-

Customers reported failed subscription payments and support issues, though a backup system kept some basic functionality online.

January 14 -

The bank technology company is adding offices in the U.S. and India as part of its quest to reach clients outside of its U.K. home base.

December 19 -

The U.K. neobank received an investment from the AI giant as the fintech aims to globally expand and acquire a U.S. banking license.

November 24 -

The U.K. bank's "Scam Intelligence" tool uses Google's Gemini to analyze images and texts for red flags, aiming to reduce losses from authorized push payment fraud.

October 30 -

The Bank of England may cap ownership, drawing ire from crypto groups that claim that will hinder innovation.

September 17 -

The bank and Chinese technology giant are speeding transaction processing for business payments, Airwallex makes a deal to bolster its payments tech and more in the American Banker global payments and fintech roundup.

September 3 -

The GENIUS Act in the U.S. and MiCA in the EU are creating a path to the mainstream for digital assets, while Britain won't have crypto regulation until 2026.

July 30 -

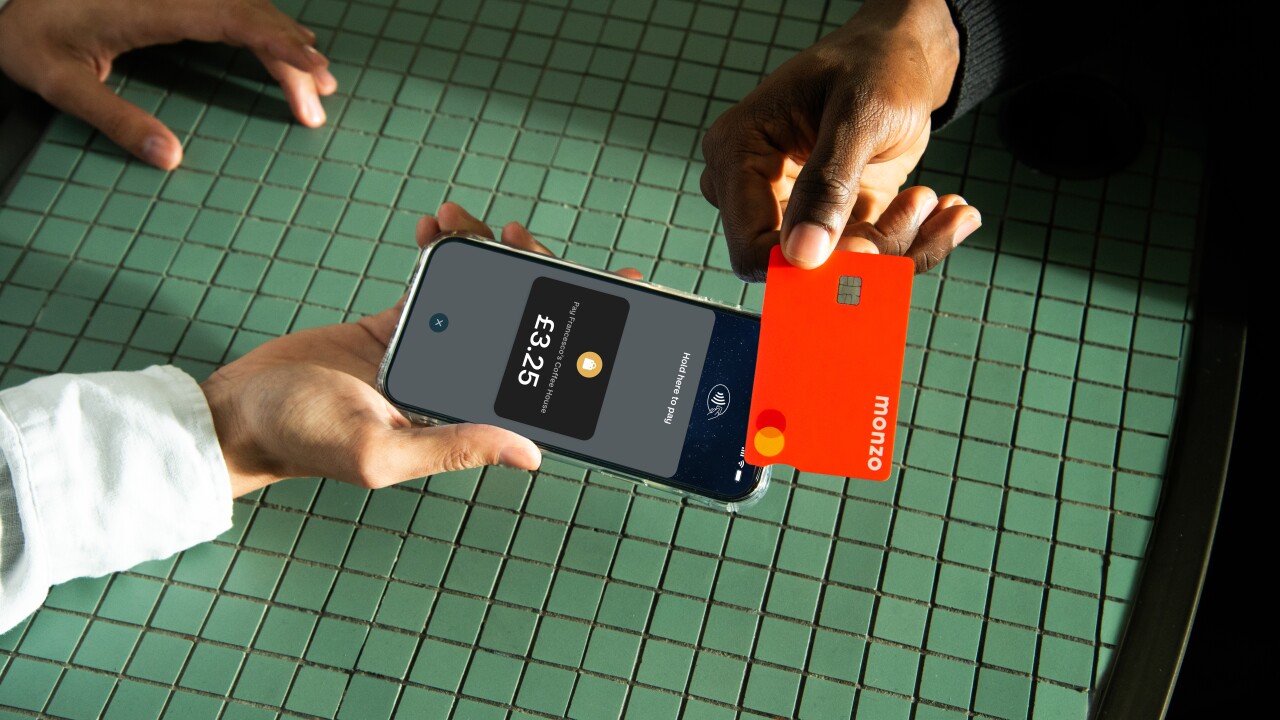

U.K. regulators said Monzo didn't properly vet new customers, while Vocalink was dinged for risk management lapses. Also, Paxos launched a dollar-backed coin in the European Union; and more news in the weekly global payments and fintech roundup.

July 9 -

The bank says it hopes to help improve the payments ecosystem and meet the needs of underserved customers through supporting U.K.-based fintechs.

June 9 -

The country's central bank cited geopolitical uncertainty and the increased reliance on digital payments as a reason to focus on offline payments as a backup. Also, a look at U.K. bank outages and other news in American Banker's global payments and fintech roundup.

March 12 -

Visa and Mastercard have long been in legal battles over payment fees, with out-of-court agreements proving elusive.

February 28 -

Alison Rose stepped down after the British government, the UK lender's largest shareholder, signaled she had lost its confidence after a political dustup.

July 26 - AB - Policy & Regulation

Nikhil Rathi, CEO of Britain's Financial Conduct Authority, said the recent cryptocurrency market crash has underscored the need for regulation on both sides of the Atlantic.

July 14 -

While pandemic restrictions cloud the sector's outlook, the London-based payment and fintech company is making hotel booking and other services part of its financial super app strategy.

July 22 -

Goldman Sachs Group has begun offering cash management and treasury services in the U.K. as it builds out its new transaction-banking arm.

June 21 -

Rapyd's new venture capital arm seeks companies that can develop or benefit from an international identity verification system.

June 17 -

The U.K.'s central bank says stablecoins should follow the same rules as traditional bank deposits.

June 7 -

Small businesses are upset at Visa and Mastercard's proposal to raise rates on cross-border payments initiated online, now that the European Commission's caps on credit and debit fees no longer apply in the U.K.

May 21 -

Railsbank and Plaid have formed a strategic partnership enabling any company in the U.K. to directly embed open banking-style payments into digital flows.

May 6 -

Central bank digital currencies are moving much faster in China and Latin America, where the financial structures are less complicated than in the U.K. and U.S.

April 27