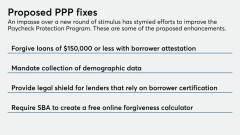

New PPP angst: Waiting for SBA to sign off on loan forgiveness

(Full story

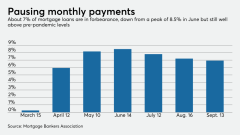

Banks criticized for requiring balloon payments on loans in forbearance

(Full story

Three more former Wells Fargo execs settle civil charges

(Full story

Will backlash over Scharf remarks hinder Wells Fargo's diversity push?

(Full story

How Cross River Bank gathered $250 million in deposits in 15 days

(Full story

PayPal and Capital One alums launch bundled banking app

(Full story

Live Oak outpaces larger rivals in moving core system to public cloud

(Full story

Fed plan to reform CRA at odds with OCC rule

(Full story

OCC reports surge in 'seriously delinquent' mortgages

(Full story

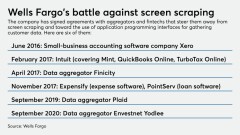

Wells Fargo says it has nearly eliminated screen-scraping threat

(Full story