Will federal control of Fannie and Freddie ever end?

(Full story

How big a data security problem is the Fiserv glitch?

(Full story

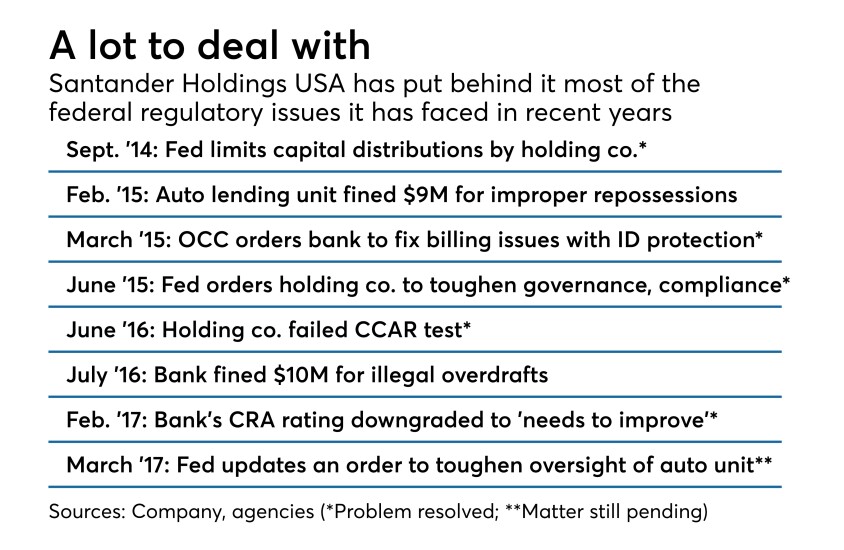

For Santander's U.S. unit, even having a growth plan is an achievement

(Full story

How a VC views the bank-fintech battle (hint: banks are losing)

(Full story

Fifth Third seeks to regroup after fatal shootings at its HQ branch

(Full story

Varo Money's bank charter application gets conditional OCC approval

(Full story

Would CFPB nominee hamstring the agency by slashing its budget?

(Full story

TD Bank's mobile browser knocked offline by software update

(Full story

Are fintechs a systemic risk?

(Full story

Morgan Stanley recruits Betterment exec to beef up digital strategy

(Full story