Wells Fargo hires KeyCorp executive to shore up risk management

(Full story

M&A on back burner as Valley chief focuses on fintech partnerships

(Full story

Name game: Rebranding BB&T-SunTrust fraught with risk

(Full story

Wells Fargo speculation, female-friendly fintechs and Most Powerful Women on the move

(Full story

BMO Harris names specialty lines chief, three Midwestern executives

(Full story

Regions bailing on indirect auto lending

(Full story

Facebook veteran: Banks have big AML blind spot

(Full story

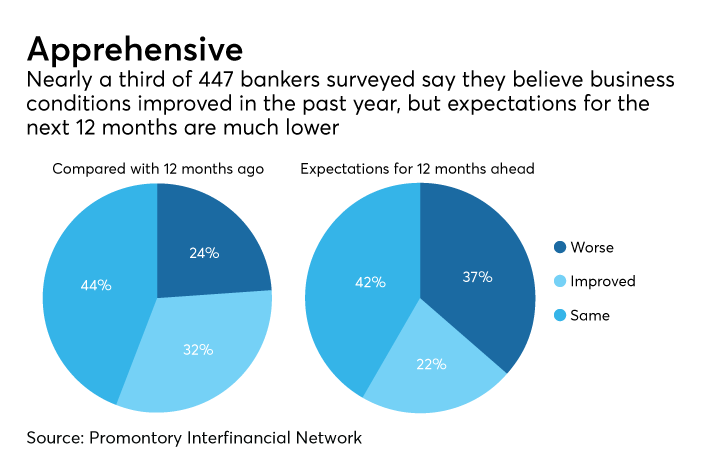

Community bankers brace for rough year — and worse 2020

(Full story

Banks won't be able to remain on sidelines of privacy debate

(Full story

In a twist, Wells Fargo gets $240M payout in latest phony-accounts settlement

(Full story