The fourth time was the charm for First Personal Bank in Orland Park, Ill.

The $147 million-asset bank tried — and failed — to negotiate a sale three times over two years before striking a deal with the $927 million-asset Northwest Indiana Bancorp in Munster, according to a

A potential sale fell through in January 2017 after the would-be acquirer agreed to sell itself. Talks with another suitor fell apart last October. In both instances, nonbinding letters of intent were signed and pricing was discussed.

First Personal and Northwest Indiana even discussed a deal as far back as February 2017, only to walk away from each other a few months later over a pricing disagreement, the filing disclosed.

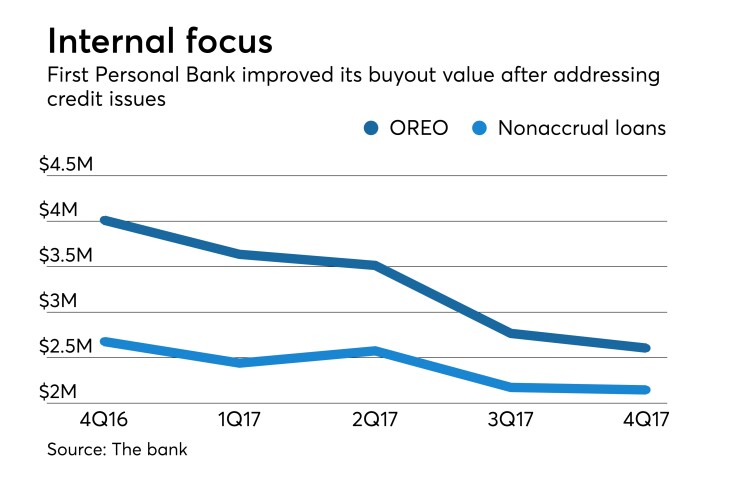

While trying to work out a sale, First Personal’s management had also been addressing internal issues that included a large amount of foreclosed properties and delinquent loans, along with management compensation costs.

Those efforts were enough to resolve the pricing gap with Northwest Indiana. it also offers proof that internal improvements can make a big difference when looking to find a buyer.

First Personal and Northwest Indiana seemed on track to reach a deal early last year, entering into a confidentiality agreement and conducting due diligence. Northwest Indiana expressed an interest in paying $13 million, which fell short of First Personal’s minimum target of $14 million.

Northwest Indiana’s original bid was also well below the amounts offered by the other banks that discussed a deal with First Personal, the filing disclosed.

While the initial discussions between First Personal and Northwest Indiana ended last April, the banks’ executives kept in touch on other matters, including working together on loan participations.

During a meeting in September, First Personal’s investment bank told Benjamin Bochnowski, Northwest Indiana’s president and CEO, that First Personal’s asset quality and credit profile had improved and “there could be additional opportunities for cost savings.”

First Personal, for instance, lowered its other real estate owned by 25% between April and September. Delinquent loans fell 10% over that time period, the filing disclosed.

Bottom line: First Personal had taken steps to justify a higher price.

At the same time, Northwest Indiana’s stock price had appreciated by about 10%.

The banks spent the rest of the year haggling over the price and consideration. A big factor was a plan by First Personal to convert outstanding senior debt to common stock, which was going to significantly increase the price required.

Northwest Indiana and First Personal eventually settled on a purchase price of roughly $15.8 million, which assumed that First Personal would also convert its subordinated debt and preferred stock into common stock before closing. The banks agreed that 55% of the consideration would involve cash.

First Personal also sought a seat on Northwest Indiana’s board, though the request was rejected.

Directors of First Personal and Northwest Indiana approved the deal on Feb. 20, and it was announced the next day. The deal has a Nov. 30 termination date.

The filing also disclosed that Northwest Indiana, which wants to expand around Chicago, insisted that Randall Schwartz, First Personal’s president and CEO, sign a new employment agreement.

Schwartz, as part of the deal, agreed to become the transitional Chicagoland market president for Northwest Indiana’s bank. He will receive $205,000 and be eligible for a cash incentive bonus, in exchange for holding the post for 26 weeks, the filing disclosed.

Schwartz will also operate under noncompete and nonsolicitation agreements for 18 months after his employment with Northwest Indiana ends.