Low loan demand for much of the post-crisis period reflected the sluggish economy. Now, demand is on a definite upswing, but that appears to be in spite of continued economic malaise and further pressures on bank profitability.

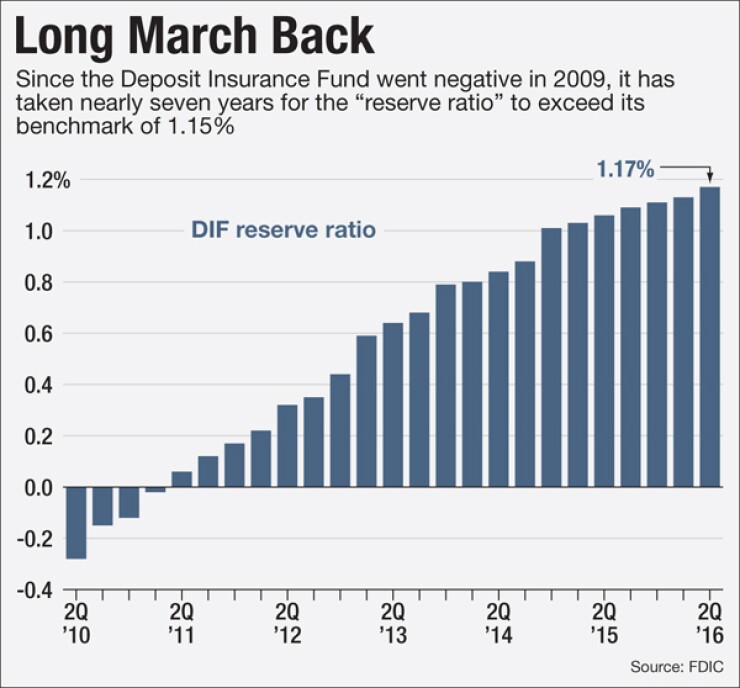

The Federal Deposit Insurance Corp.'s second-quarter industry update showed banks buoyed by strong interest-related income, loan growth and lower expenses at large banks. In another noteworthy sign of the industry's strength, the FDIC's insurance fund cleared a key benchmark in the quarter, passing its previous statutory minimum of 1.15% of insured deposits.

But the positive signs in the Quarterly Banking Profile underlying the industry's record net income of $43.6 billion were in contradiction to lackluster gross domestic product and still historically low interest rates. The tight net interest margins were mostly unchanged and the average return on assets dropped 3 basis points to 1.06% from a year earlier. The growth in assets outpaced the quarterly earnings, the FDIC said.

"Even with the economy less than robust, banks continue to see a steadily increasing demand for loans, particularly in business lending and commercial real estate," said James Chessen, chief economist for the American Bankers Association.

Despite just 1.2% GDP growth in the second quarter, banks' net operating revenue of $179 billion was more than 3% higher than a year earlier. Loan balances increased across all major loan categories and net interest income rose 4.8% year over year, to $113.5 billion. Loans and leases rose 2% from the first quarter to $9.1 trillion and rose 6.7% year over year.

"All sizes and types of businesses were borrowing, with loan growth to small businesses exceeding pre-recession levels," Chessen said.

The loan increase was driven by residential mortgages, other types of real estate loans and credit card balances. Residential mortgages rose 2.2% to $1.96 trillion while credit card balances rose over 3% to $745.9 billion. Moreover, banks' unfunded loan commitments increased by only 0.5% — marking the smallest quarterly jump in unfunded loan commitments since 2013.

The industry's overall loan growth was outpaced by that of community banks, which saw a 9.1% year-over-year increase in loan balances.

"Community banks, which account for 44% of the industry's small loans to businesses, continued to grow their small business loans at a faster pace than the industry," FDIC Chairman Martin Gruenberg said in remarks accompanying the report.

Also boosting the industry's overall earnings growth were reductions in litigation expenses at a few large banks, which limited the industry's increase in noninterest expenses to just 0.3% from a year earlier.

But one of the clearest indicators of the industry's resurgence wasn't from banks' balance sheets, but from that of the FDIC. The agency's 1.17% ratio of insurance reserves to insured deposits in the quarter was the DIF's highest reserve ratio in more than eight years. It passed the threshold of 1.15%, which was the agency's statutory minimum before it was raised in the Dodd-Frank Act.

Going past the benchmark will now trigger several modifications in banks' assessment rates starting in the third quarter as the fund builds up to a new statutory minimum of 1.35%. The industry overall will see their regular assessment rates cut, while banks with under $10 billion in assets will begin to collect credits for future assessments. Large banks will be responsible for bearing the costs of pushing the ratio higher.

"Assessment rates for 93% of institutions with less than $10 billion in assets are expected to decline," Gruenberg said.

Gruenberg struck a positive tone overall, though he noted a weak spot in the large decline in lines of credit to commercial and industrial borrowers, "which may reflect the stress occurring in the energy sector."

"Results for the banking industry were largely positive in the second quarter," he said. "Income and revenue both increased from a year ago, loan growth remained strong, there were fewer unprofitable banks, and the number of 'problem banks' continued to decline."

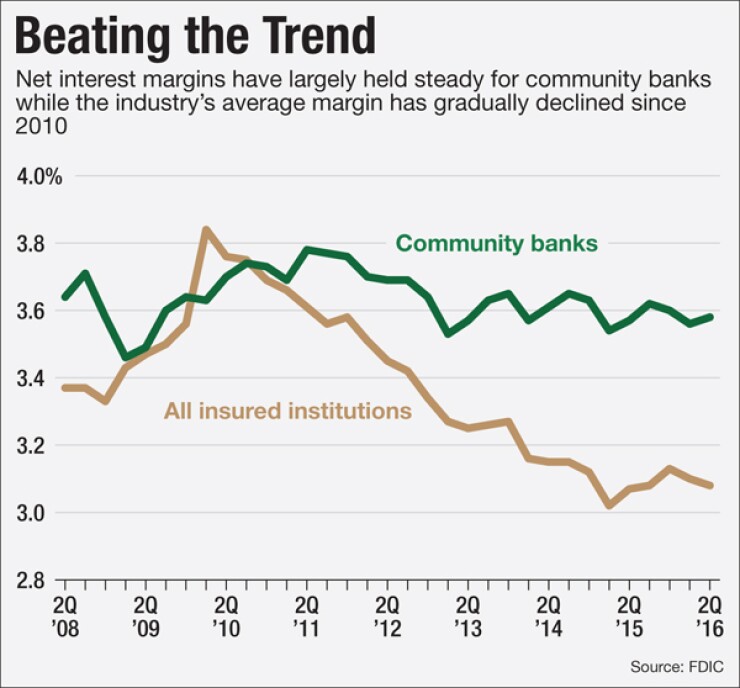

He added, however, that the strong earnings growth came despite persistent near-zero interest rates and compressed loan margins. The average net interest margin rose just one basis point from a year earlier to 3.08%. Community banks reported a stronger average net interest margin of 3.58%.

While the Federal Reserve's benchmark interest rate was raised in December to a range of 0.25% to 0.5%, uncertainty about the timing of the next rate increase remains.

"What's pretty impressive is how adaptive the industry has actually been to [the] low interest rate environment," Gruenberg said.

Yet the low interest rates, while suppressing profitability, are likely tied to borrower demand and therefore banks' strong loan growth in the second quarter. "Historically low interest rates continue to encourage businesses to borrow, which is so essential to job growth," Chessen said.

Gruenberg warned that community banks could also face interest rate risks on their balance sheets if rates move higher because of long-term loans. A high interest rate environment "will be a double-edged sword for the industry as well," Gruenberg said. "Any scenario is going to present challenges of its own."

But other second-quarter figures indicate banks are taking looming risks into account as they expand lending. Loan-loss provisions grew 44.2% in the second quarter, to $11.8 billion, compared to a year earlier — marking the eighth consecutive quarter of growth for provisions.

These numbers show "prudent behavior on the part of banks," Chessen said. The industry is aware, he added, that "we're late in the economic cycle, where we may see some further weakness in the economy."