M&A

M&A

-

The deal for Summit Financial furthers First Financial’s strategy of acquiring national niche business lines.

December 7 -

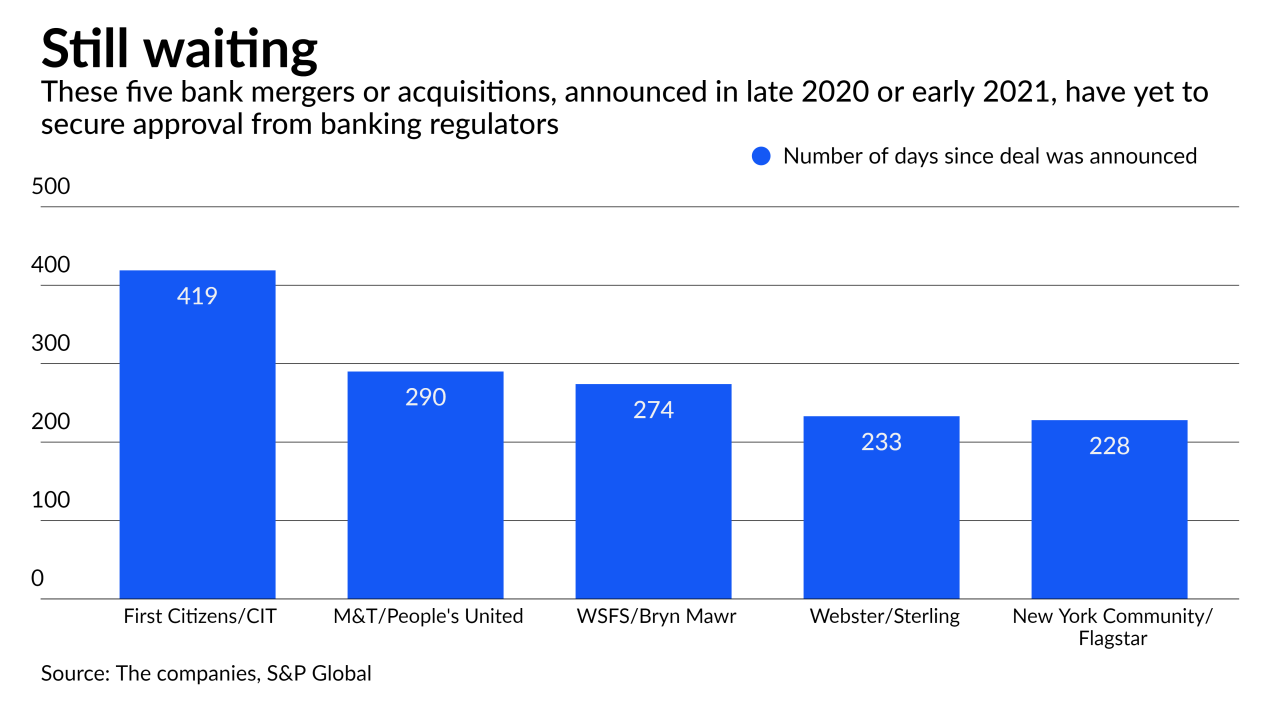

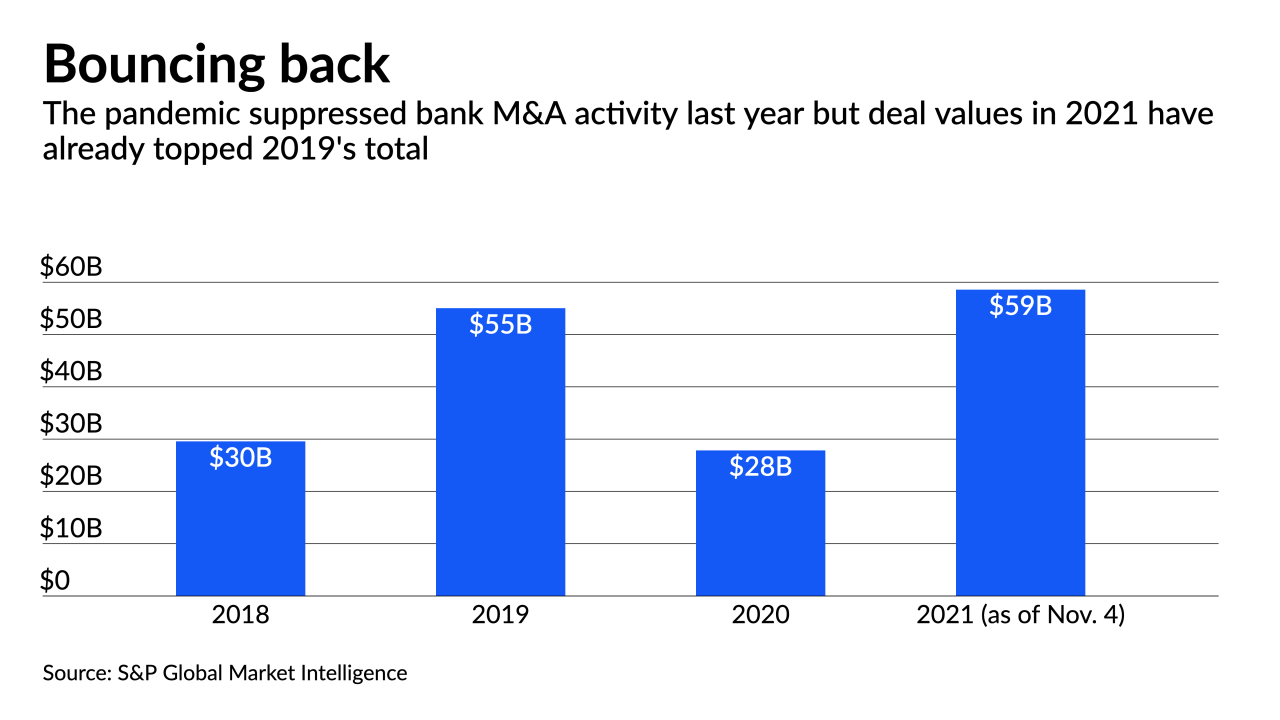

Bankers say the Biden administration’s call for regulatory greater scrutiny of mergers and acquisitions is causing holdups and could slow dealmaking activity in 2022.

December 7 -

The $129 million deal for Rahway-based RSI would give Columbia a stronger presence in Union and Middlesex counties.

December 2 -

The combination is a bid to offer members expanded access to financial services and a larger network of locations.

December 2 -

The commissioner of the Tennessee Department of Financial Institutions said Orion Federal Credit Union's deal for Financial Federal Bank violates the Tennessee Banking Act.

December 2 -

The Denver company said it would pay $56 million for Legacy Bank in Colorado and pick up nearly $500 million of assets.

December 1 -

Symphony Technology Group is in talks to acquire parts of Fidelity National Information Services' capital markets business in a deal that could be valued at about $2 billion, according to people familiar with the matter.

November 24 -

The buyer said it would enter two of Wyoming’s largest markets and expand in Nebraska and Colorado with the purchase.

November 22 -

Buying Spirit of Texas would give the Arkansas company access to the Austin, San Antonio and Houston markets and make it a bigger player in the fast-growing south-central U.S.

November 19 -

The combination of Horizon Credit Union in Washington and Embark Credit Union in Montana would have $1.8 billion of assets and 31 branches in four states.

November 18 -

Acquiring the company, which has a namesake savings app, would allow the Silicon Valley lender to accelerate its plan to offer more consumer banking services. The deal comes less than six weeks after Oportun withdrew its application for a bank charter, which it plans to refile.

November 16 -

After more than a year of collaboration, the Minneapolis bank is buying the company to enhance its corporate expense and travel management offerings.

November 16 -

Advocates negotiating with the Minneapolis bank also want commitments for mortgage assistance and payouts to financial nonprofits. The pressure for Federal Reserve hearings coincides with Biden administration calls for more scrutiny of big bank mergers.

November 15 -

Patriot National Bancorp was exploring a digital pivot, and American Challenger Development Corp. had been seeking a bank charter in its quest to become open an all-digital bank. They decided it was quicker to join forces.

November 15 -

The $3.6 billion-asset Canvas Credit Union in Lone Tree is combining with the $173 million-asset Western Rockies Federal Credit Union in Grand Junction.

November 15 -

If the French megabank retreats from the U.S. retail banking market, it would be the fifth foreign-owned company to do so in the past 12 months.

November 15 -

The acquisition of First Sound Bank would give the fintech a lending platform to go along with its deposit-gathering capabilities. It would be BM's first buyout since being spun off from Customers Bancorp last year.

November 15 -

Circle, the principal operator of the second-biggest stablecoin, sees potential growth with corporate balance sheets as it broadens its geographic footprint and product offerings.

November 15 -

The purchase of Peoples Banktrust would create the fifth-largest bank based in Georgia’s most populous metropolitan area.

November 11 -

Without the ability to build cutting-edge technology or recruit top talent, the best outcome for many small lenders is to merge with a bank seeking to enter a new market.

November 10