The sale of AJS Bancorp in Midlothian, Ill., was no small feat.

The $192 million-asset company contacted 42 potential suitors — including a fintech firm and a credit union — over nearly two years before agreeing on July 31 to be sold to NorthWest Indiana Bancorp in Munster for $35 million.

AJS faced several challenges as it sought a buyer, including its shrinking loan book and the toll of tax reform on the value of its deferred tax asset, according to a recent

The former mutual thrift felt compelled to sell after the third anniversary of becoming a fully stock-owned company, a legal hurdle it had to clear before seeking a buyer. It needed to diversify by gaining scale in mortgages and commercial lending, but management realized that doing so would have required pricey technology upgrades.

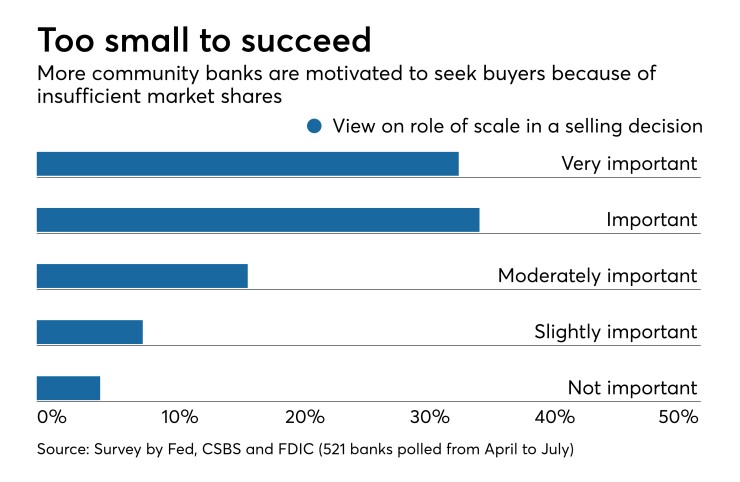

In that sense, AJS is like many community banks that have to decide whether to sacrifice profitability to modernize their businesses. Institutions the size of AJS are also struggling to find even smaller banks to buy, so they are forced to consider sales. But few have gone to the lengths that AJS did to seek a buyer.

The journey for AJS began in January 2017 when its investment bank contacted 19 financial institutions, including NorthWest, to gauge interest in a deal. A dozen banks signed nondisclosure agreements to access data.

Four banks submitted nonbinding offers. NorthWest passed on the opportunity.

The filing highlighted two offers presented in March. An all-cash offer valued AJS at $15.76 a share; a bid consisting of 55% stock priced the potential seller’s stock at $16 each.

AJS decided to negotiate with the higher bidder, but talks fell apart in late April when AJS refused to divest a “major performing asset” at a loss of up to 60%, the filing said.

A succession issue arose in May 2017 when Thomas Butkus told the AJS board he wanted to retire as chairman, president and CEO. Three months later, AJS announced the retirement, along with the promotion of Jerry Weberling, its chief financial officer, as president and CEO.

During that time, the investment bank reached out to 13 banks. Four institutions submitted initial offers ranging from $12 a share to $17.44 a share. Three banks were allowed to conduct on-site due diligence, though two of those walked away by late September.

The only bank remaining was the one that had insisted on the asset divestiture. This time, the bank offered $16.50 a share, with 70% of the consideration in stock.

The AJS board, on a vote of 4 to 1, approved renewed talks with the unnamed bank.

The suitor made a series of demands that concerned AJS executives. The offer included a clause that would have let the buyer walk away if AJS capital levels fell below a stated level. Another clause would have terminated the deal if impaired loans or the loan-loss allowance at AJS rose above a certain threshold.

A revised draft of the merger agreement included clauses to let the buyer walk away if deposits at AJS fell by more than 2%. It also would have entitled the buyer to a termination fee if AJS failed to secure shareholder approval.

AJS ended those talks in December.

AJS was becoming concerned at that time that tax reform would reduce its valuation due to potential adjustments to its deferred tax asset and stockholders’ equity. In February, the company reported a $195,000 full-year loss after the value of its DTA fell by $611,000.

Still, AJS asked its investment bank to again explore a sale.

Talks between AJS and the $959 million-asset NorthWest resumed on March 16 when Weberling met with Benjamin Bochnowski, NorthWest’s president and CEO.

But other companies were interested. Two other banks signed nondisclosure agreements.

An unnamed fintech firm also signed a nondisclosure agreement in early April to conduct due diligence, and AJS also had a conversation with a credit union about the potential for a deal.

NorthWest on April 27 advised its investment bank to look into a deal with AJS, believing that an acquisition would complement its purchase of First Personal Financial in the Chicago area. Like AJS, First Personal had

By mid-May, AJS had received seven nonbinding offers. NorthWest’s bid priced AJS at $33.6 million, or $15.50 a share, evenly split between cash and stock.

The fintech firm offered a price equal to 150% of the seller’s tangible book value, the filing said. But the deal would have triggered tax liabilities and would have been contingent on a capital raise from primarily foreign sources. Also, the fintech suitor had not discussed the deal with bank regulators.

The other offers valued AJS between $12.41 a share and $17.83 a share.

NorthWest, the fintech firm and one other bank were allowed to conduct additional due diligence. Final bids were due by June 15.

The fintech firm walked away after AJS refused to enter into exclusive negotiations.

NorthWest’s bid valued AJS at $34.5 million, or $15.90 a share, with 55% of the consideration involving stock. The other bank bid $34.7 million in cash.

AJS asked each bank to raise its offer. While the unnamed bank balked, NorthWest bumped its offer up to $34.8 million, or $16 a share. AJS decided to enter into an exclusivity agreement with NorthWest.

The board of AJS and NorthWest unanimously approved the merger during separate July 30 meetings. The deal, which is expected to close in the first quarter, priced AJS at 109% of its tangible book value.

The acquisition “is a great strategic, financial, and cultural fit,” Bochnowski said in a release announcing the deal. “This merger … also grows our position in the south suburban Chicagoland and northwest Indiana markets as a locally managed, community-focused financial institution.”

NorthWest expects the deal to be about 25 cents accretive to its 2019 earnings per share, excluding merger-related charges. It should take about two years to earn back the expected 0.8% dilution to NorthWest’s tangible book value.

Weberling will enter into a 13-week consulting agreement with NorthWest that will pay him about $23,000, the filing said. He is also set to receive a lump-sum payment of about $344,000 when the deal closes. In exchange, he must refrain from soliciting NorthWest clients or employees for 18 months after leaving the company.