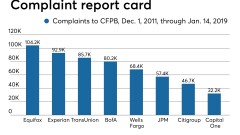

As CFPB mulls privatizing database, consumer complaints mount

(Full story

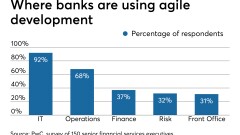

Don't let AI become a black box

(Full story

How some banks are luring talent from big tech

(Full story

Fintech executive sworn in as California's top financial regulator

(Full story

Florida's top bank regulator placed on leave after sexual harassment complaint

(Full story

CFPB official under fire for past writings on race resigns

(Full story

Did BNY Mellon violate 'code of conduct' in dealings with a community bank?

(Full story

CFPB opens door to rewrite of 2009 overdraft rule

(Full story

What's behind the rise in credit card delinquencies

(Full story

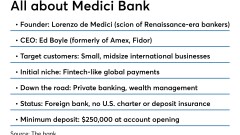

The Medicis are back, and starting a U.S. challenger bank

(Full story