-

While there were positive signals like loan growth and improved interest margins in the Federal Deposit Insurance Corp.'s first-quarter report card, there were also signs of trouble for the future, including larger institutions' ongoing exposure to the energy sector.

June 1 -

The Independent Community Bankers of America said that it agrees with the Office of the Comptroller of the Currencys support for responsible innovation in fintech but that it worries marketplace lenders have a regulatory advantage.

June 1 -

We need to adopt a more nuanced view of credit that considers not only the cost of credit, but also the cost of default and the cost of having no credit.

June 1

-

The drumbeat of news about hackers stealing millions of dollars by gaming the Swift interbank messaging system should have been a wake-up call for banking executives, but it's unclear how many of them answered it. Is it too late for them to shore up their defenses?

June 1 -

While existing state laws show that payday lending curbs lead to positive outcomes, those laws will still benefit from a strong Consumer Financial Protection Bureau rule.

June 1

-

The Federal Reserve detected more than 50 breaches of its computer systems from 2011 to 2015, Reuters reported, adding to signs that the central bank may be vulnerable to hackers or spies.

June 1 -

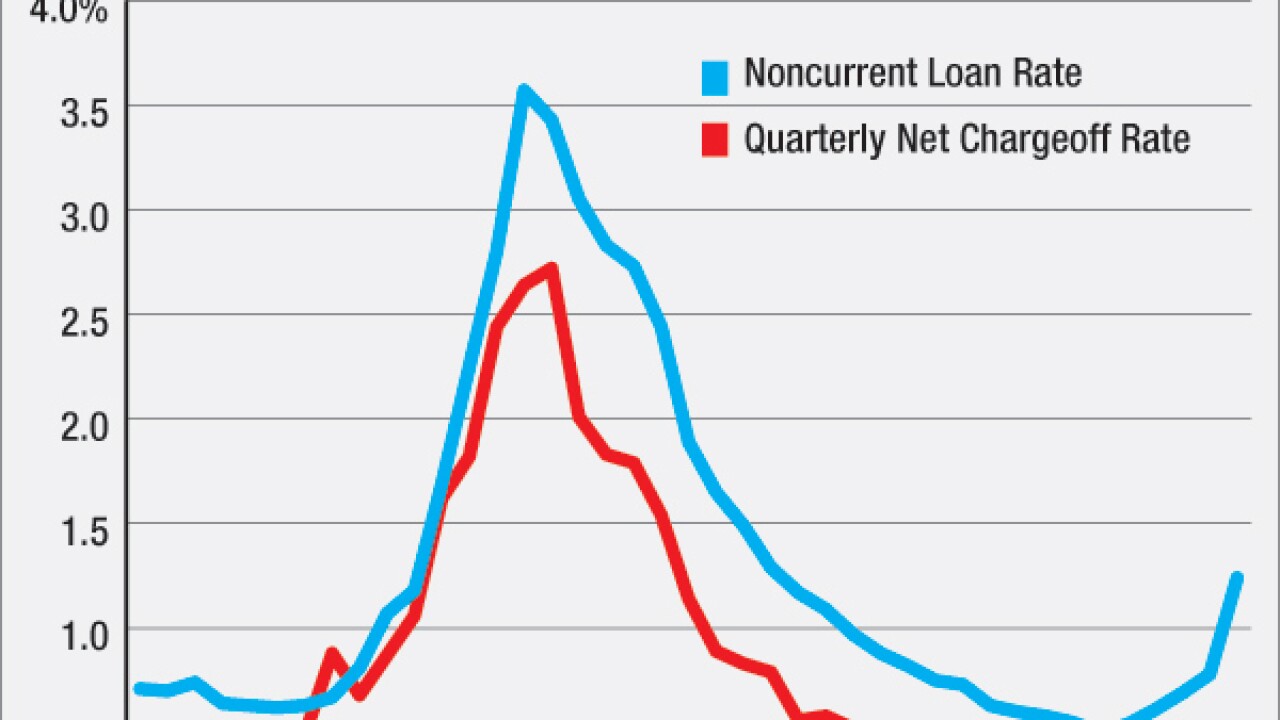

Ties to the energy sector hurt the banking industry in the first quarter as earnings fell 1.9% to $39.1 billion compared with a year earlier, the Federal Deposit Insurance Corp. said Wednesday.

June 1 -

Several civil rights and community development groups wrote Tuesday to urge the Federal Housing Finance Agency to recapitalize Fannie Mae and Freddie Mac.

June 1 -

Community Business Bank in West Sacramento, Calif., has finally put the Troubled Asset Relief Program in the past.

May 31 -

WASHINGTON The Federal Housing Finance Agency is set to make the sales of nonperforming loans by Fannie Mae and Freddie Mac more transparent, including providing information on trends at the individual pool level, according to a top agency official.

May 31