Intentionally or not, large and regional banks appear to be ceding some market share in business lending to smaller competitors.

Traditional commercial lenders such as Comerica, JPMorgan Chase and U.S. Bancorp all reported

lackluster year-over-year growth in commercial and industrial lending, while smaller regionals such as Pinnacle Financial Partners in Nashville and Umpqua Holdings in Portland, Ore, reported double-digit gains.

Overall commercial loans at the nation's 25-biggest banks rose by just 2.3% over the 12-month period that ended Oct. 3, based on Federal Reserve data. In comparison, commercial portfolios at all other banks

increased by 9.4% over the same period.

On earnings calls, executives at large banks were peppered with questions about why they have seemingly become complacent about competing for commercial credits. The responses were varied

Annual stress testing, which encourages conservative underwriting, is a factor, Marianne Lake, JPMorgan Chase’s chief financial officer, said when asked about the company’s 1% linked-quarter decrease in C&I loans.

Large banks are “increasingly bound by standard risk-weighted assets” and face pressure to keep the quality of their loan portfolios pristine, Lake said. “On some level, we have to generate a positive return and shareholder value … and on these very high-credit-quality loans that we’re producing. It’s expensive.”

Competition from community banks and nonbanks is another factor.

“The nonbanks are still very, very aggressive and they are clearly penetrating further down into the commercial portfolio than they ever have,” Kelly King, BB&T’s chairman and CEO, said during his company’s quarterly conference call.

Nonbanks are lowering interest rates and compromising other terms, making it “substantially tougher for commercial banks to be able to compete,” King said. C&I loans at BB&T increased

by just 2% from a year earlier.

“My own view is they're taking enormous risk, and when we do have a cycle you're going to see a lot of them washed out,” King said. “That will be a very good thing. But today they are a competitive factor.”

Community banks are also beginning to compromise more to land commercial loans, King said.

“I think some of the smaller institutions are clearly taking more risk than what you see the large regionals or big banks taking,” he said.

Not all regional banks are struggling to add commercial loans. KeyCorp and PNC Financial Services Group are two that reported strong growth relative to their peers.

Meanwhile, some large banks are taking steps of their own to win back some of the market share they are losing to other institutions.

U.S. Bancorp, for example,

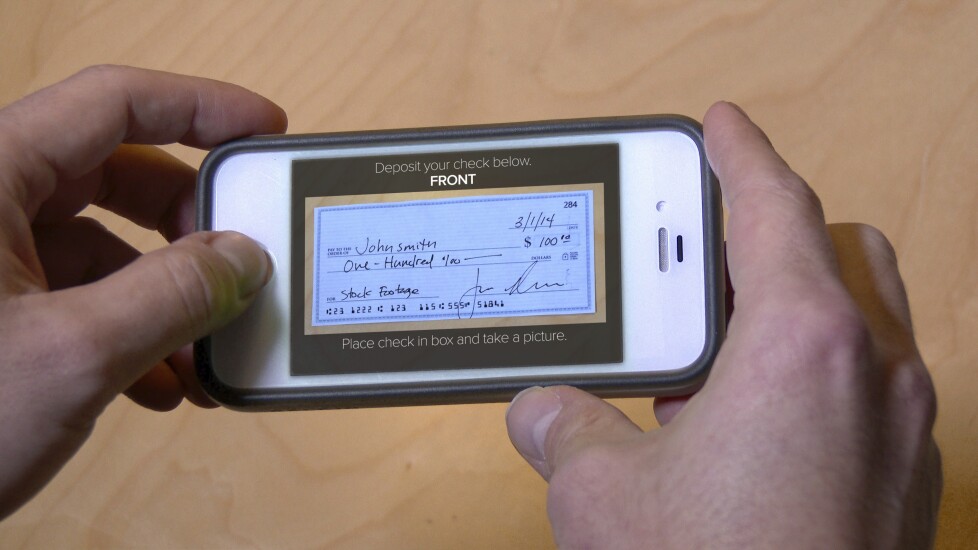

said this week that it is adding commercial lenders in New York to pursue middle-market business in the nation’s largest metropolitan market. It has also launched a digital small-business lending platform.