-

Limited acquisition opportunities remain in the state's hottest markets, which will force buyers to pay bigger premiums or pursue deals elsewhere.

July 16 -

New service provides credit scores to members via mobile, home banking.

July 13 -

Member Business Lending is a Utah-based provider of commercial, small business lending origination for credit unions.

July 11 -

When GDPR went into effect in May, it was expected that the European law would touch a lot of U.S. payment companies because of their international scope. Now it's clear that even purely domestic U.S. firms will have to adhere to some version of the data-privacy law.

July 10 -

Echoing the set of restrictive rules known as GDPR enacted earlier this year by the European Union, the state legislation — which does not take effect until 2020 — will almost certainly be the subject of intense lobbying from business giants that vacuum up all the data.

July 9 -

Mark Herter has been with the credit union since 1985 and will be succeeded as CEO by current president Laura Campbell.

July 6 -

Consumer advocates are urging local governments and courts to consider a person’s ability to pay before assessing fines and fees for such infractions as unpaid traffic tickets. Such changes could help low-income households avoid bankruptcy — and perhaps even make them more bankable.

July 5 -

A first-in-the-nation ordinance, passed by the city council in the wake of the Wells Fargo scandal, would require banks that want the city’s business to reveal if they have sales quotas for employees. It remains to be seen, though, whether Mayor Eric Garcetti will sign the measure into law.

July 3 -

A Chicago bank isn't afraid of taking on competitors that spend billions on technology. A state regulator is afraid of giving fintech startups too much latitude. Yet another one of our Most Powerful Women retires. Plus, blockchain's leading ladies, the fallout from a big political upset and a tool to help you stop apologizing.

July 2

-

The Oakland company has hired Colleen Atkinson, a former manager at HSBC, to oversee its new professional banking business line.

June 29 -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

Banc of California in Santa Ana will cut roughly 9% of its workforce as it looks to trim $15 million in expenses.

June 29 -

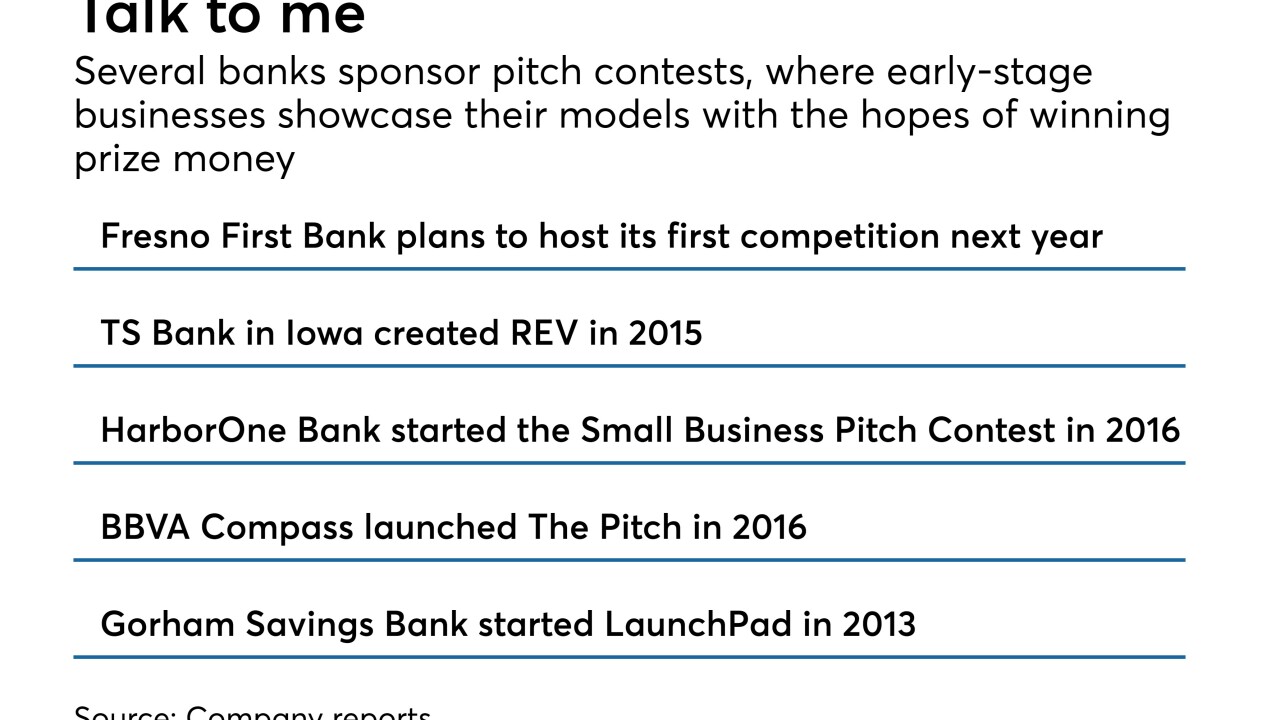

Sponsoring so-called pitch competitions helps lenders gain Community Reinvestment Act credit and gather deposits.

June 28 -

Former chief operations officer Anne McClure spent nearly two months as interim CEO.

June 28 -

Under a consent order with Texas and seven other states, the Atlanta-based credit reporting firm agreed to shore up its information security efforts, but it will not have to pay any financial penalties.

June 27 -

A number of banks are upgrading technology and hiring more lenders to better reach small-business owners, who are becoming more confident in their outlooks.

June 27 -

A ballot initiative that taps into the public's anger about online data abuses has qualified for the November ballot. But lawmakers are considering whether to head off the statewide vote by passing a measure that may be more amenable to the financial industry.

June 26 -

The trend may be partly attributable to a strong economy. Growth in high-cost installment lending could also be a factor.

June 22 -

C.G. Kum, who has been the Los Angeles company's CEO the past five years, plans to retire in May.

June 15 -

A bill moving through the California Legislature seeks to tame the largely unregulated world of online small-business lending. If passed, it would be the first of its kind nationally, but so far it has failed to satisfy either the industry or its critics.

June 12