Wells Fargo customers targeted with phishing attacks using calendar invites

(Full story

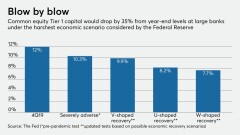

Fed freezes stock buybacks, caps dividends after stress test results

(Full story

Citigroup names Titi Cole to senior post in global consumer bank

(Full story

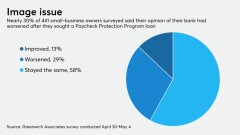

Frustrated by PPP, many small businesses are ditching their banks

(Full story

Why bankers remain unsold on Fed's Main Street program

(Full story

OnDeck Capital in high-stakes talks with creditors

(Full story

Digital banking: Once-steady shift now moving at lightning speed

(Full story

What BBVA aims for with new mobile app

(Full story

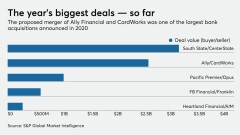

Ally's deal to acquire CardWorks called off

(Full story

Societal upheaval strengthens case to expand CRA to nonbanks: Ludwig

(Full story