A slow start

That was particularly true for March, when only 11 deals were announced, according to data compiled by FIG Partners. Those deals had an aggregate value of $2.5 billion, thanks largely to one deal, while the average premium was 166% of sellers’ tangible common equity, based on data from S&P Global Market Intelligence.

The lethargy extended to first quarter activity, which was the slowest in at least five years. FIG counted 50 deals in the quarter, representing a 12% decline from 2018 and a 28% drop from 2015.

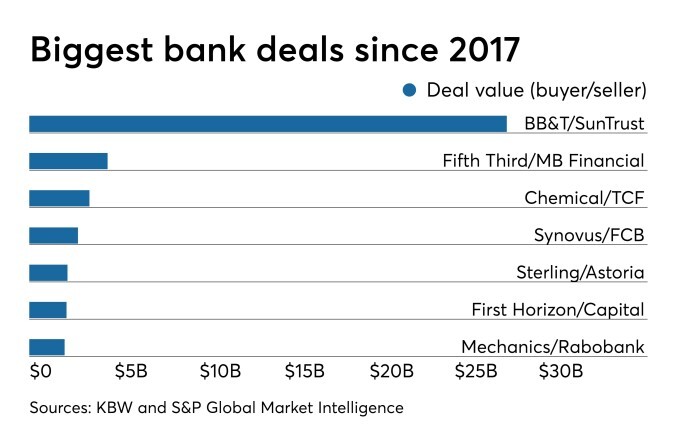

To be sure, 2019 has seen a few large mergers of similarly sized companies, including the combinations of Chemical-TCF and BB&T-SunTrust, that have propped up overall volume.

March, meanwhile, did have some notable deals.

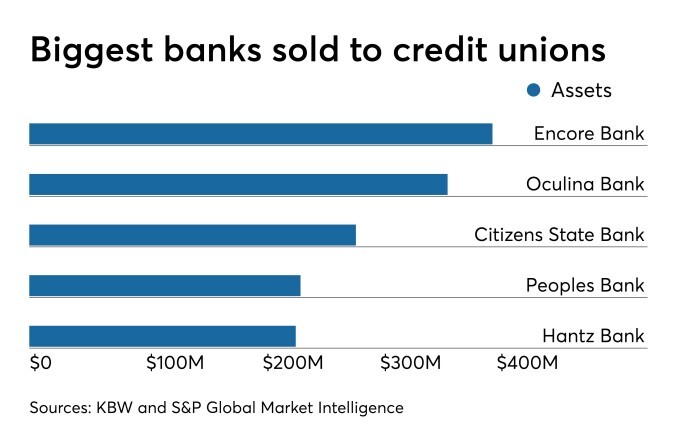

BancorpSouth announced two acquisitions, a large foreign bank agreed to sell its U.S. operations and another credit union announced plans to buy a small bank.

Here is a look at the activity that took place last month.

BancorpSouth doubles down

The $18 billion-asset BancorpSouth

The announcements continue a trend for BancorpSouth. The bank agreed in November to buy Merchants Trust and Casey Bancorp. Those deals just closed.

BancorpSouth also announced two deals — Ouachita Bancshares and Central Community Bank — within weeks of each other in 2014. Those deals were delayed for four years while BancorpSouth worked through a number of regulatory issues.

A big divestiture

The $6 billion-asset Mechanics

The transaction, which provides Mechanics with a statewide presence that it had highly coveted, had been in the works for several years.

The banks had negotiated a deal two years ago, but agreed to walk away to give Rabobank time to

A deal between neighbors

The $1.7 billion-asset bank

The banks' headquarters are just miles away from each other.

"This strategic transaction strengthens our market position and deposit share in our core Central New Jersey marketplace, while complementing our strong organic growth strategy," said Patrick Ryan, First Bank's president and CEO (pictured).

"Grand Bank's organizational values and culture are a very good fit with ours, and we are delighted to welcome Grand Bank's employees to the First Bank team," Ryan added.

A trend continues

The $655 million-asset Power Financial Credit Union in Pembroke Pines

The $655 million-asset Power Financial has six branches and 32,000 members; TransCapital has 2,500 customers.

It's the fourth deal this year in which a credit union is acquiring a bank, and in each case the seller was based in Florida. Two of the nine credit union-bank deals announced last year were also in the Sunshine State.

Turning the tables

The $316 million-asset bank will also buy Texas Farm Bureau Federal Credit Union's only branch. The price was not disclosed.

The $6.7 million-asset credit union had $3.4 million in loans on Dec. 31. Its biggest category — 266 loans totaling $1.1 million — is unsecured loans and lines of credit. The credit union also holds about $1 million in loans for used cars.

A spokesman for the credit union said the membership approved the sale on March 25. While the deal doesn't involve deposits, the spokesman said a lot of the credit union's members are moving their accounts to Alliance.

Texas Farm Bureau Credit Union decided to pursue the deal because of the pending retirement of several longtime employees and the increasing challenges of keeping up with technology. Management reached out to several credit unions about a merger, but was rebuffed when maintaining the headquarters branch was made a condition.