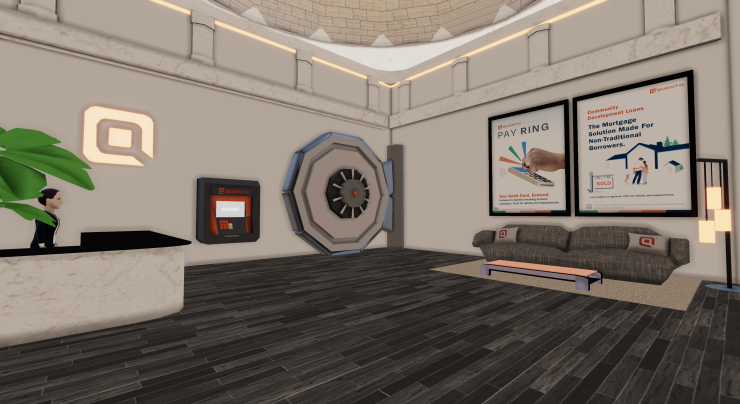

Quontic Bank’s newest site has pillars framing a grand entrance and graffiti scrawled along the base. Inside, posters advertise Quontic’s

None of this exists in the real world. Instead, it is the New York City community bank’s first foray into the metaverse, a set of immersive digital worlds that blur the lines of reality.

Quontic, which has $916 million of assets, is

Quontic Bank’s approach is one banks may emulate as the digital environment evolves. In fact, testing it now may give financial institutions a head start in navigating complex technology and reskilling employees as necessary, even as monetization opportunities remain unclear.

“More than anything else, banks feel they cannot afford to ignore the metaverse,” said Sandeep Vishnu, a partner at the technology and management consultancy Capco. “They don’t yet know what they want to do with it or what it is. But the overwhelming sentiment is, if we don’t do a land grab ourselves, we may have an opportunity pass us by.”

Steven Schnall, founder and CEO of Quontic, compares the metaverse to the early days of the internet, when people sensed there was utility but could not define it.

“The metaverse is the new frontier,” said

For now, planting the flag means promoting some of Quontic’s products in its Decentraland outpost and embedding surprises for visitors. Decentraland is a virtual world that lets its participants build structures and trade digital assets.

In February, the bank purchased two parcels of land for the equivalent of $40,000, first acquiring that amount in ethereum and then converting it into MANA, Decentraland’s cryptocurrency. (“We wanted to be next door to Snoop Dogg, but that land was too expensive,” joked Schnall.)

Then came time to build. The team at Quontic worked with developers at three-dimensional modeling and game development studio Metaverse Architects. They constructed the space in a roughly six-week sprint between the end of March and the beginning of May.

To enter Quontic’s corner of Decentraland, which will open its doors May 19, visitors will log in through the bank’s website as guests or via a digital wallet such as MetaMask. Then they can guide their avatars into the building. The structure is meant to look stately but not imposing, with graffiti at the base to evoke the bank’s underlying edginess. If a user clicks on the pay ring or bitcoin rewards posters, they land on pages describing these products on Quontic’s website.

There is also a teller avatar in the site, Steve, waving hello and interacting with visitors, chatting about Quontic’s history and products. Clicking on the ATM prompts the bank vault door to swing open into the hidden backyard. Visitors can approach the DJ booth to request limited-edition hats or sunglasses NFTs that Quontic minted on the blockchain.

“It’s business in front, party in the back,” said Aaron Wollner, chief marketing officer at Quontic. “People in Decentraland like surprises.”

In the shorter term, the bank may entice people to return by giving away more NFTs. The team also hopes to make the NFTs redeemable for perks at the bank, such as an interest rate boost, once they clear the regulatory hurdles.

As the metaverse evolves, Schnall envisions a time when Quontic can establish a full-service banking center. “We see a world where we have avatars in the metaverse branch, where someone can walk in and meet face to face, open accounts and conduct business,” he said.

Potential future activities in the virtual site could include demonstrating how to change a password and completing homeownership counseling.

“We think a lot about bringing the human touch and warmth to banking,” said Wollner. “There are limitations in the two-dimensional, flat dot-com world.”

There are potential pitfalls around privacy and data security in the metaverse. For instance, fraudsters could impersonate avatars, say the experts at Capco. For now, getting involved in the metaverse is a leap of faith.

“The investment time horizon needs to be large and there needs to be an appetite to understand that the investment might not yield immediate returns,” said Vishnu.

That hasn’t fazed Quontic.

“It’s part of Quontic’s DNA to be digital and adaptive,” said Schnall. “We think it will be a powerful new platform where you can meet your customers.”