As companies downsize and restructure, American Banker is tracking these decisions to help our readers understand how their industries are adapting.

Read more:

Read more:

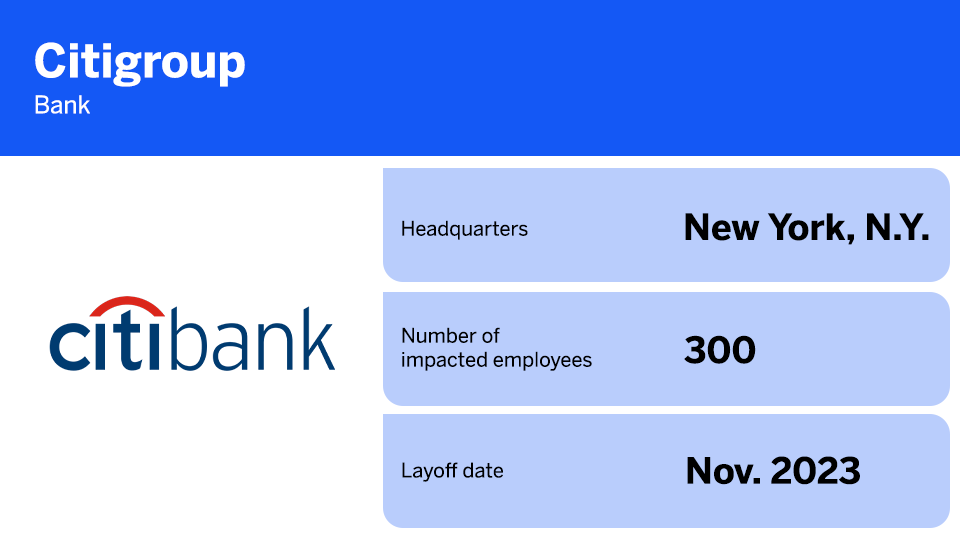

Citi did not say how many positions are being eliminated, or provide the total number of jobs it plans to cut between now and the end of March, when the company expects to complete its reorganization. The company declined to comment on a

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

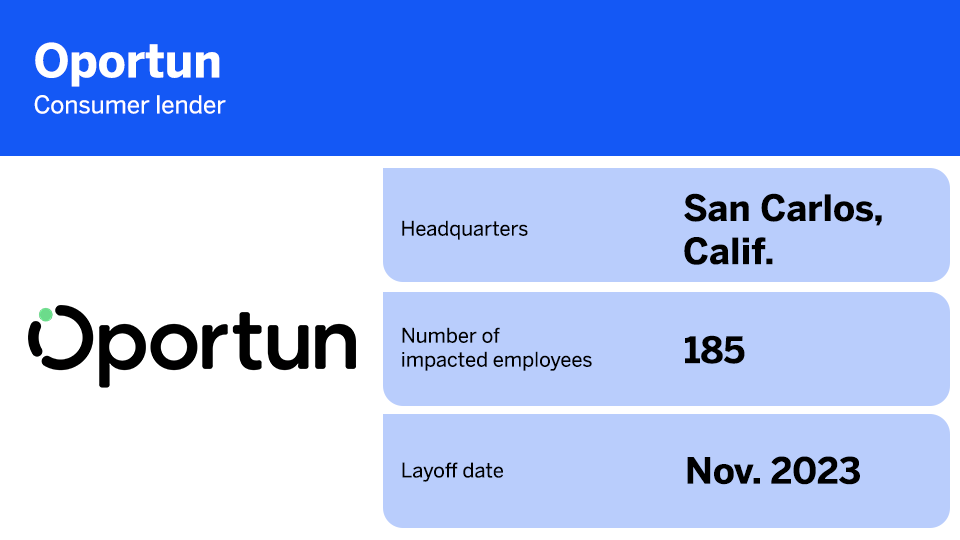

"I remain confident that we will emerge from this challenging economic environment a stronger company than ever before, just as Oportun did following the pandemic and the financial crisis," said Raul Vazquez, CEO of Oportun, in a press release.

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more:

Read more: