deposit Insurance Corp. official said Thursday.

June 2 -

The Federal Reserve has announced the schedule for releasing the results of the 2016 stress tests of the largest U.S. banks.

June 2 -

The National Retail Federation wants the Federal Trade Commission to do more than merely check up on the companies that routinely assess merchants for compliance with the Payment Card Industry Data Security Standards (PCI DSS).

June 2 -

The Consumer Financial Protection Bureau proposal could have included flexibility for banks to offer payday loan alternatives, but the plan misses the mark.

June 2

-

Federal Reserve Govs. Jerome Powell and Daniel Tarullo Thursday said they expect banks to have to meet significantly higher capital minimums after the central bank applies its capital surcharge rule for large globally risky banks to its stress test. That difference could significantly cost banks.

June 2 -

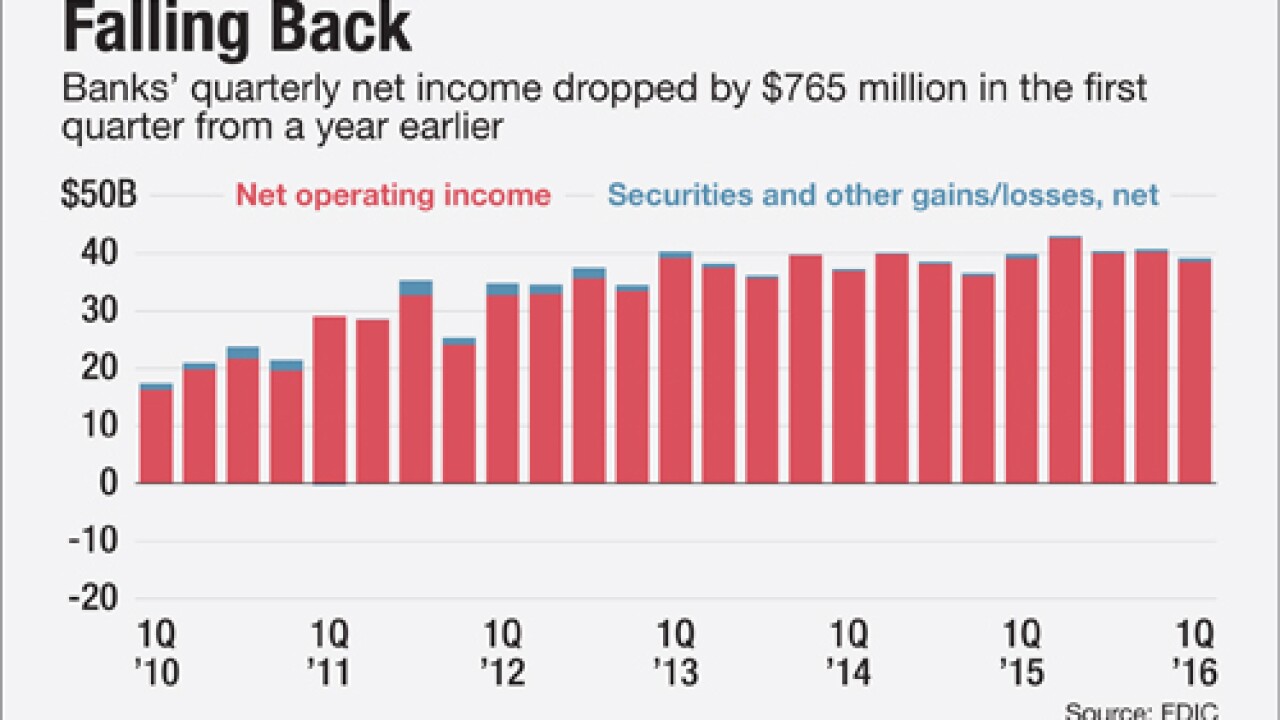

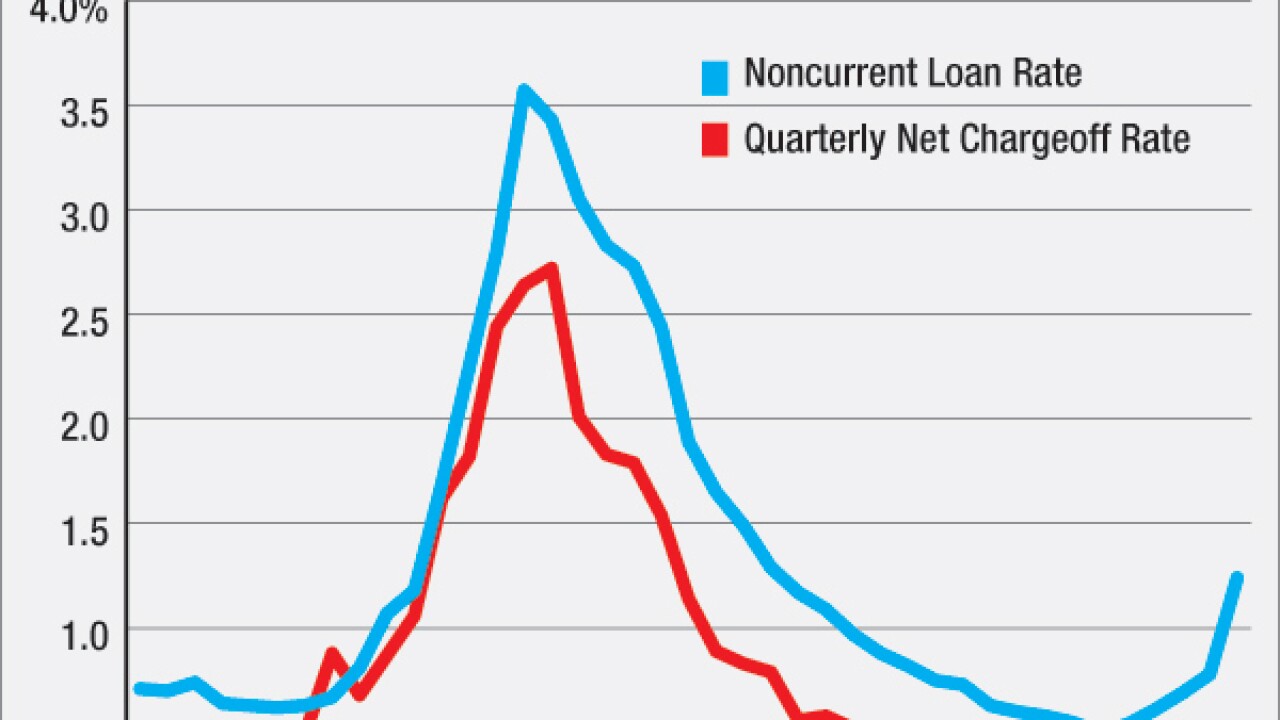

Bank earnings fell by 2% in the first quarter, mostly due to higher loan loss provisions because of troubles in the energy sector. But there were other alarming signs and some positive ones in the FDIC's Quarterly Banking Profile report. Following are the most significant:

June 2 -

The Federal Deposit Insurance Corp. has reached a $190 million settlement with eight large financial institutions over residential mortgage-backed securities claims as the receiver of five banks that failed during the crisis.

June 2 -

Sen. Elizabeth Warren, the founder of the Consumer Financial Protection Bureau, said Thursday she would fight back against congressional efforts to delay or revamp the agency's payday lending proposal even while she acknowledged the plan could have been tougher.

June 2 -

Federal Reserve Board Gov. Daniel Tarullo said Thursday that he anticipates the agency will eliminate the qualitative requirements in the annual stress testing program for most midsize banks as early as next year.

June 2 -

The Consumer Financial Protection Bureau's long-awaited proposal to establish the first federal rules for payday, auto title and high-cost installment loans did not include a provision that banks had planned would allow them to compete by offering small-dollar installment loans.

June 2 -

While there were positive signals like loan growth and improved interest margins in the Federal Deposit Insurance Corp.'s first-quarter report card, there were also signs of trouble for the future, including larger institutions' ongoing exposure to the energy sector.

June 1