The latest U.S. challenger bank has a unique origin: the powerful Medici family, which ruled Florence and Tuscany for more than two centuries and founded a bank in 1397.

The Medicis invented banking conventions that still exist. They pioneered branch banking because messengers transporting money or goods along the famed Silk Road were often robbed. With branches, the money could be deposited at one location and disbursed elsewhere. That developed into banks forging relationships with one another to help distribute money to far-flung locations, a concept now called correspondent banking. They invented the double-entry system of tracking deposits and withdrawals that banks still use, as well as letters of credit.

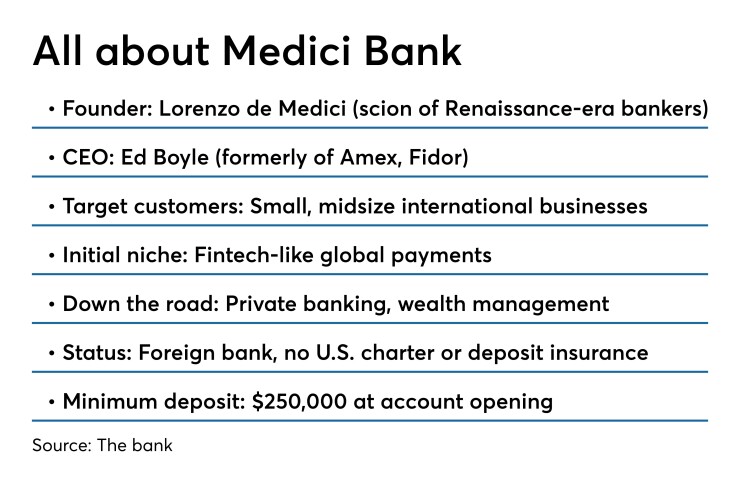

In a return to his forebears’ work, Prince Lorenzo de Medici is setting up a challenger bank in the U.S. to disrupt the old-school bankers in this country. The plan is for the new, digital-only bank to serve small and midsize international businesses in a tech- and crypto-friendly way.

“We are reimagining modern-day banking by leveraging technology that creates seamless, digital customer experiences and expands financial opportunity across global markets,” said de Medici, who is director of the bank as well as the manager of his family’s portfolio and shared ownership in several European banks.

Why the Medicis are back

Growing up near a town on the old Silk Road that hosted a major trading exchange, de Medici always felt pressure to restart the family business.

“His entire life, people asked him, ‘You're Lorenzo de Medici, where's your bank? Why don't you have a bank? You should start a bank.’ It's always been on the back of his mind — if he had a bank, what would it be like?” says Ed Boyle, CEO of Medici Bank.

Boyle, meanwhile, had worked at American Express and at the German online bank Fidor Bank. After trying to find U.S. bank partners for Fidor, and determining they were too hamstrung by legacy systems to do the customer-friendly things he wanted to do, he decided to create a Fidor-like bank in the U.S. He compared notes with de Medici. They realized they had a similar vision and decided to work together.

“What Lorenzo de Medici brings from the original Medici family approach to banking is an orientation towards facilitating trade and commerce via banking and innovating in banking in order to remove pain points that exist in trade and commerce,” Boyle said. “It's that approach to innovating in order to solve the pain points of the customer as opposed to innovating in order to generate more margin for the shareholder.”

Boyle recently asked a New York importer-exporter what problem he would like a bank to solve. The New Yorker said he exports high-end electronics from the United States to other parts of the world for trade shows — he might get asked to send 100 iPads to a trade show coming up in Dusseldorf, for instance. He has to invoice customers for shipping the electronics and for paying customs duties in a foreign currency.

“You need to move the money, you need to move it fast, and an exact amount needs to arrive,” Boyle said. “And typically as a small business working with a bank, you are sending a wire and an invisible amount of money goes into the ether; you don't know when it will arrive, and it's never in the amount you thought it would be.”

There are fintechs that have services that help, but usually customers have to wire money from their banks to the fintechs first.

“You have the customer jumping through extra hoops in order to avoid hoops in the banking and payments space,” Boyle said.

Medici Bank plans to offer a fintech-like international payment service from a chartered bank.

Boyle and de Medici have been selecting best-of-breed technologies for their new bank that will most likely include distributed ledger, international automated clearing house, and Swift wire solutions. They plan to announce their vendor choices in coming months.

Over time, Medici Bank might serve the customers of these international business customers with private banking and wealth management services.

“Lorenzo and I think the wealth management business is this last bastion of banking, where it is anything but fast and data-centric,” Boyle said. “And where you see robo advisers making inroads into the retail space with apps on phones for millennials, we think there's a big opportunity in the traditional family office wealth management space.”

Medici Bank plans to let business customers use its application programming interfaces to integrate with their accounting, payables, receivables and shipping systems. It’s co-designing APIs with new and prospective customers, who are sharing what they want a digital-account-opening process and online banking to look like.

Becoming a U.S. bank

Becoming a U.S. bank is not easy. Obtaining a state or federal banking charter takes time, money and patience.

Medici Bank has taken an indirect route.

Boyle and de Medici’s team acquired a division of a Belize bank called Choice Financial. Through that acquisition, they obtained an international banking charter from the U.S. Commonwealth of Puerto Rico. It is supervised by the Federal Reserve Bank of New York.

“We were not allowed to use the word ‘bank’ until three weeks ago, when the commissioner told us we could use it,” Boyle said.

This international banking charter lets Medici Bank operate in any nonsanctioned nation-state in the world (including the United States), as long as it can comply with Bank Secrecy Act and anti-money-laundering obligations. It can open accounts with customers inside and outside the U.S.

It does not have a U.S. federal or state bank charter, nor does it have Federal Deposit Insurance Corp. coverage.

“FDIC insurance at this stage is optional,” Boyle said. “We're considering whether or not we will opt for it when we launch the bank by the end of the year.”

Crypto-friendly, to a degree

One of the modern aspects of Medici Bank is its so-called crypto-friendliness.

This term has to be parsed. The bank has no plans to offer digital asset custody, digital wallets or other cryptocurrency services. It does not plan to accept cryptocurrency, it intends to deal only in sovereign fiat money, and it is not set up just to provide banking to crypto companies.

It is open to doing business with companies that do something related to blockchain technology and cryptocurrency.

“We look at prospective customers of the bank on an individual basis — what business are they in, what is the nature of that business, what products, policies and procedures do they utilize in their business and how well do they apply those policies and procedures?” Boyle said. “So even in a high-risk industry like cryptocurrency, we are friendly to the extent that we'd be willing to speak with them and have an application from them and possibly bank them.”

Medici Bank will require these companies to have full know-your-customer processes in place, transaction monitoring and to give the bank the right to audit their processes.

With the bank’s focus on small and midsize high-tech companies that do business internationally, “a lot of cryptocurrency companies fall into that category because they're 100% digital, 100% online, young and growing,” Boyle said. “They like the open API banking and support for national and local currency. They also have a very difficult time getting banking. About 99% of U.S. banks categorically won't bank that sector, even if it’s a software developer or a data center.”

Editor at Large Penny Crosman welcomes feedback at