-

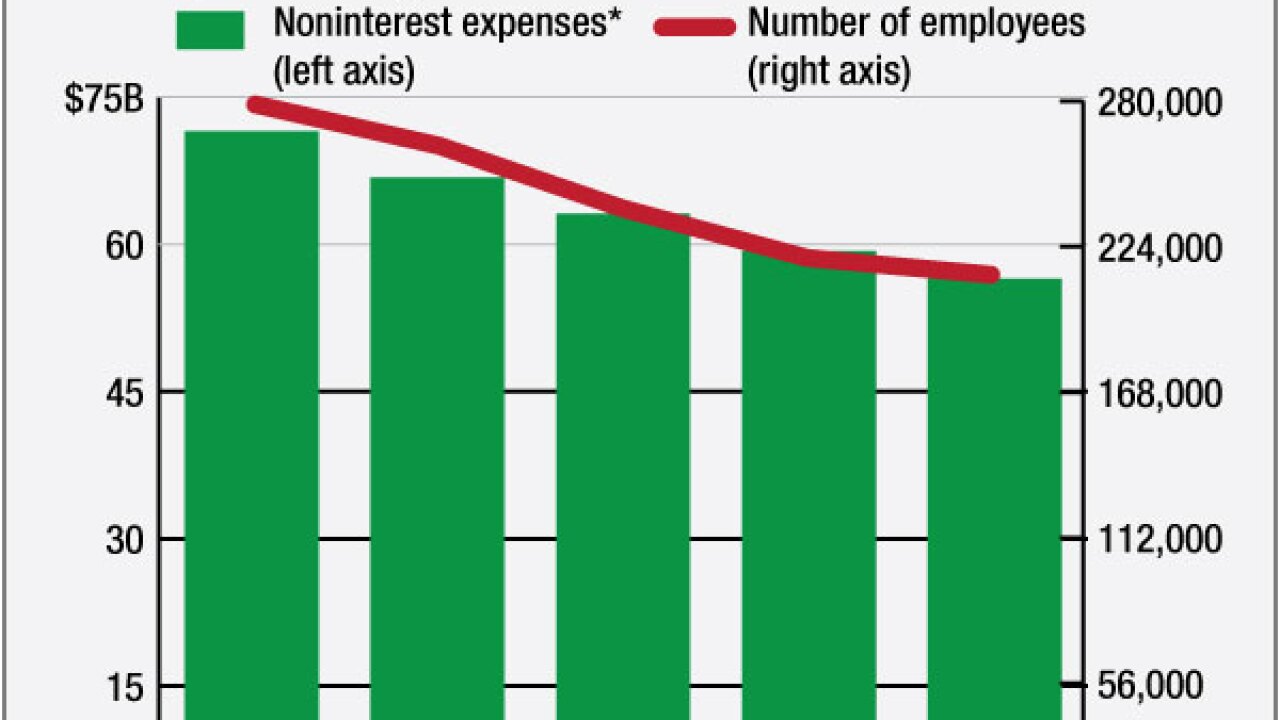

Even absent a rate hike, executives believe that the banking giant can still improve profits by hitting this expense target.

July 18 -

Gov. Pat McCrory on Wednesday signed the North Carolina Money Transmitters Act, as requested by the state banking commissioner's office.

July 7 -

North Carolina has lost more than 40% of its banks in the past decade, creating a new tier of larger institutions. More deals are expected to occur, raising questions about the pace of M&A and the fate of those bigger banks.

July 5 - North Carolina

The Charlotte, N.C., company on Thursday appointed Michael White, former chairman and chief executive at DirecTV, effective immediately.

June 23 -

First Bancorp in Southern Pines, N.C., has agreed to buy Carolina Bank Holdings for $97.3 million, or $19.26, in cash and stock.

June 22 -

First Citizens BancShares in Raleigh, N.C., has terminated five of its nine loss-share agreements with the Federal Deposit Insurance Corp.

June 20 -

The $3.2 billion-asset Park Sterling announced this week that it will hire four commercial and industrial bankers from the $2.3 billion-asset CommunityOne Bancorp to help expand its commercial banking team in the Charlotte metropolitan area.

June 15 -

First South Bancorp survived a close vote on a shareholder proposal to "immediately" take steps to sell the Washington, N.C., company.

May 31 -

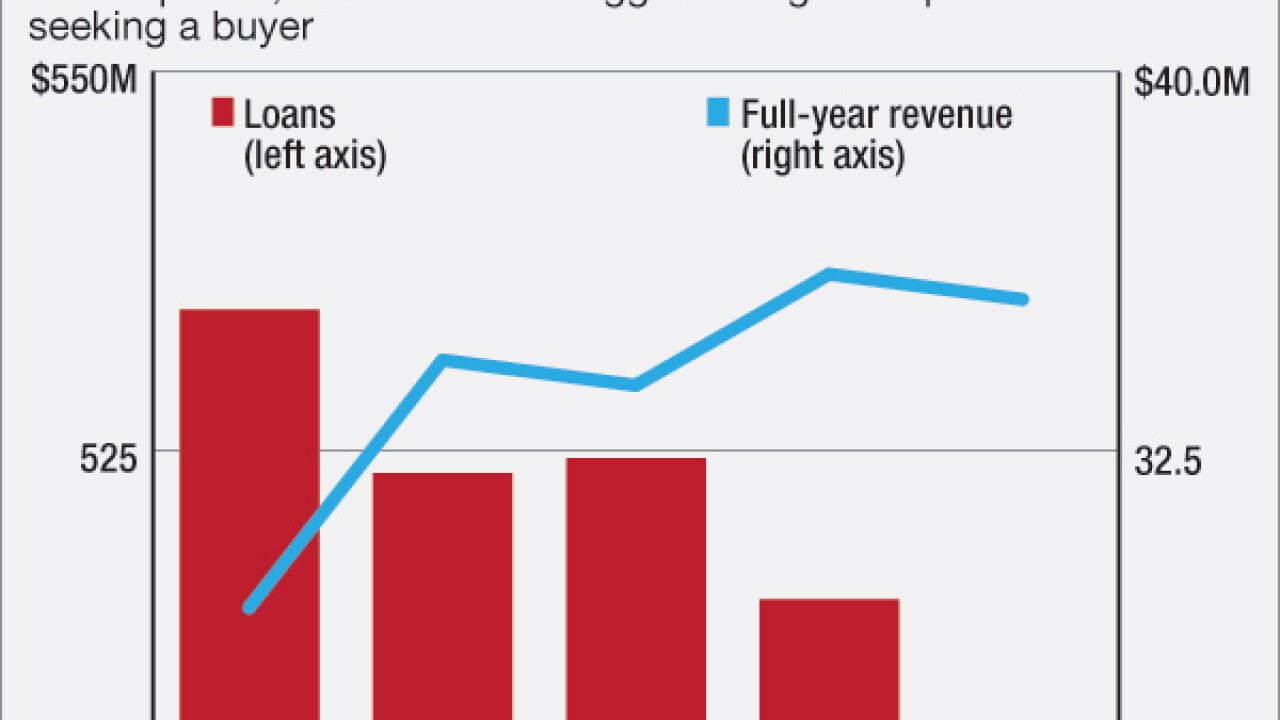

Yadkin Financial, a North Carolina community bank, is exploring a sale and working with Sandler O'Neill & Partners to solicit offers, according to people familiar with the matter.

May 25 -

First Citizens BancShares in Raleigh, N.C., has agreed to buy Cordia Bancorp in Midlothian, Va.

May 20 - Pennsylvania

BB&T in Winston-Salem, N.C., plans to cut 240 jobs and close 28 branches as part of its integration of National Penn Bancshares.

May 17 -

Lola Hart, who oversaw the liquidation of the controversial CertusBank in South Carolina, has been hired as the chief accounting officer of Entegra Financial in Franklin, N.C.

May 2 -

Paragon Commercial Bank, Unity Bancorp and Nicolet Bankshares have found success by radically rethinking their strategies.

April 25 -

High Point Bank considered bulking up to the size of other community banks in its market but quickly realized that the strategy would involve significant expense, risk and capital. So the company ended up selling to BNC Bancorp.

April 21 - North Carolina

B of A is normally thought of as a U.S. economic bellwether, but it has substantial operations overseas, and its international performance last quarter provided a painful reminder of that fact.

April 14 -

Bank of America, the second-biggest U.S. lender by assets, said profit declined 13% on a drop in trading and underwriting revenue and a 30% increase in provisions for credit losses, mostly tied to souring energy loans.

April 14 -

BNC Bancorp in High Point, N.C., has delayed the closing of its acquisition of Southcoast Financial in Mount Pleasant, S.C., as the Federal Reserve has not completed its review of the deal.

March 31 -

HomeTrust Bancshares in Asheville, N.C., will name a the former North Carolina market president for Fifth Third Bancorp to its board, along with two other professionals.

March 29 -

Carolina Trust Bank in Lincolnton, N.C., has revised downward its fourth-quarter results because of accounting changes related to its retirement plan and an acquisition from years ago.

March 23 -

Capital Bank Financial in Charlotte, N.C., will record a first-quarter $5.5 million net loss, after it agreed to an early termination of its loss-share agreements tied to three failed banks.

March 21