-

The California company reported increases in loans and deposits, along with a wider net interest margin.

October 18 -

Net income soared 32% thanks to higher interest rates that contributed to a wider net interest margin and its most interest income in a quarter in years.

October 15 -

More than half of all federally insured credit unions have less than $50 million of assets. But challenges, including increased demands for technology, are making it harder for small institutions to thrive, forcing some to look for merger partners.

October 15 -

The Pittsburgh bank reported a double-digit increase in 3Q profits on a mix of higher loan yields in its retail and corporate banking units, higher corporate service fees and several other factors.

October 12 -

The biggest U.S. bank leaned on old-fashioned lending in the third quarter to weather a slump in fixed-income trading.

October 12 -

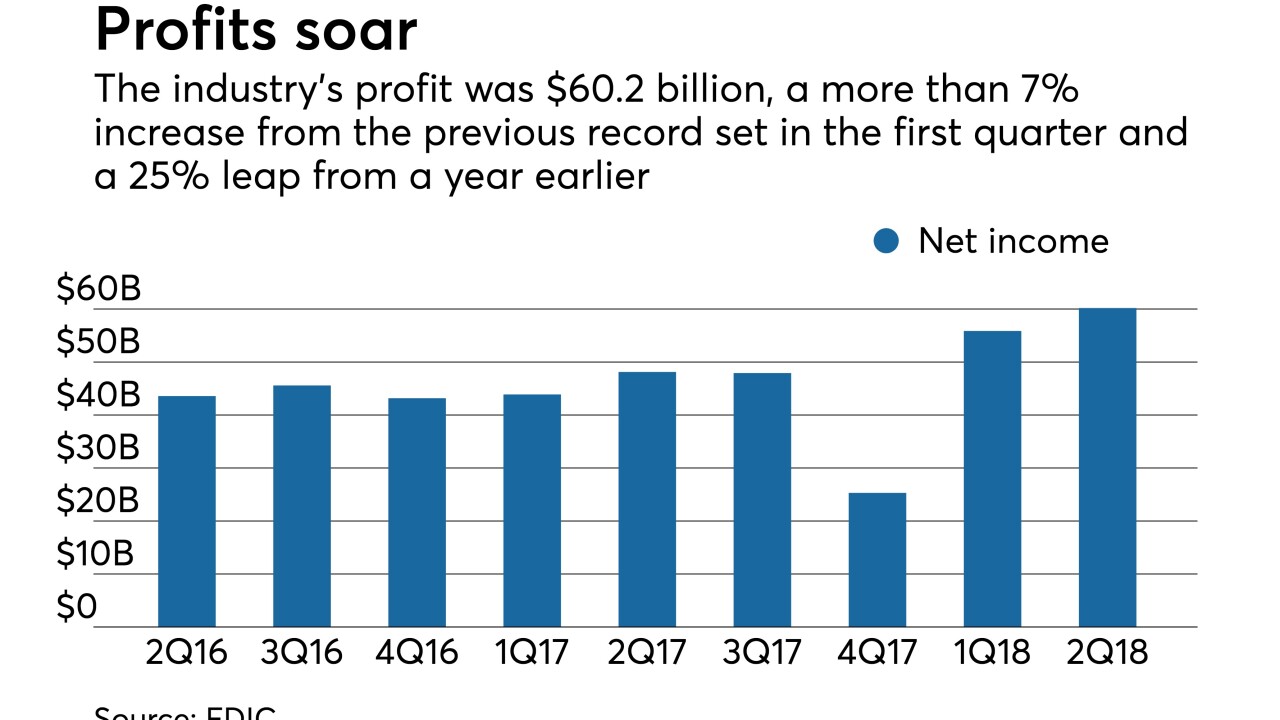

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

Prosperity Bancshares in Houston said that its earnings increased 19% from a year earlier as its efficiency ratio rose.

July 25 -

BankUnited in Miami Lakes, Fla., said that second-quarter earnings rose 36% as average loan and investment securities balances increased.

July 24 -

The combination of rising interest rates and increased competition from nonbank lenders is prompting many commercial real estate investors to seek better deals elsewhere.

July 23 -

Despite some green shoots in key credit segments, total loan growth was light at many banks last quarter. Rate hikes are threatened, and deposits will get pricier — where will the earnings come from?

July 20 -

Repayments on acquired residential mortgage loans were the main reason, but other bottom-line boosters more than made up for that, the Buffalo, N.Y., bank said in reporting second-quarter results.

July 18 -

Declines in corporate banking and energy loans were part of the reason loan growth was light, but the Dallas bank reported strong earnings thanks heavily to fatter margins.

July 17 -

Price competition on deposits may finally force the largest banks to pay up, and consumers’ aggressive use of rewards and promotional rates is weighing on card income. And then there are those tariff fights that could hurt global clients.

July 13 -

The recent string of positive news for the banking industry, from lower corporate taxes to less regulation, is starting to feel like a distant memory.

June 27 -

Investments in analytics and a focus on courting midsize businesses have helped regional banks add non-interest-bearing deposits even as they struggle for other types of deposits. Can they keep it up as rates rise?

May 1 -

The U.S. subsidiary of the Spanish banking giant BBVA said Friday that direct consumer loans increased 40% in the first quarter and that its digital strategy is bearing fruit.

April 27 -

A 20% increase in lending, largely to players in the tech industry, helped the California company offset a one-time loss tied to an investment in the streaming company Roku.

April 26 -

Double-digit growth in personal loans and record wealth management revenue also helped the Tulsa, Okla., beat earnings forecasts.

April 25 -

The Cincinnati bank reported strong profits, but its efforts to lower credit risk curbed lending as expenses rose in the first quarter.

April 24 -

The $17 billion-asset Bank of Hawaii reported higher profits on rising interest income, even as it saw yearly declines in mortgage banking and deposit fee income, as well as losses on investment securities.

April 23