In this week's banking news roundup: Ex-City National CEO Kelly Coffey has a new venture in wealth management; Erin Siegfried is Northwest Bancshares' new chief legal counsel and corporate secretary; Flagstar Bank secures OCC approval to merge its holding company into the bank; and more.

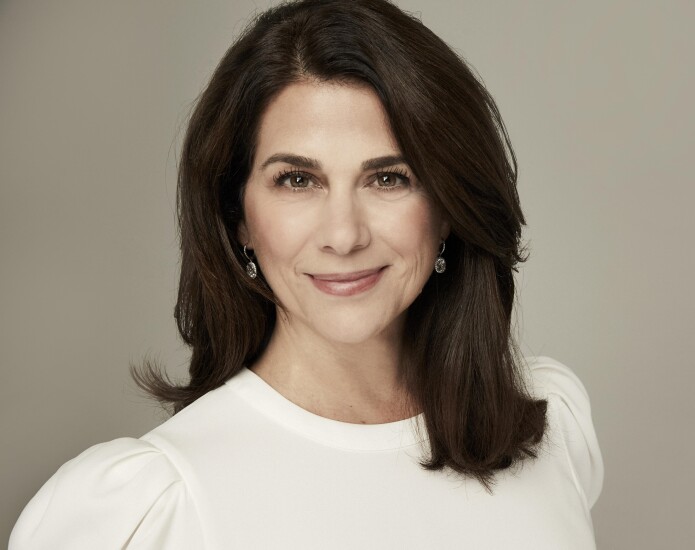

Ex-City National CEO starts wealth management firm

Coffey, along with Christine Leong Connors, launched Verita Strategic Wealth Management, with Coffey serving as executive chairperson and Connors serving as CEO. Both women previously worked at JPMorganChase. Coffey used to be the CEO of JPMorgan's U.S. private bank and Connors was the head of JPMorgan's private bank in Northern California.

Verita provides "a bespoke, high-touch approach to wealth management" and focuses on wealth management for individuals and families, according to its website.

Coffey was CEO of City National from 2019 through 2023, at which time she was

Northwest hires new legal chief from Huntington Bancshares

Siegfried, who has joined Northwest's executive management team, most recently served as the deputy general counsel at Huntington Bancshares, also based in Columbus. Siegfried will report to Northwest President and CEO Louis Torchio, who said in the release that Siegfried's "extensive experience advising large, complex organizations … will be invaluable as Northwest continues to grow and transform."

Siegfried joined Huntington in 2018 and worked on corporate law, securities law, corporate governance, executive compensation and mergers and acquisitions. Northwest

Siegfried succeeds Richard Laws, who joined WesBanco this summer to become its chief legal counsel, according to his LinkedIn profile. —Allissa Kline

Flagstar gets thumbs-up to dissolve holding company

Now it awaits shareholder approval, which will be determined at a special meeting of shareholders on Oct. 15. If shareholders vote in favor of the proposed change, Flagstar expects to finalize the reorganization by the end of this month, the release said.

Flagstar CEO Joseph Otting, who was the OCC comptroller during President Donald Trump's first term in office,

Both the OCC and the Federal Reserve currently have regulatory oversight of Flagstar. Dissolving the holding company would leave the OCC as Flagstar's primary regulator. —Allissa Kline

Lloyds expands North America presence with strategic appointments

Laurie McCoo was named managing director, head of consumer — North America. She brings more than 20 years of experience at Mizuho Securities and Bank of America Securities to her new position and will report to Farhad Merali, head of corporate & institutional coverage, who joined Lloyds in April.

In addition to strengthening client coverage, Ryan Grady will join the firm as managing director, head of U.S. debt capital markets, following his 20-plus years of experience at BNP Paribas and Santander.

"These appointments reflect our commitment to deepening relationships with key corporate and institutional clients," Bill Mansfield, CEO and country head — North America, said in an Oct. 6 press release. "Laurie and Ryan bring exceptional expertise and will be instrumental in driving our continued growth. I'm delighted to welcome them both to the team." —Editorial Staff

Blackstone taps Deutsche Bank’s Shah for top private credit role

Shah, the firm's first hire for credit in India, will report to Mark Glengarry, head of Asia Pacific private credit strategies at Blackstone Credit & Insurance, known as BXCI, according to a spokesperson for Blackstone.

"Building our private credit capabilities in India is a natural evolution of the business," Glengarry said in an emailed statement. "We have two decades of experience partnering with leading Indian businesses and supporting their growth, and now there's an opportunity to help finance their next phase of expansion and parts of the economy more broadly."

Shah has more than 26 years of experience in leveraged finance, securitizations, structuring, mergers and acquisitions advisory, and capital markets. He worked for two decades in senior roles at Deutsche Bank, after working with other banks including Citi. —Baiju Kalesh and Saikat Das, Bloomberg News

UBS BB hires equity sales executive to boost brokerage activity

Yamamoto is joining the company as fund managers in Latin America's biggest nation increasingly look abroad for investment opportunities, according to the lender's co-head for global markets for Latin America, Marcelo Okura.

The trend started with macro hedge funds, which invest in interest rates and currencies, and was followed by equity funds in search of tech stocks, Okura said, adding that there are Brazilian funds with about 80% of their portfolio invested outside Brazil.

Before joining UBS BB, Yamamoto was working in institutional equity sales at the JPMorganChase-backed digital bank Banco C6 SA. Before that, he worked at UBS Group AG in Brazil for about 13 years.

UBS BB is a joint-venture between UBS Group and Banco do Brasil SA for investment banking and institutional brokerage in South America.—Cristiane Lucchesi and Matheus Piovesana, Bloomberg News

Societe Generale hires Petcu for health care investment banking

Gabriel Petcu, a managing director, will focus on originating and executing health care sector M&A deals and will report to the bank's Americas head of investment banking, Krzysztof Walenczak, according to a person familiar with the matter.

Petcu started Monday and is based in New York, the person said.

Societe Generale also expects next month to hire a banker in the U.S. specifically focused on the biotech sector, the person said.

Petcu previously worked at HSBC as an M&A partner, and prior to that at TD Cowen, Bank of America, UBS and Goldman Sachs., according to his LinkedIn profile. Petcu declined to comment.

The bank has stepped up hiring activity in the Americas, last month bringing in Ajit Dogra as head of consumer and retail banking based in New York and Sohan Talwalker as a managing director covering the software sector in Menlo Park. —Anthony Hughes, Bloomberg News