-

He will take over as CEO from Carlos Torres Vila, who becomes chairman at year-end. Still unknown: who will run the company's U.S. bank once Genç moves up.

November 28 -

Date, now a venture capitalist, worked with the lending software company's CEO, Dan O'Malley, at Capital One in the 2000s.

November 28 -

Warren Kornfeld, senior vice president at Moody’s Investors Service, explains why banks’ fear of Amazon, Apple, Facebook and other tech giants is legitimate.

November 27 -

Minorities are still charged more for mortgages when all other applicable credit factors are equal — both in person and online, according to a new study by the University of California, Berkeley.

November 26 -

The online lender will roll out its first new product in 12 years, a home equity line of credit. But it's taking a different approach than with its original offering.

November 14 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks and credit unions rally and fend off the insurgents?

November 8 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks rally and fend off the insurgents?

November 7 -

The head of the agency developing the special-purpose federal license said the process is moving forward “independent” of legal challenges mounted by state regulators.

November 7 -

The San Francisco company, which has racked up big losses over the last two and a half years, signaled Tuesday that it is on a path to profitability after resolving a series of longstanding regulatory problems.

November 6 -

The Atlanta-based consumer lender, which partners with both retailers and banks, cited a higher-than-expected cost of funds as one reason for its less rosy forecast.

November 6 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

November 6 -

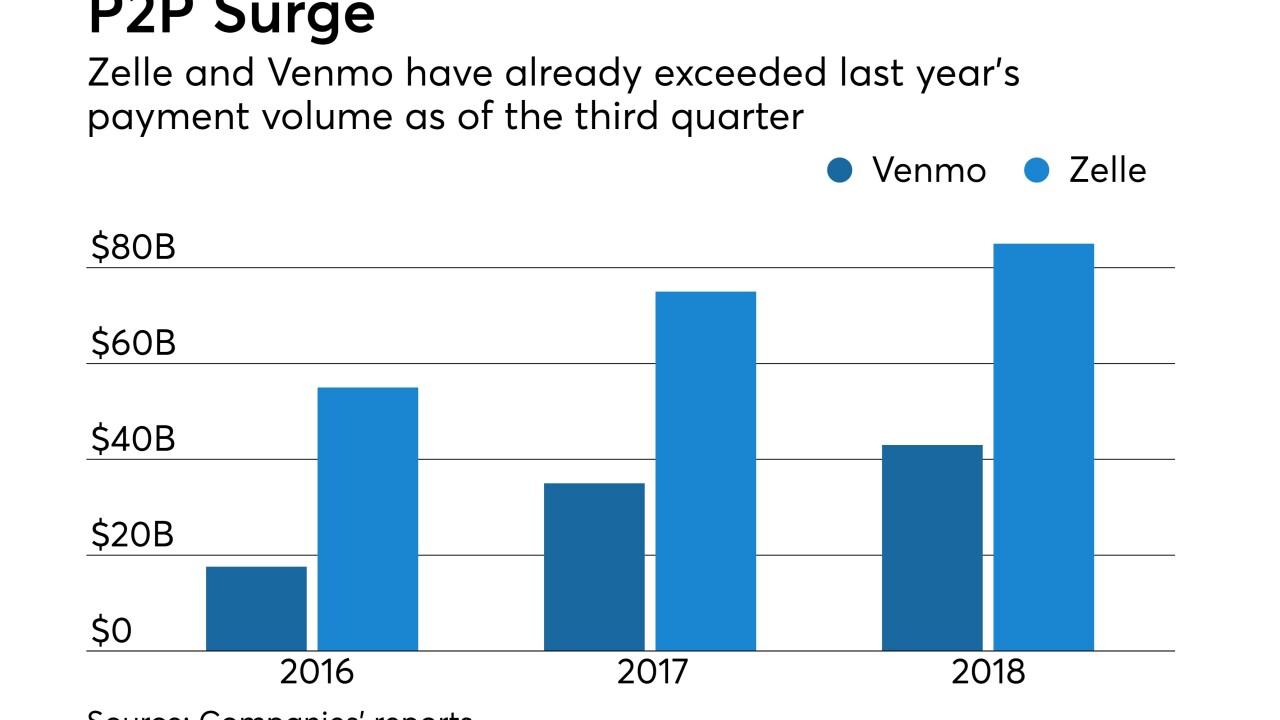

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

The personal lending boom continues: HSBC's U.S. arm is teaming up with Avant, a closely held online lender, to offer unsecured loans to new and existing customers.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The firm is disbanding its consumer and commercial banking division and will make the Marcus brand one of the new business offerings that can be sold to its wealth management unit’s expanding roster of clients.

October 22 -

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

October 22 -

The $286.4 million deal is an important test for Upgrade, which has raised $142 million of equity over the past two years but has yet to turn a profit.

October 18 -

ODX will pursue deals with banks that want to use the New York lender’s technology to offer online small-business loans.

October 16 -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1