-

Ocwen Financial is able to keep the answers to questions from the Consumer Financial Protection Bureau involving the improper handling of escrow accounts confidential, a federal magistrate ruled.

June 26 -

The bill aimed at helping struggling homeowners also requires documentation of servicer behavior and FHFA evaluation of the services provided to borrowers.

June 18 -

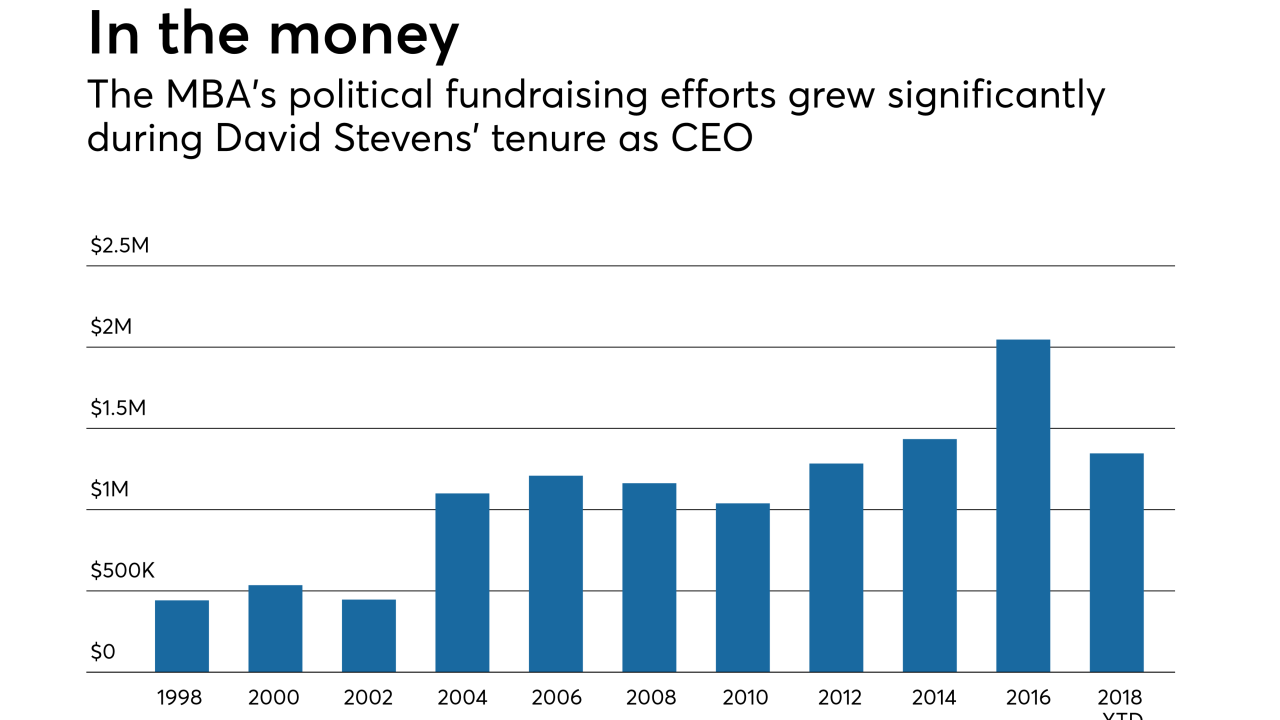

Robert Broeksmit has a tough act to follow succeeding David Stevens, the CEO revered for navigating the Mortgage Bankers Association through one of its most tumultuous eras on record. But in doing so, Broeksmit has a distinct advantage over many of his predecessors: inheriting an organization on the upswing.

June 8 -

Acting CFPB Director Mick Mulvaney wrote in a two-paragraph filing that the Mount Laurel, N.J., company did not violate the Real Estate Settlement Procedures Act.

June 7 -

Robert Broeksmit, a career mortgage industry executive, will succeed David Stevens as the president and CEO of the Mortgage Bankers Association.

June 7 -

The Atlanta bank had previously failed compliance metrics in five straight quarters before passing them last year, according to the settlement's monitor.

June 6 -

As other banks de-emphasize mortgage lending, Citizens is spending half a billion dollars to buy a large originator with a big servicing portfolio.

May 31 -

Credit unions may be able to reach more underserved consumers through partnerships with an unlikely ally.

May 18 Blend

Blend -

Banking and mortgage groups are asking the Federal Communications Commission to issue new Telephone Consumer Protection Act rules that would make consumer lawsuits over robocalls harder to win.

May 10 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7