-

Debates on the issue often focus on how lending decisions affect certain demographic groups, but those analyses tend to ignore an important factor: default rates.

July 19

-

Mortgage fees at the nation’s biggest home lender declined by a third in the three months ended June 30 to the lowest in more than five years.

July 13 -

The Albany, N.Y. based credit union announced the program just in time for the Fourth of July.

July 3 -

The bank can pay out 40% more than it is expected to earn; the German bank’s stock slide may lead to its removal from a major European bank index.

July 2 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

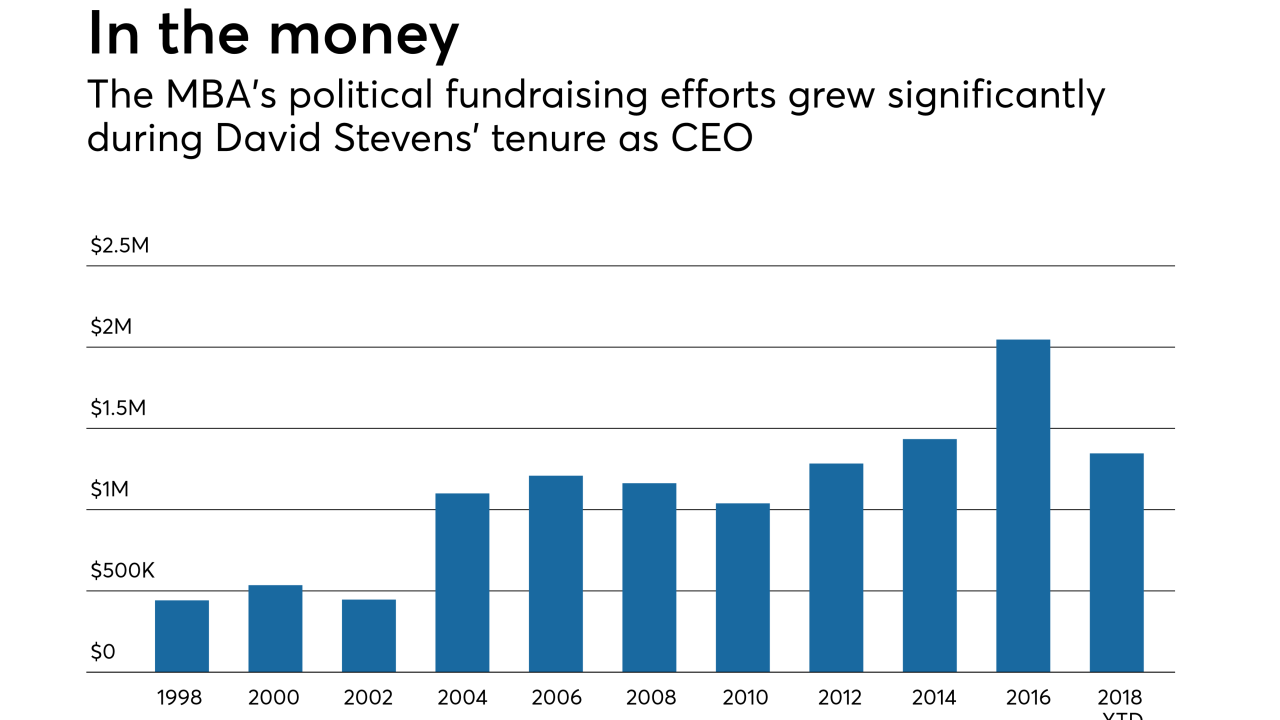

Robert Broeksmit has a tough act to follow succeeding David Stevens, the CEO revered for navigating the Mortgage Bankers Association through one of its most tumultuous eras on record. But in doing so, Broeksmit has a distinct advantage over many of his predecessors: inheriting an organization on the upswing.

June 8 -

Robert Broeksmit, a career mortgage industry executive, will succeed David Stevens as the president and CEO of the Mortgage Bankers Association.

June 7 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

As other banks de-emphasize mortgage lending, Citizens is spending half a billion dollars to buy a large originator with a big servicing portfolio.

May 31 -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24