Wells Fargo snags tech executives from JPMorgan, WarnerMedia

(Full story

Suspense builds on new brand for BB&T-SunTrust

(Full story

Wells Fargo 'irresponsible': Dimon blasts rival on lack of CEO plan

(Full story

Wells Fargo expands board, mulls changes to auto loan pricing

(Full story

How APIs are being used at Citi, BBVA and other leading banks

(Full story

A less defensive posture from Wells Fargo's interim CEO

(Full story

This fintech drove billions in deposits to EU banks. Can it work here?

(Full story

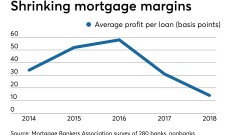

Expect more banks to exit national mortgage lending

(Full story

Huntington unlikely to pursue merger or online-only bank, top executive says

(Full story

CFPB's Kraninger digs in over halt to military lending exams

(Full story