The nation's four biggest banking companies may need to raise up to $800 billion in additional capital to withstand further loan losses and investment banking writedowns, according to new research.

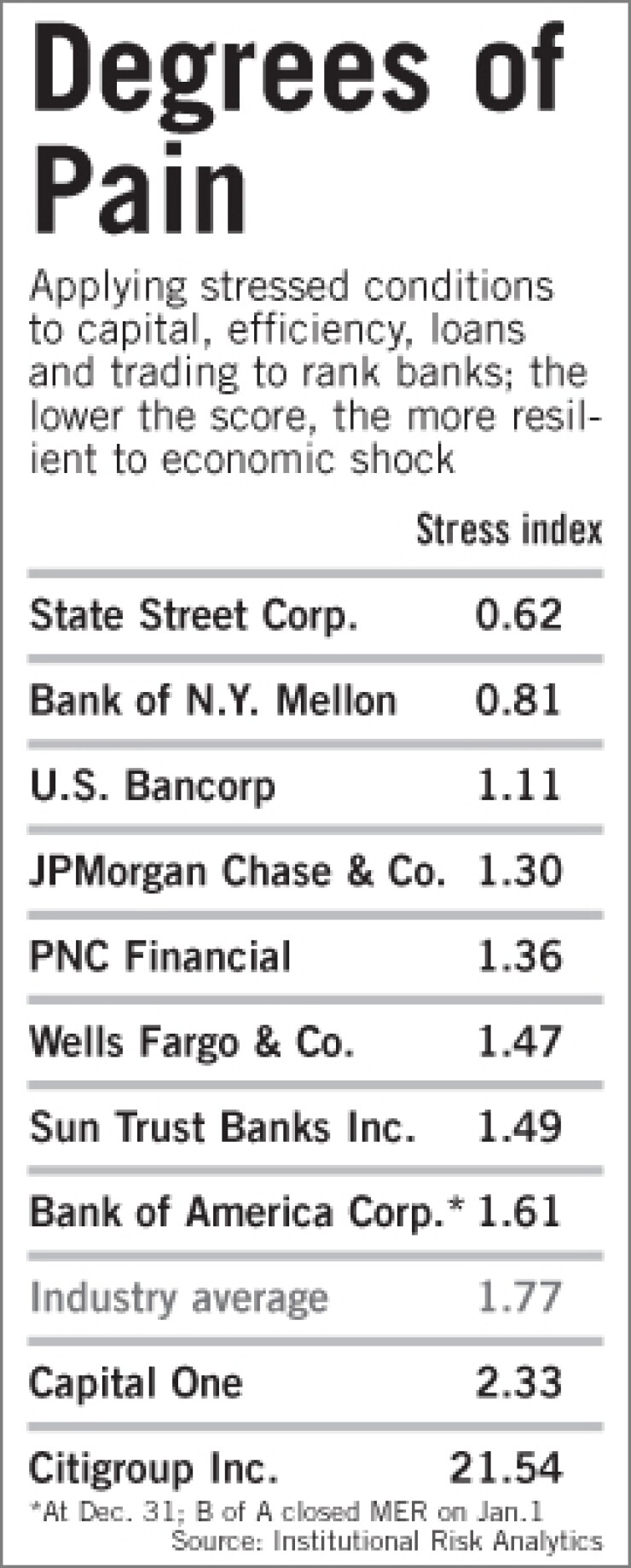

Lord, Whalen LLC's Institutional Risk Analytics put the entire banking industry through a stress test using fourth-quarter data, evaluating what it called "economic capital," or a "highly stressed scenario" for maximum losses in lending, trading, and investment activities. The Torrance, Calif., research firm determined that the average industry measure of stress jumped 15% from the previous quarter, to 1.77.

Christopher Whalen, the company's managing director, said that the four biggest banking companies — Citigroup Inc., JPMorgan Chase & Co., Bank of America Corp., and Wells Fargo & Co. — all did worse than they did in the third quarter, indicating more stress while prompting concern that they all would need more capital.

"The top four could need anywhere from $700 billion to $800 billion in total capital if the maximum probable losses come in," he said in an interview. Whalen conceded, however, that his testing appears "more Draconian" and probably "two to three times more severe" than the stress testing the Treasury Department has planned for banks.

Nonetheless, Whalen said, he believes big banks' need for more capital will exist regardless of stress testing's severity.

Several big firms have already moved to shore up capital.

Citi last Friday announced that the Treasury Department and other investors would convert preferred shares in the $2.02 trillion-asset New York company to common stock to boost the company's tangible common equity. Vikram Pandit, the company's chief executive, said during a conference call discussing the move that the conversions would "put all capital issues aside."

Like Citi, Bank of America has also taken $45 billion in government capital and cut its dividend to a penny.

JPMorgan Chase & Co. on Feb. 26 cut its quarterly dividend by 87%, to a nickel, in a move that the $2.2 trillion-asset New York company said would save $5 billion in capital a year.

Frederick Cannon, an analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc., wrote in a note that he believes Wells should follow the other large banks by cutting or eliminating its dividend and converting its $25 billion in Treasury capital to common stock to boost its tangible common equity by $42 billion.

Whalen also said he was concerned about Wells' capital, given the potential for more losses and the trading book the $1.4 trillion-asset San Francisco company inherited with its Dec. 31 purchase of Wachovia Corp. "It is a good thing that Wells doesn't have a trading book of its own," he said, and his testing showed that the company could use another $73 billion in capital. Bank of America's ultimate situation is more difficult to calculate, Whalen said, because it closed its purchase of Merrill Lynch & Co. Inc. on Jan. 1. The $2.5 trillion-asset Charlotte company, like Wells, will need more capital just to cover future loss assumptions, he said.

Bank of America chairman and chief executive Kenneth D. Lewis said in an internal memo to employees last month: "I believe our company has more than enough capital, liquidity, and earnings power to make it through this downturn on our own from here on out." James Dimon, the chairman and chief executive at JPMorgan Chase, also touted existing capital levels during a conference call last week to announce the dividend cut.

JPMorgan Chase appears in the best shape, Whalen said, because of good operating efficiency and the low prices it paid for Bear Stearns Cos. and Washington Mutual Inc. He said, however, that he remains concerned that losses in JPMorgan Chase's trading book could force it eventually to pursue more capital. "The company hasn't picked up any large stones," he said. "That has bought it some time." A Wells spokeswoman said she would not comment. Efforts to reach Citi and JPMorgan Chase were unsuccessful. A B of A spokesman would not discuss the matter.