-

Moodys Investors Service, which put three of Citigroups securitizations of unsecured consumer loans originated by Prosper Marketplace under review for a downgrade, was not invited to rate the latest offering.

March 17 -

A leading alternative lender has admitted that balance sheets and liquidity matter, and that it is a problem that such lenders need to keep growing lending volumes to prosper.

March 15

-

Prosper Marketplace on Monday announced a three-year agreement to offer financing to consumers making improvements to their homes through the website HomeAdvisor.com.

March 14 -

Berkshire Hills Bancorp in Massachusetts invested in technology to beef up its small-business lending, an area ripe for the picking by alternative lenders.

March 11 -

Traditional financial institutions are often seen as the outdated rival to new disruptors, but the idea that a bank can't be a marketplace lender, and vice versa, is a myth.

March 11

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 11 -

Startups, including one in the virtual currency field, have approached the Office of the Comptroller of the Currency about applying for banking charters, the agency's chief counsel said Thursday.

March 10 -

Prosper Marketplace is rebranding a personal-finance app that it acquired last year, a key part of the firms efforts to engage more frequently with its borrowers.

March 10 -

LendKey, which manages online lending programs for banks and credit unions, has named Salil Mehta to senior vice president of credit risk and analytics.

March 8 -

The Consumer Financial Protection Bureau's move to collect complaints about online marketplace lenders is a sure sign it is laying the groundwork for rules or enforcement actions against the industry.

March 7 -

WASHINGTON The Consumer Financial Protection Bureau is taking aim at marketplace lenders, announcing Monday that it is accepting complaints about the developing industry and releasing a bulletin to inform the public about such firms.

March 7 -

Cordia Bancorp recently sold its student lending platform due to concerns about loan concentrations. In doing so, the Virginia company provided another example of why it is difficult for smaller institutions to gain traction in marketplace lending.

March 4 -

A new survey from seven regional Federal Reserve banks found that many small businesses are going online to access credit. But even when they are approved, applicants often end up dissatisfied because the loans carry high interest rates or have unfavorable repayment terms.

March 3 -

Complying with legal and credit bureau criteria for data furnishers is just one of the compelling reasons why a marketplace lender may take a pass on reporting credit data.

March 3

-

Prosper Marketplace has tapped USAA executive David Kimball to be its next chief financial officer.

March 2 -

Cordia said in a press release Tuesday that it sold its CordiaGrad platform to its Jack Zoeller, the $348 million-asset company's chief executive.

March 1 -

More than 200 small banks across the country will be able to offer online loans to their small-business customers as part of a new partnership announced Tuesday.

March 1 -

The nation's largest marketplace lender announced changes Friday to its partnership with Utah-based WebBank. The revisions are designed to preserve Lending Club's ability to ignore state interest rate caps.

February 26 -

Regulators focus on having banks and credit unions offer payday loan alternatives to underserved consumers overlooks the success of Web-based companies in filling credit gaps.

February 26 MWWPR

MWWPR -

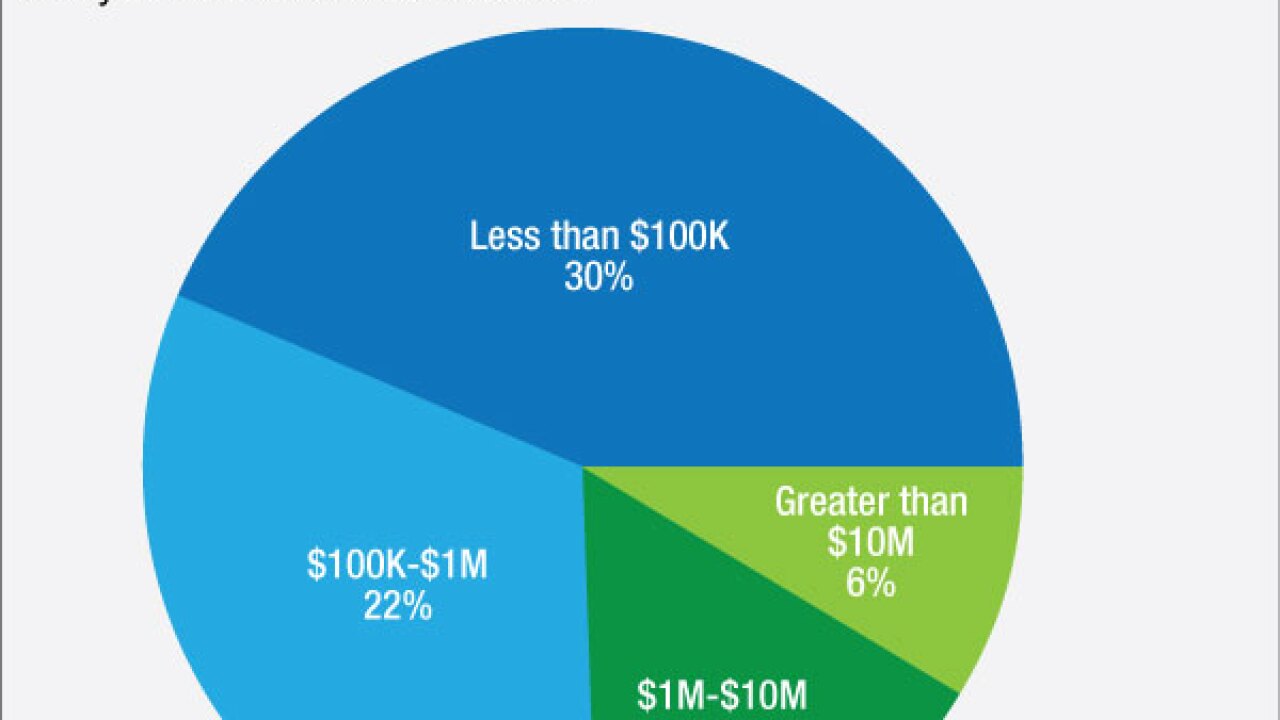

Delinquencies are rising among the sector's less creditworthy borrowers, which is contributing to smaller returns for investors. This sets up the first major test for an industry that blossomed during a period of unusually low defaults.

February 25