ORLANDO, Fla. — When consumers are asked about their bank, the good news for financial institutions is that most — 76% according to a survey by Deloitte's Center for Financial Services released this week — are satisfied, while 69% would recommend their institution to relatives or friends.

But there's a dark cloud within that silver lining.

"The asterisk on that comparison is that consumers don't necessarily compare banks with another bank, they compare their primary bank with other consumer-focused experiences. What we found is that banks are lagging in that,” said Jim Eckenrode, managing director for Deloitte’s Center for Financial Services, at this year's BAI Beacon conference here.

In its survey, Deloitte measured banks against brands like Amazon with questions meant to measure ease of service and satisfaction. For each question, banks lagged other retail brands by 12%.

Therein lies the challenge for banks. While Apple has lengthy lines outside their stories with each new release, and Amazon customers flock to the site on Prime Day, banks typically lack the same kind of loyalty. Experts here say the key to forging it remains reimagining the branch experience.

“We think it’s very important to provide a great digital experience but also great a human experience,” said Linda Garner, senior vice president of omnichannel platforms at U.S. Bank. “Customers want that.”

Deloitte suggested customers would use a branch more often if locations offered digital self-service screens, extended hours to virtually meet with a representative remotely, and a branch that could double as a cafe or co-working space. Eckenrode also recommended that banks eliminate the number of times a customer has to do one task to carry out a transaction.

Those suggestions echoed many made during a brainstorming session at the BAI conference, with Garner asking a room to brainstorm on how to make branch banking more appealing to customers.

“We feel strongly that digital is very important for almost all of our customers,” Garner said. “We also know that in those moments of truth, somebody who may be very tech savvy may not be savvy in the way of financial affairs. In those moments of truth, where most customers want a human interaction, branches are the ideal places for that.”

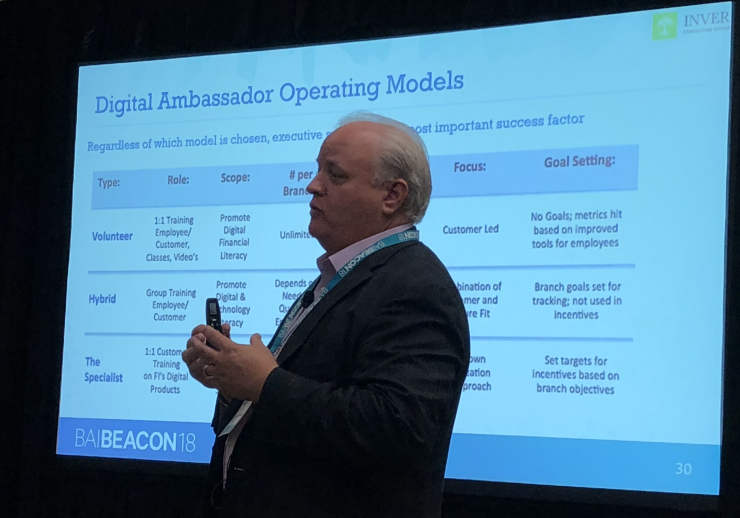

Some steps banks can take include integrating desktop sites and mobile apps with a customer’s local branch and lounges for advisory and sales, said Thomas P. McDermott, managing partner at Inver Consulting Group in Milton, Ga.

McDermott urged participants to look at recent retailer programs, such as Walmart’s click and connect service. He also suggested the creation of a branch digital ambassador, someone who teaches clients how to do branch transactions online. Popular in the U.K., the role has been making inroads at some U.S. branches.

Participants listed ideas for the workshop: making appointments online for branch visits, increased use of biometrics, smaller branch buildings, and more highly trained staff.

To be sure, some banks are ahead of the curve in this area. And bankers overall have been trying to remake the branch for years, even while other institutions shutter them.

More concerning, however, is that even if they remake the branch, it may not be a silver bullet. Garner cautioned that the inherent structure of banks may not be able to accommodate the same level of attachment that consumers have with big tech retailers.

“Amazon is the gold standard for a lot of things. That’s one of the reasons why we look up to them,” Garner said. “I don’t think you can necessarily always deliver the same cuddly experience that a nonregulated industry can. As a bank, we have to manage a consumer’s confidentiality extremely closely."