-

Chubb's Banks and the Digital Wallet Race: The Embedded Insurance Strategy looks to gauge how fintechs and banks view embedded insurance.

October 5 -

People love the convenience of nonbanks' financial apps. Regulators could make it much safer for them to share their data with third parties.

June 29 Chase

Chase -

The personal financial management app, which has been downloaded 5 million times, was letting some users view emails and other personal information of other customers.

February 14 -

Banking companies are increasingly using application programming interfaces that transfer customer information to third-party money-management apps popular with consumers. But fraudsters are exploiting vulnerabilities in the technology to steal information.

December 1 -

-

Venture capital firms are pouring money into startups whose data-crunching technology — including machine-learning systems that predict funds availability — speed payments and inform credit decisions in e-commerce.

October 4 -

Buying the cross-border payment and software company can help the card brand provide more services to fast-growing challenger banks.

July 22 -

Salt Labs researchers exploited four types of vulnerabilities in the application programming interfaces of a large financial company. Their findings contradict conventional wisdom about the safety of APIs in the sharing of consumer data.

July 15 -

The San Francisco data aggregator, which also operates out of London, provides international connections between fintechs and traditional banks.

July 8 -

U.S. regulators blocked the card network's attempt to buy Plaid last year for antitrust reasons. Its bid to acquire Tink, a similar company based in Sweden, may have a better shot given European officials' desire to promote open banking.

June 24 -

The company's Drop-In Components allow developers to verify important data without extensive coding.

June 15 -

The company's payment processing platform supports the likes of Uber and Square in their ambitions to create all-in-one offerings that bundle financial and other services.

June 9 -

The card network is connecting its Enhanced Authorization system with products from Accertify, Microsoft and Riskified, providing Amex with more data at the time of the transaction.

June 2 -

EU regulation permits digital connections between banks and fintechs, creating ways for pension providers and brokerages to streamline payment acceptance and cut costs by replacing manual processes with automated ones.

June 1 -

The Australian bank's stakes in technology firms Little Birdie and Amber add price shopping for point of sale credit and bill pay.

May 27 -

U.K. and EU regulations enable cards that provide digital-first features for funds kept in a different bank's account.

May 19 -

Snippets API combines with other APIs to produce marketing and sales programs for merchants.

May 14 -

Legacy vendors are competing more aggressively to modernize payroll, insurance payouts and data sharing.

May 12 -

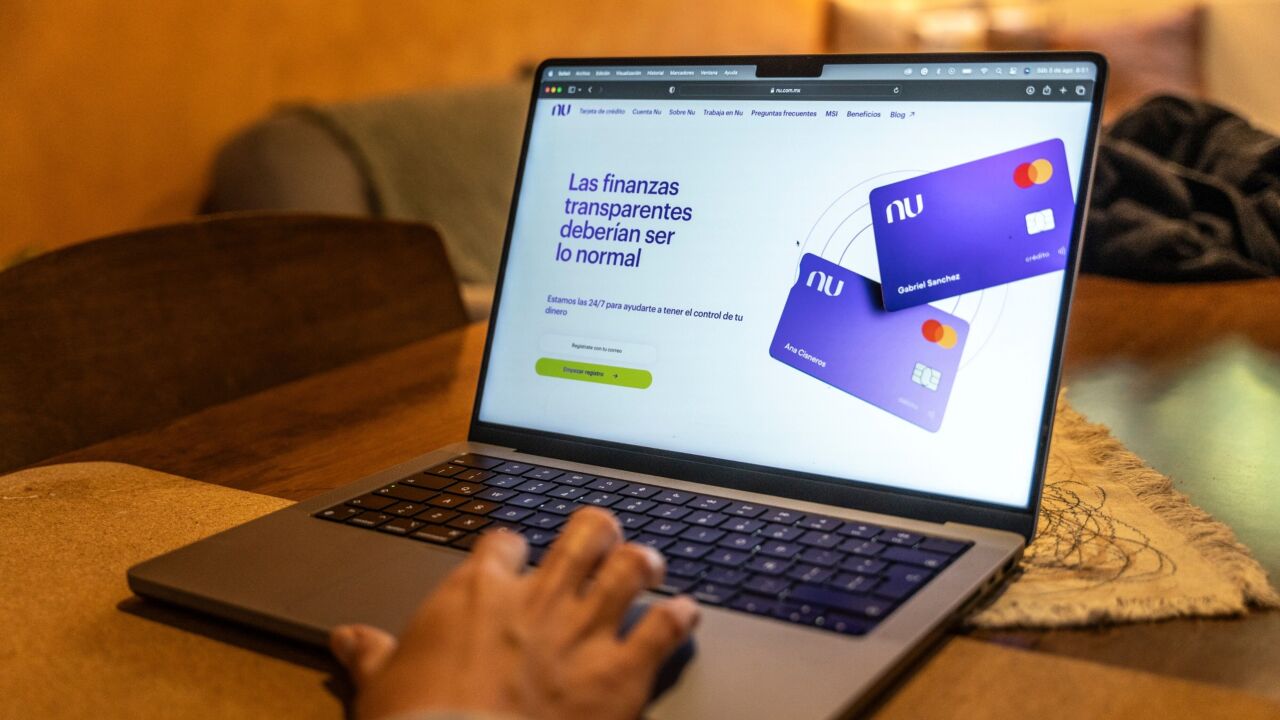

Banks face increasing competition from fintechs, third-party lenders and large technology companies as customer demands evolve, says Mastercard's Fabrizio Burlando.

April 21 Mastercard

Mastercard -

Visa has expanded its push payments platform to enable businesses and their customers to make real-time domestic and cross-border payments.

March 30